Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

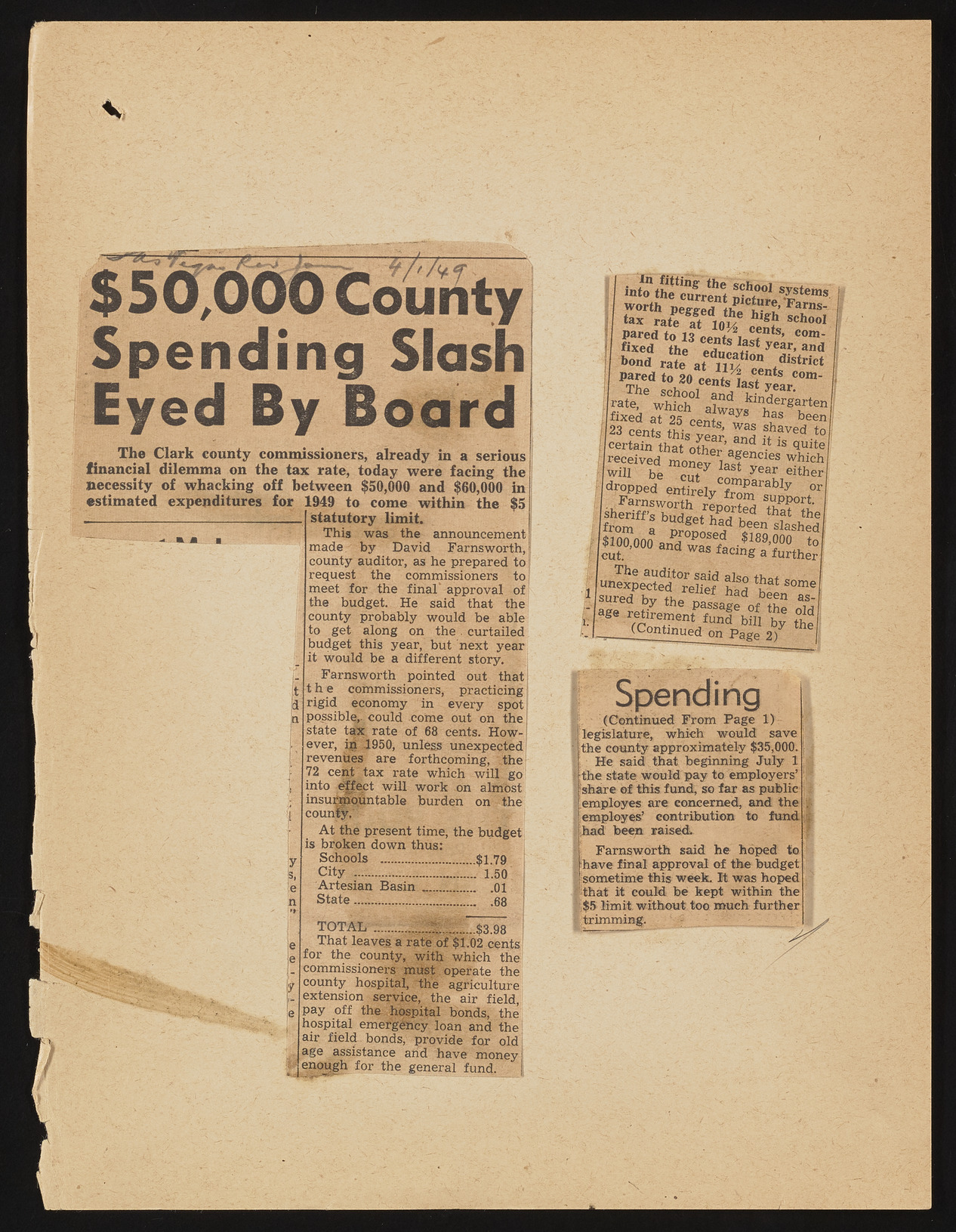

m m a m $50,000 County Spending Slash Eyed By Board The Clark county commissioners, already in a serious financial dilemma on the tax rate, today were facing the necessity of whacking off between $50,000 and $60,000 in estimated expenditures for 1949 to come within the $5 statutory limit. This was the announcement made.’ by David Farnsworth, county auditor, as he prepared to request the commissioners to meet for the final' approval of the budget. He said that the county probably would be able to get along on th e . curtailed budget this year, but next year it would be a different story. Farnsworth pointed out that t h e commissioners, practicing rigid economy in every spot! possible,-;could come out on the. state tax rate of 68 cents. H ow-1 ever, ijd 1950, unless unexpected revenues are forthcoming, .the 72 cent tax rate which will go into e|fect will work on almost insumto.Untable burden on the county. At the present time, the budget is broken down thus: Schools .................. ........$1.79 City ............................ 1.50 Artesian Basin ...... 01 State............................. ... .68 TOTAL .....I I ....... $3.98 That leaves a rate of $1.02 cents! for the county, with which the commissioners must operate the county hospital, the agriculture: extension service, the air field, pay off the hospital bonds, the hospital emergency loan and the! air field. bonds,' provide for old age assistance and have money j enough for the general fund. | into the^urrent worth nW°01 TS.yasrtnems- s tax rjeegltem e I J SCh°o1 bond rafe ^ iCt t0 20 cental J t "ear?°m’ rate, which° alwf kin^ ergarten fixed at 25 cents w L ^ been 23 cents this year and *Ved-to certain that o th e ^ ^ T 1 s qultel received mom>v *5 a|encies which win be cuty l ast year m m (dropped emrrW foZarf Iy °r [. Farnsworth renor fsrhoemri ff’os budggeett hhaadd bifede nt hsalats htehde The auditor said unexpected relief had R some (Continued on Page 2) Spending (Continued From Page 1) | legislature, which would save lithe county approximately $35,000.j ; | He said1 that beginning July 1 a; |:the state would pay to employers’ '$! ' share of this fund, so far as public j employes are concerned, and the !| . employes’ contribution to fund ; had been raised. Farnsworth said he hoped to 5 have final approval of the budget, l sometime this week. It was hoped •that" it couM be kept within the § $5 limit without too much- further i.trimming. X