Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

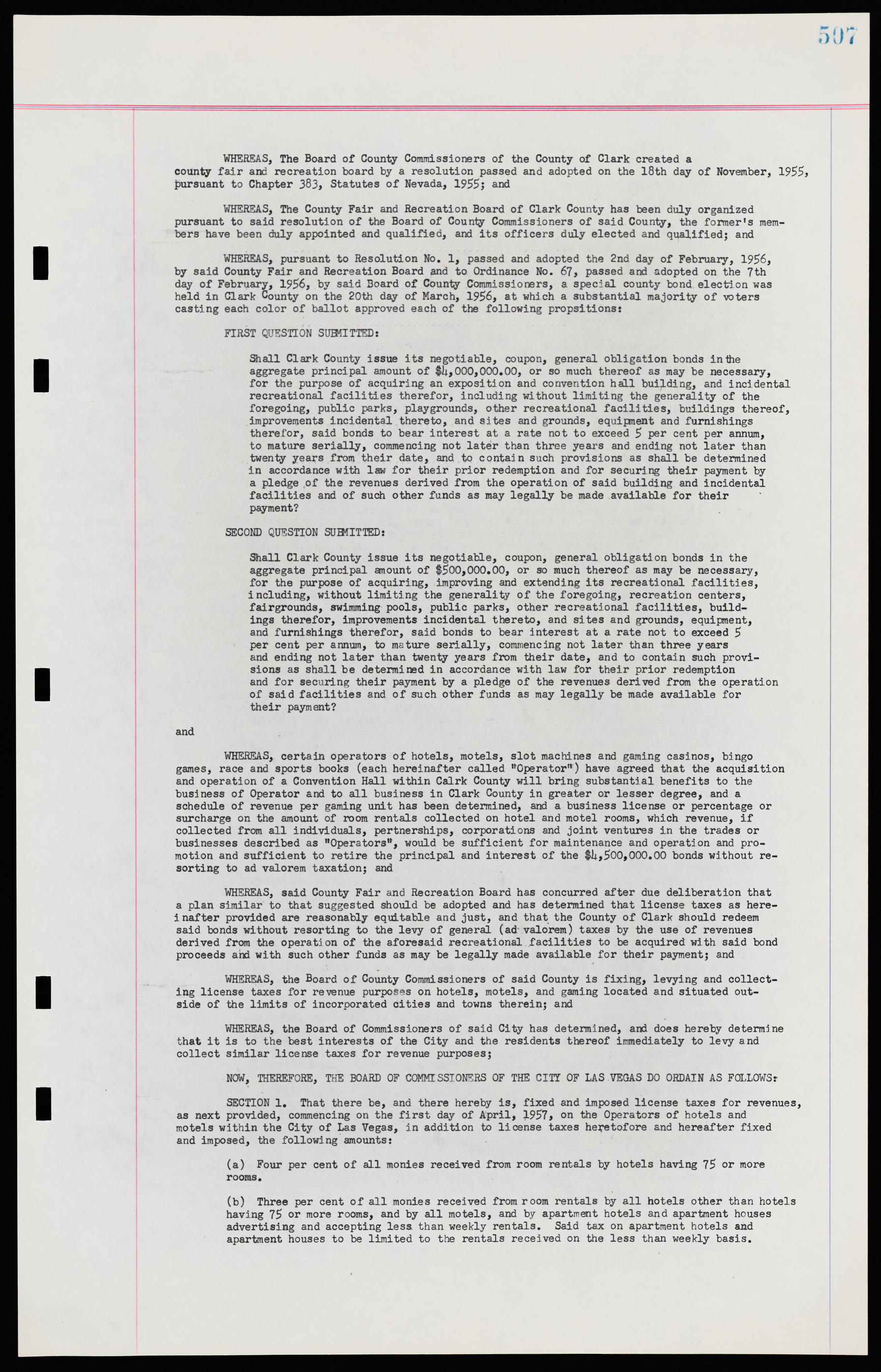

WHEREAS, The Board of County Commissioners of the County of Clark created a county fair and recreation board by a resolution passed and adopted on the 18th day of November, 1955 pursuant to Chapter 383, Statutes of Nevada, 1955; and WHEREAS, The County Fair and Recreation Board of Clark County has been duly organized pursuant to said resolution of the Board of County Commissioners of said County, the former's members have been duly appointed and qualified, and its officers duly elected and qualified; and WHEREAS, pursuant to Resolution No. 1, passed and adopted the 2nd day of February, 1956, by said County Fair and Recreation Board and to Ordinance No. 67, passed and adopted on the 7th day of February, 1956, by said Board of County Commissioners, a special county bond election was held in Clark County on the 20th day of March, 1956, at which a substantial majority of •voters casting each color of ballot approved each of the following propositions: FIRST QUESTION SUBMITTED: Shall Clark County issue its negotiable, coupon, general obligation bonds in the aggregate principal amount of $4,000,000.00, or so much thereof as may be necessary, for the purpose of acquiring an exposition and convention hall building, and incidental recreational facilities therefor, including without limiting the generality of the foregoing, public parks, playgrounds, other recreational facilities, buildings thereof, improvements incidental thereto, and sites and grounds, equipment and furnishings therefor, said bonds to bear interest at a rate not to exceed 5 per cent per annum, to mature serially, commencing not later than three years and ending not later than twenty years from their date, and to contain such provisions as shall be determined in accordance with law for their prior redemption and for securing their payment by a pledge of the revenues derived from the operation of said building and incidental facilities and of such other funds as may legally be made available for their payment? SECOND QUESTION SUBMITTED: Shall Clark County issue its negotiable, coupon, general obligation bonds in the aggregate principal amount of $500,000.00, or so much thereof as may be necessary, for the purpose of acquiring, improving and extending its recreational facilities, including, without limiting the generality of the foregoing, recreation centers, fairgrounds, swimming pools, public parks, other recreational facilities, buildings therefor, improvements incidental thereto, and sites and grounds, equipment, and furnishings therefor, said bonds to bear interest at a rate not to exceed 5 per cent per annum, to mature serially, commencing not later than three years and ending not later than twenty years from their date, and to contain such provisions as shall be determined in accordance with law for their prior redemption and for securing their payment by a pledge of the revenues derived from the operation of said facilities and of such other funds as may legally be made available for their payment? and WHEREAS, certain operators of hotels, motels, slot machines and gaming casinos, bingo games, race and sports books (each hereinafter called "Operator") have agreed that the acquisition and operation of a Convention Hall within Clark County will bring substantial benefits to the business of Operator and to all business in Clark County in greater or lesser degree, and a schedule of revenue per gaming unit has been determined, and a business license or percentage or surcharge on the amount of room rentals collected on hotel and motel rooms, which revenue, if collected from all individuals, partnerships, corporations and joint ventures in the trades or businesses described as "Operators", would be sufficient for maintenance and operation and promotion and sufficient to retire the principal and interest of the $4,500,000.00 bonds without resorting to ad valorem taxation; and WHEREAS, said County Fair and Recreation Board has concurred after due deliberation that a plan similar to that suggested should be adopted and has determined that license taxes as here- in after provided are reasonably equitable and just, and that the County of Clark should redeem said bonds without resorting to the levy of general (ad- valorem) taxes by the use of revenues derived from the operation of the aforesaid recreational facilities to be acquired with said bond proceeds and with such other funds as may be legally made available for their payment; and WHEREAS, the Board of County Commissioners of said County is fixing, levying and collecting license taxes for revenue purposes on hotels, motels, and gaming located and situated outside of the limits of incorporated cities and towns therein; and WHEREAS, the Board of Commissioners of said City has determined, and does hereby determine that it is to the best interests of the City and the residents thereof immediately to levy and collect similar license taxes for revenue purposes; NOW, THEREFORE, THE BOARD OF COMMISSIONERS OF THE CITY OF LAS VEGAS DO ORDAIN AS FOLLOWS: SECTION 1. That there be, and there hereby is, fixed and imposed license taxes for revenues, as next provided, commencing on the first day of April, 1957, on the Operators of hotels and motels within the City of Las Vegas, in addition to license taxes heretofore and hereafter fixed and imposed, the following amounts: (a) Four per cent of all monies received from room rentals by hotels having 75 or more rooms. (b) Three per cent of all monies received from room rentals by all hotels other than hotels having 75 or more rooms, and by all motels, and by apartment hotels and apartment houses advertising and accepting less than weekly rentals. Said tax on apartment hotels and apartment houses to be limited to the rentals received on the less than weekly basis.