Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

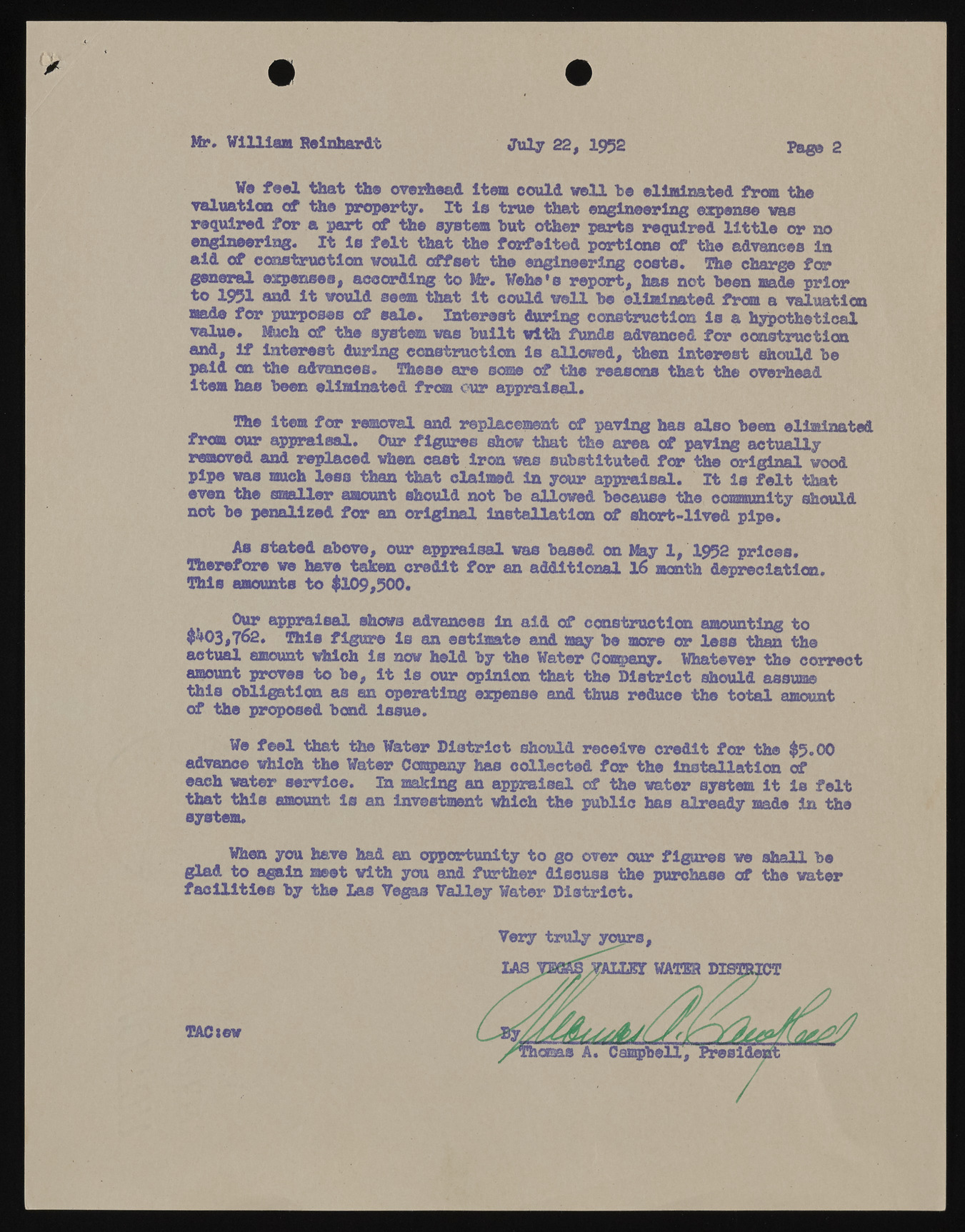

M r. W illia m R e in h ard t J u ly 22, 1952 Page 2 We feel that the overhead item could veil he eliminated from the valuation of the property. It is true that engineering expense was required for a part of the system hut other parts required little or no engineering. It le felt that the forfeited portions of the advances in aid of construction would offset the engineering costa. The charge for general expenses, according to Mr. Wehe's report, has not been made prior to 1951 and it would seem that it could veil he eliminated from a valuation made for purposes of sale. Interest during construction is a hypothetical value. Much of the system was built with funds advanced for construction and, if interest during construction is allowed, then interest should he paid an the advances. These are some of the reasons that the overhead item has been eliminated from our appraisal. The item for removal and replacement of paving has also been from our appraisal. Our figures show that the area of paving actually removed and replaced when cast iron was substituted for the original wood pipe was much lees than that claimed In your appraisal. It is felt that even the smaller amount Should not be allowed because the community should not be penalized for an original installation of short-lived pipe. As stated above, our appraisal was based on May 1, 1952 prices. Therefore ve have taken credit for an additional 16 This amounts to $109,500. month depreciation. Our appraisal Shows advances In aid of construction amounting to $^03,762. This figure is an estimate and may be more or less +.hgn the actual amount which is now held by the Water Company. Whatever the correct amount proves to be, it is our opinion that the District should assume othfi st heo bplriogpaotsieodn baosn adn isospueer.ating expense and thus reduce the total amount We feel that the Water District should receive credit for the $5.00 advance which the Water Company has collected for the installation of each water service. Tn making an appraisal of the water system it is felt tshysatte mt.his amount is an investment which the public has already made in the When you have had an opportunity to go over our figures we shall be glad to again meet with you and further discuss the purchase of the water facilities by the las Vegas Valley Water District.