Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

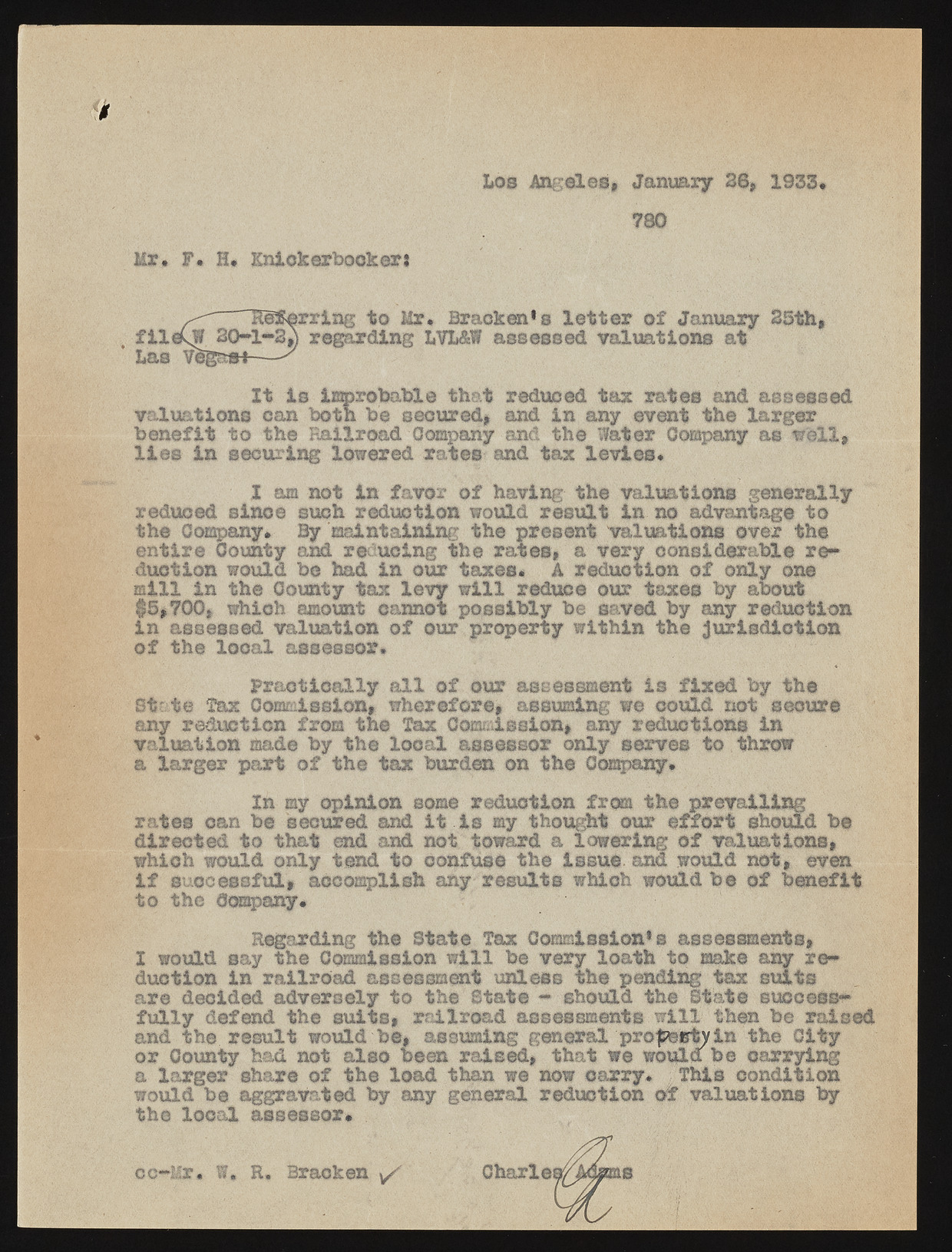

i Los A ngeles, January 26, 1933 780 Mr* F. H* Knickerbocker* r rin g t o Mr* Bracken’ s l e t t e r o f January 25th, regarding LVL&W assessed v a lu a tion s at I t I s Improbable th at reduced ta r ra te s and assessed v a lu a tion s can both be secured, and in any event th e la r g e r b e n e fit t o the R ailroad Company and th e Water Company as w e ll, l i e s in seem in g low ered r a te s and ta x le v ie s * reduced sin ce such red u ction would r e s u lt in no advantage t o th e Company* By m aintaining th e p resen t v a lu a tion s over the e n tir e County and redu cin g th e r a te s , a very co n sid e ra b le red u ction would be had in our taxes* A red u ction o f on ly one m ill in the County tax le v y w il l reduce our ta xes by about $5,700, which amount cannot p o s s ib ly be saved by any red u ction in assessed v a lu a tion o f our p rop erty w ith in th e ju r is d ic t io n o f th e l o c a l a sse sso r. S tate 'Tax Commission, w h erefore, assuming we cou ld not secure any red u ction from the Tax Commission, any red u ction s in v a lu a tio n made by th e l o c a l a sse sso r on ly serv es to throw a la r g e r p a rt o f th e ta x burden on th e Company. r a te s can be secured and i t i s my thought our e f f o r t should be d ir e c te d t o th at end and not toward a low erin g o f v a lu a tio n s, which would on ly tend t o c o n fe s s th e is s u e and would n o t, even i f s u c c e s s fu l, accom plish any r e s u lts which would b e o f b e n e fit t o the Company* 1 would say th e Commission w i l l be very lo a th to make any red u ction in r a ilr o a d assessment u nless the pending ta x s u its a re d ecid ed a d v ersely to the S tate »? should the S ta te su ccessf u l l y defend the s u it s , r a ilr o a d assessm ents w il l then be ra ise d and the r e s u lt would b e, assuming general pro twenty in the C ity o r County had not a ls o been r a is e d , th at we would b e ca rry in g a la r g e r share o f th e loa d than we now carry* This co n d itio n would b e aggravated by any general red u ction o f v a lu a tion s by th e l o c a l assessor* . I am not in fa v or o f having the v a lu a tion s g en era lly P r a c t ic a lly a l l o f our assessment i s fix e d by th e Regarding the S tate Tax Commission’ s assessm ents. cc-llr. W. R. Bracken y/ Charle