Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

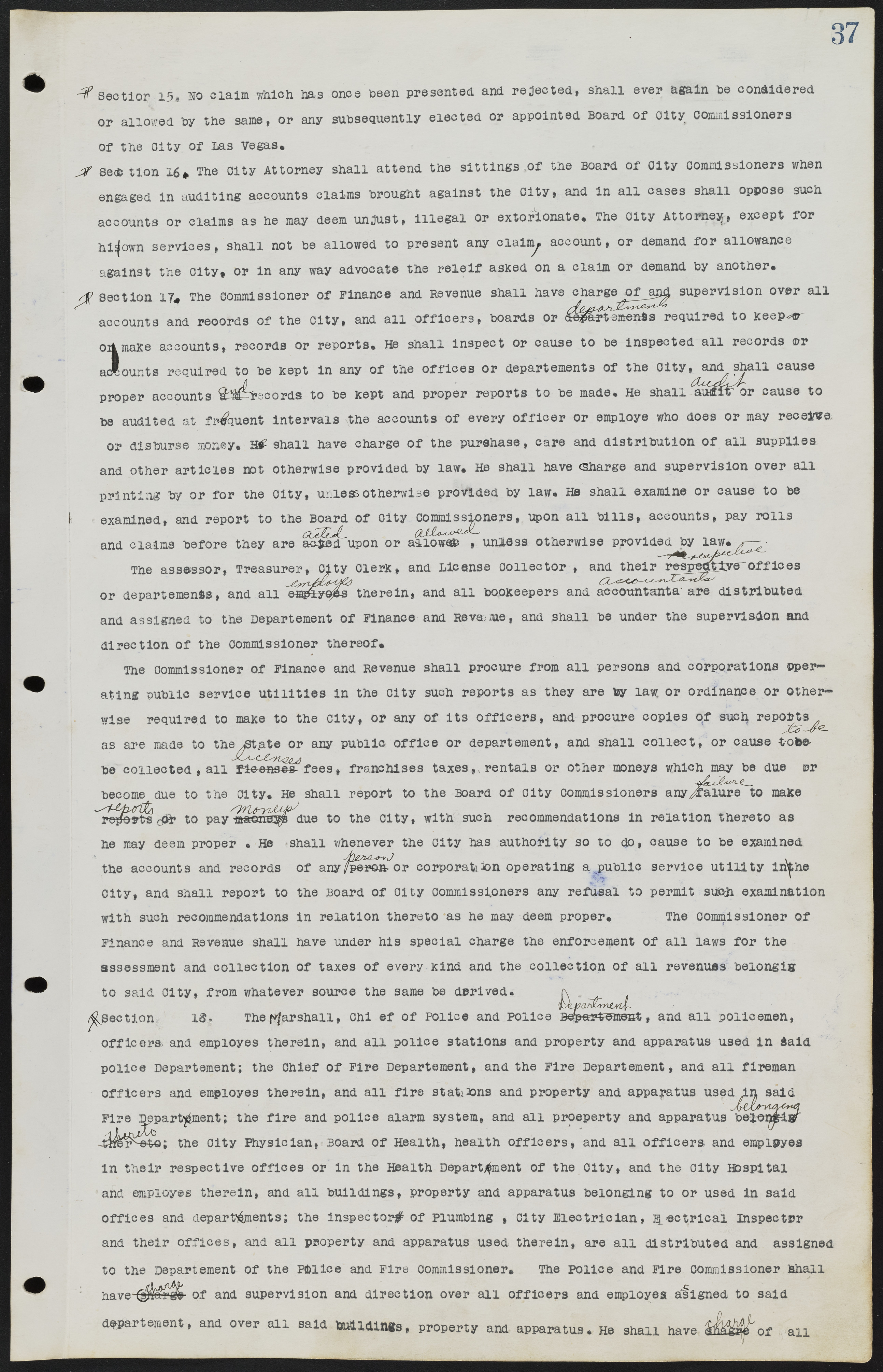

Section 15. No claim which has once been presented and rejected, shall ever again be considered or allowed by the same, or any subsequently elected or appointed Board of city Commissioners of the City of Las Vegas. Section 16. The City Attorney shall attend the sittings of the Board of City commissioners when engaged in auditing accounts claims brought against the City, and in all cases shall oppose such accounts or claims as he may deem unjust, illegal or extortionate. The City Attorney, except for his own services, shall not be allowed to present any claim, account, or demand for allowance against the City, or in any way advocate the relief asked on a claim or demand by another. Section 17. The Commissioner of Finance and Revenue shall have charge of and supervision over all accounts and records of the City, and all officers, boards or departments required to keep or make accounts, records or reports. He shall inspect or cause to be inspected all records or accounts required to be kept in any of the offices or departments of the City, and shall cause proper accounts and records to be kept and proper reports to be made. He shall audit or cause to be audited at frequent intervals the accounts of every officer or employe who does or may receive or disburse money. He shall have charge of the purchase, care and distribution of all supplies and other articles not otherwise provided by law. He shall have charge and supervision over all printing by or for the City, unless otherwise provided by law. He shall examine or cause to be examined, and report to the Board of City Commissioners, upon all bills, accounts, pay rolls and claims before they are acted upon or allowed, unless otherwise provided by law. The assessor, Treasurer, City Clerk, and License collector, and their respective offices or departments, and all employees therein, and all bookkeepers and accountants are distributed and assigned to the Department of Finance and Revenue, and shall be under the supervision and direction of the commissioner thereof. The Commissioner of Finance and Revenue shall procure from all persons and corporations operating public service utilities in the city such reports as they are by law or ordinance or otherwise required to make to the City, or any of its officers, and procure copies of such reports as are made to the State or any public office or department, and shall collect, or cause or to be collected, all license fees, franchises taxes, rentals or other moneys which may be due or become due to the City. He shall report to the Board of City Commissioners any failure to make reports or to pay moneys due to the city, with such recommendations in relation thereto as he may deem proper. He shall whenever the city has authority so to do, cause to be examined the accounts and records of any person or corporation operating a public service utility in the City, and shall report to the Board of City commissioners any refusal to permit such examination with such recommendations in relation thereto as he may deem proper. The commissioner of Finance and Revenue shall have under his special charge the enforcement of all laws for the assessment and collection of taxes of every Kind and the collection of all revenues belonging to said City, from whatever source the same be derived. Section 18. The Marshall, Chief of Police and police Department, and all policemen, officers and employes therein, and all police stations and property and apparatus used in said police Department; the Chief of Fire Department, and the Fire Department, and all fireman officers and employes therein, and all fire stations and property and apparatus used in said Fire Department; the fire and police alarm system, and all property and apparatus belonging thereto; the City Physician, Board of Health, health officers, and all officers and employes in their respective offices or in the Health Department of the City, and the City Hospital and employes therein, and all buildings, property and apparatus belonging to or used in said offices and departments; the inspector of Plumbing, City Electrician, Electrical inspector and their offices, and all property and apparatus used therein, are all distributed and assigned to the Department of the Police and Fire Commissioner. The police and Fire commissioner shall have charge of and supervision and direction over all officers and employes aligned to said department, and over all said buildings, property and apparatus. He shall have charge of all