Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

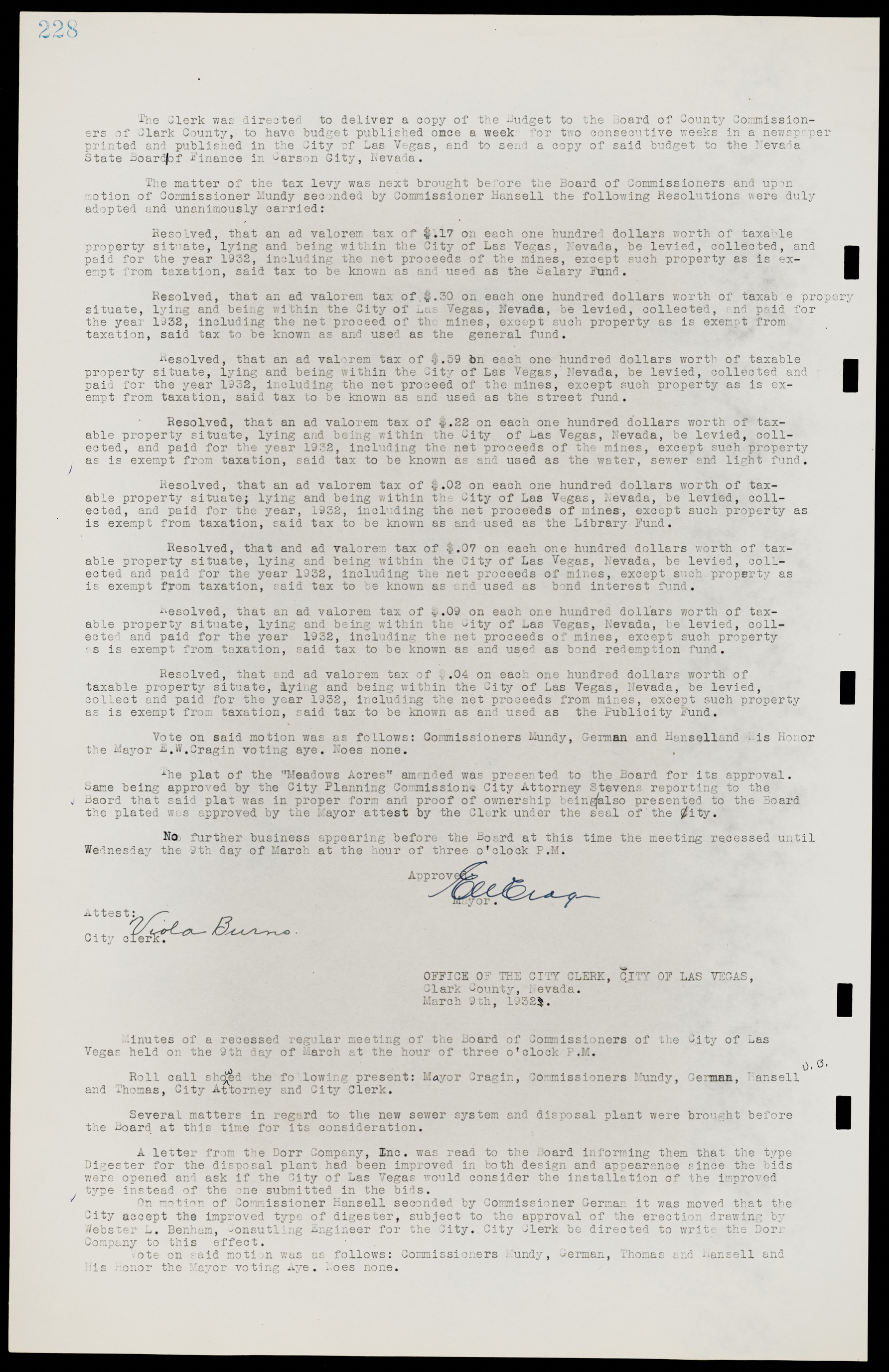

The Clerk was directed to deliver a copy of the Budget to the Board of County Commissioners of Clark County, to have budget published once a week for two consecutive weeks in a newspaper printed and published in the City of Las Vegas, and to send a copy of said budget to the Nevada State Board of Finance in Carson City, Nevada. The matter of the tax levy was next brought before the Board of Commissioners and upon motion of Commissioner Mundy seconded by Commissioner Hansell the following Resolutions were duly adopted and unanimously carried: Resolved, that an ad valorem tax of $.17 on each one hundred dollars worth of taxable property situate, lying and being within the City of Las Vegas, Nevada, be levied, collected, and paid for the year 1932, including the net proceeds of the mines, except such property as is exempt from taxation, said tax to be known as and used as the Salary Fund. Resolved, that an ad valorem tax of $.30 on each one hundred dollars worth of taxable property situate, lying and being within the City of i.as Vegas, Nevada, be levied, collected, and paid for the year 1932, including the net proceed of the mines, except such property as is exempt from taxation, said tax to be known as and used as the general fund. Resolved, that an ad valorem tax of $.59 bn each one hundred dollars worth of taxable property situate, lying and being within the City of Las Vegas, Nevada, be levied, collected and paid for the year 1932, including the net proceed of the mines, except such property as is exempt from taxation, said tax to be known as and used as the street fund. Resolved, that an ad valorem tax of $.22 on each one hundred dollars worth of taxable property situate, lying and being within the City of Las Vegas, Nevada, be levied, collected, and paid for the year 1932, including the net proceeds of the mines, except such property as is exempt from taxation, said tax to be known as and used as the water, sewer and light fund. Resolved, that an ad valorem tax of $.02 on each one hundred dollars worth of taxable property situate; lying and being within the City of Las Vegas, Nevada, be levied, collected, and paid for the year, 1932, including the net proceeds of mines, except such property as is exempt from taxation, said tax to be known as and used as the Library Fund. Resolved, that and ad valorem tax of $.07 on each one hundred dollars worth of taxable property situate, lying and being within the City of Las Vegas, Nevada, be levied, collected and paid for the year 1932, including the net proceeds of mines, except such property as is exempt from taxation, said tax to be known as and used as bond interest fund. Resolved, that an ad valorem tax of $.09 on each one hundred dollars worth of taxable property situate, lying and being within the City of Las Vegas, Nevada, be levied, collected and paid for the year 1932, including the net proceeds of mines, except such property s is exempt from taxation, said tax to be known as and used as bond redemption fund. Resolved, that and ad valorem tax of $.04 on each one hundred dollars worth of taxable property situate, lying and being within the City of Las Vegas, Nevada, be levied, collect and paid for the year 1932, including the net proceeds from mines, except such property as is exempt from taxation, said tax to be known as and used as the Publicity Fund. Vote on said motion was as follows: Commissioners Mundy, German and Hansell and His Honor the Mayor E.W.Cragin voting aye. Noes none. The plat of the "Meadows Acres" amended was presented to the Board for its approval. Same being approved by the City Planning Commission. City Attorney Stevens reporting to the Board that said plat was in proper form and proof of ownership being also presented to the Board the plated was approved by the Mayor attest by the Clerk under the seal of the City. No further business appearing before the Board at this time the meeting recessed until Wednesday the 9th day of March at the hour of three o'clock P.M. OFFICE OF THE CITY CLERK, CITY OF LAS VEGAS, Clark County, Nevada. March 9th, 1932. Minutes of a recessed regular meeting of the Board of Commissioners of the City of Las Vegas held on the 9th day of March at the hour of three o'clock P.M. Roll call showed the following present: Mayor Cragin, Commissioners Mundy, German, Hansell and Thomas, City Attorney and City Clerk. Several matters in regard to the new sewer system and disposal plant were brought before the Board at this time for its consideration. A letter from the Dorr Company, Inc. was read to the Board informing them that the type Digester for the disposal plant had been improved in both design and appearance since the bids were opened and ask if the City of Las Vegas would consider the installation of the improved type instead of the one submitted in the bids. On motion of Commissioner Hansell seconded by Commissioner German it was moved that the City accept the improved type of digester, subject to the approval of the erection drawing by Webster L. Benham, Consulting Engineer for the City. City Clerk be directed to write the Dorr Company to this effect. Vote on said motion was as follows: Commissioners Mundy, German, Thomas and Hansell and His Honor the Mayor voting Aye. Noes none.