Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

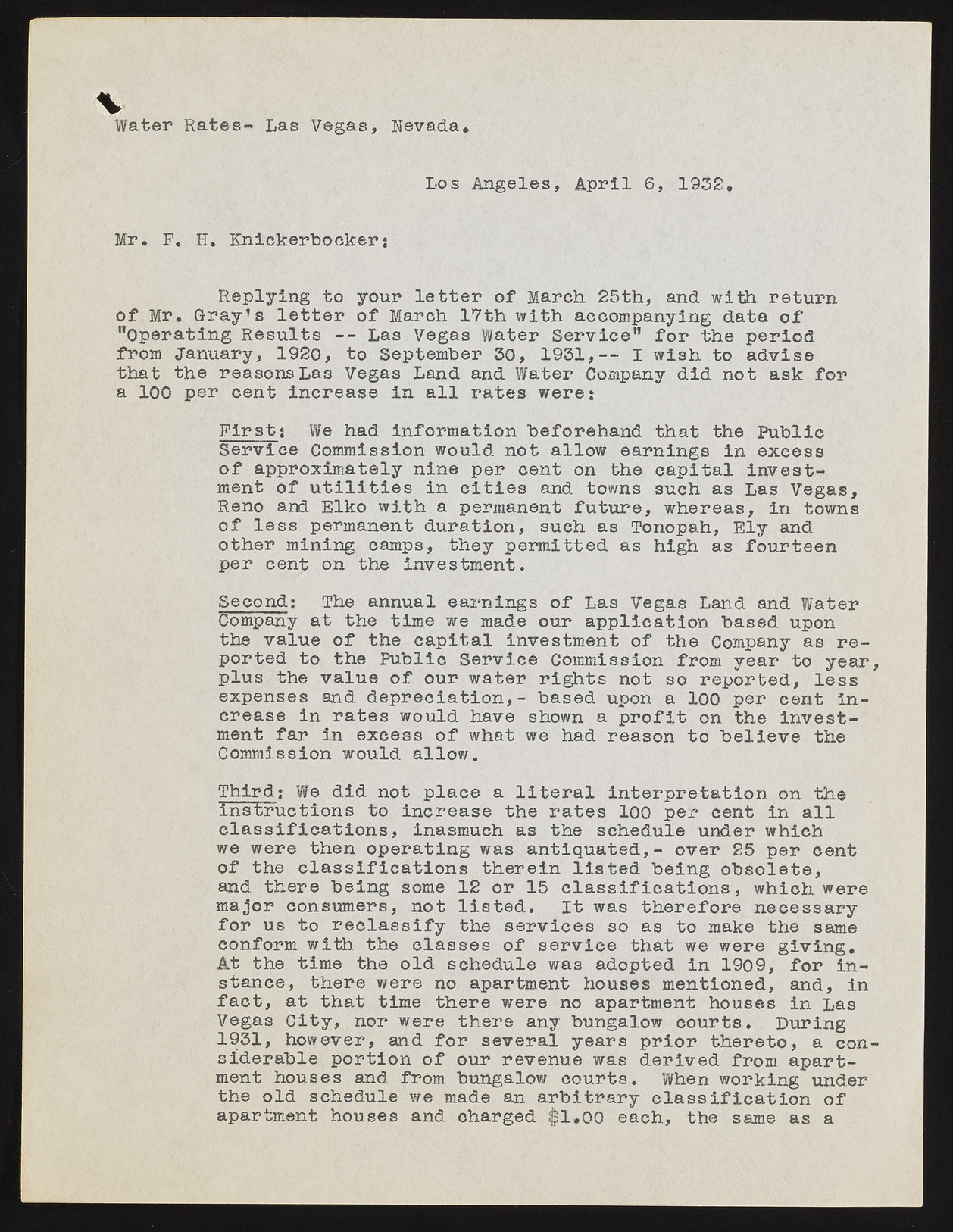

Water Rates- Las Vegas, Nevada* Los Angeles, A pril 6, 1932. Mr. P. H. Knickerbocker: Replying to your l e t t e r of March 25th, and with retu rn o f Mr. Gray’ s l e t t e r of March 17th with accompanying data o f "Operating R esu lts - - Las Vegas Water S erv ice" fo r the period from January, 1920, to September 30, 1 9 3 1 ,-- I wish to advise th at the reasons Las Vegas Land and Water Company did not ask fo r a 100 per cent in crease in a l l ra te s were: F i r s t : We had inform ation beforehand th at the Public Serv ice Commission would not allow earnings in excess o f approximately nine per cent on the c a p ita l in v e stment o f u t i l i t i e s in c i t i e s and towns such as Las Vegas, Reno and Elko w ith a permanent fu tu re , whereas, in towns o f le s s permanent duration, such as Tonopah, Ely and other mining camps, they perm itted as high as fourteen per cent on the investm ent. Second: The annual earnings o f Las Vegas Land and Water Company a t the time we made our ap p licatio n based upon the value o f the c a p ita l investment of the Company as r e ported to the Public Service Commission from year to year plus the value o f our water rig h ts not so rep orted, le s s expenses and d e p re c ia tio n ,- based upon a 100 per cent in crease in ra te s would have shown a p r o fit on the in v e stment fa r in excess o f what we had reason to b e lie v e the Commission would allow . Third: We did not place a l i t e r a l in te rp re ta tio n on the in stru c tio n s to in crease the r a te s 100 per cent in a l l c la s s if ic a t io n s , inasmuch as the schedule under which we were then operating was a n tiq u a te d ,- over 25 per cent of the c la s s if ic a t io n s th erein lis t e d being o b so le te , and there being some 12 or 15 c la s s if ic a t io n s , which were major consumers, not l is t e d . I t was th erefore necessary fo r us to r e c la s s if y the se rv ice s so as to make the same conform with the cla sse s o f se rv ice th at we were g iv in g . At the time the old schedule was adopted in 1909, fo r in stan ce, there were no apartment houses mentioned, and, in f a c t , a t th a t time there were no apartment houses in Las Vegas C ity , nor were there any bungalow co u rts. During 1931, however, and fo r several years p rio r th e re to , a con sld erab le p ortion o f our revenue was derived from ap artment houses and from bungalow co u rts. When working under the old schedule we made an a r b itr a ry c la s s if ic a t io n o f apartment houses and charged $1.00 each, the same as a