Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

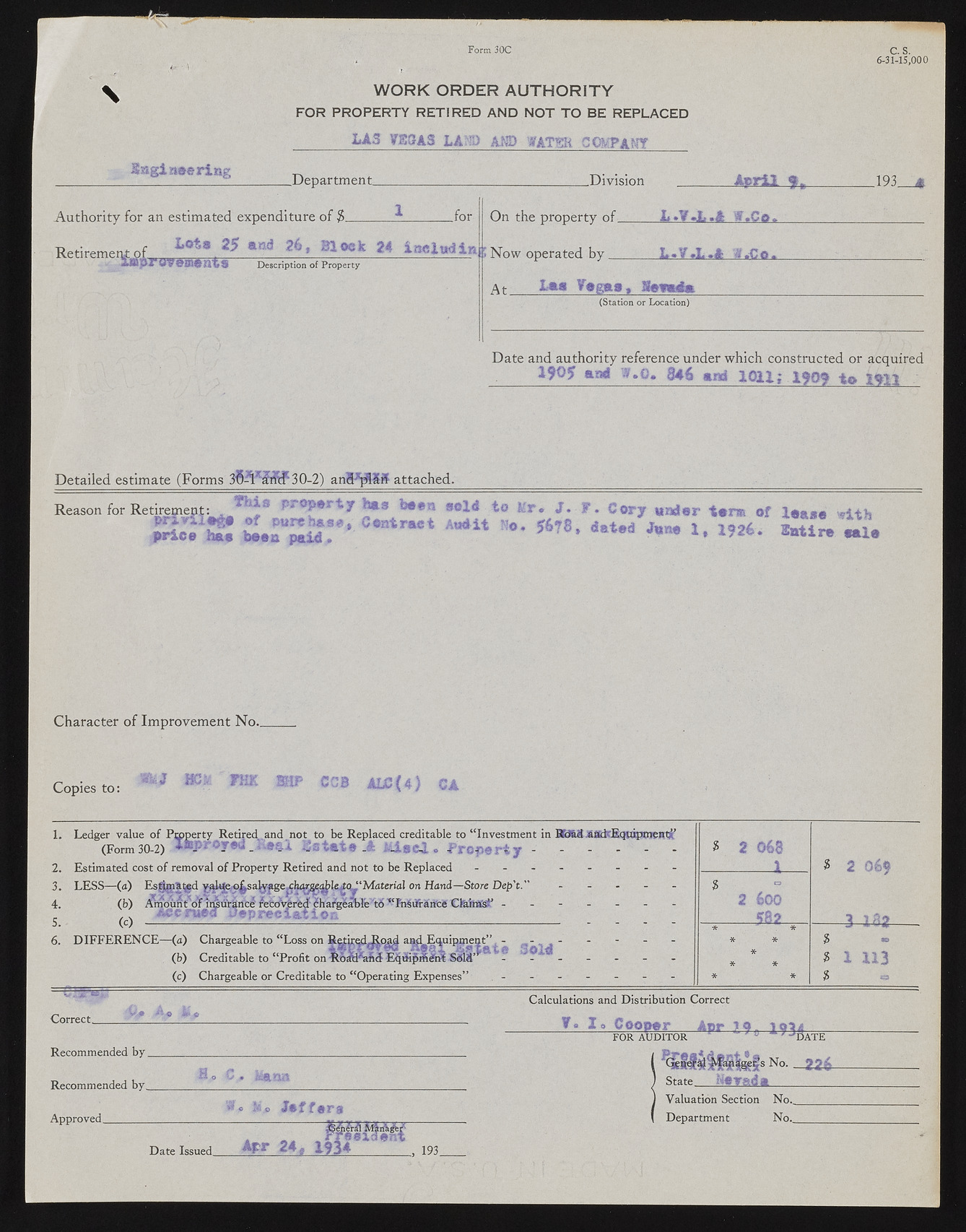

Form 30C WORK ORDER AUTHORITY FOR PROPERTY RETIRED AND NOT TO BE REPLACED _______LA 5 TjTBSAS LAND AM) WATtgR GOVT ANT Sag!neering _Department_ .Division April f, _for 1 Authority for an estimated expenditure of 3________* Retirement:of & «Bd ^ ’ Block ™ inelndin A JUSjkTDescription of Property On the property of. »Now operated by L»¥.L.A iff .Co. L.V.L.A l.Ca. At. lii y<gn, iiiiip (Station or Location) C. S 6-31-15*000 J93_* Date and authority reference under which constructed or acquired 190? and W.O. 846 and 1011; 1909 to 1*11 Detailed estimate (Forms 30-2) anS-^SSff attached. Reason for Retirement: priviiog# of pure ha3*, Centract price hap been paid. eold to Mr. J. F. Cory under term of lease with Audit No. 9678, dated June 1, 1926. Satire tele Character of Improvement No.. Copies to: fMJ 1. Ledger value of Pmperty Retired,and not to be Replaced creditable to “Investment in BOS.fi AadrEqutprneBtx’ (Form30-2) .A^proyed_.Resl 32state-A MiseJ. Property -................................ 2. Estimated cost of removal of Property Retired and not to be Replaced - -- -- -- - 3. LESS—(a) EsjjgjS^ed y^U^^^sa^jgejCh^rfK^d.e^tqJ'Materta! on Hand—Store Dep't." - 4. ft) mncmnt*<lfTr^uViB&§fefefv^f6d'?hafglabIe/t6 “rnSifi-anfciiS CteiMSST ------- c Aecnjed Depreciation 3 2 068 1 3 2 O69 a lAe 3 2 600 _________582 6. DIFFERENCE—(a) Chargeable to “Loss on a^LEauiptpent” - n- - (b) Creditable to “Profit on TlnairaKS $$8’ * - 3? - (c) Chargeable or Creditable to “Operating Expenses” ------- * * * * * * * * * $ ® 3 1 113 $ Calculations and Distribution Correct Correct 34# -, '*» •© .Jp-£r y. 1. Cooper___Apr ?9n 1934 FOR AUDITOR " ' DATE Recommended by Recommended by. Approved_______ g « o Date Issued. (Uoa Sso Jeffers . _ FreeideM Apr 24, 1934 193. No- —226 State __ Merada___________ Valuation Section No., Department No.,_______