Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

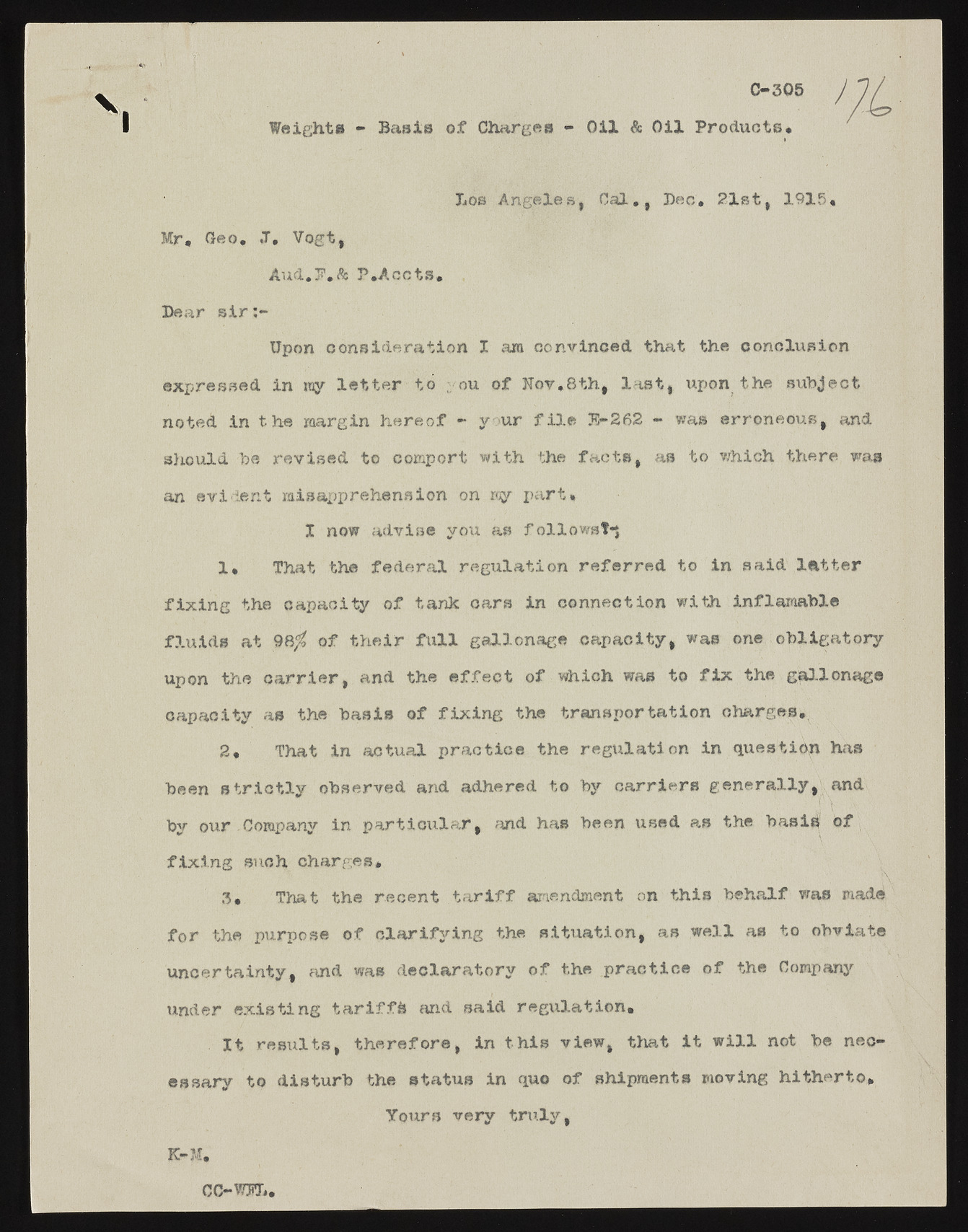

C-305 Weights - Basis of Charges - O il & O il Products* Los Angeles, C al., Deo. 21st, 1915* Mr, Geo. .T, Vogt, Aud.F.ft P.Accts. Bear sir Upon consideration I am convinced that the conclusion expressed in ray le tt e r to you of Nov.8th., la s t , upon the subject noted in the margin hereof - y ur f i l e 75-262 - was erroneous, and should be revised to comport with the fa c ts, as to which there was an evident misapprehension on roy part, X now advise you as followsT-j 1, That the federal regulation referred to in said latter fix in g the capacity of tank cars in connection with inflamabie flu id s at 98^ of their f u ll gallcnage capacity, was one obligatory upon the c a rrie r, and the effect of which was to f i x the gallonage capacity as the basis of fixin g the transportation charges, 2, That in actual practice the regulation in question has been s tr ic t ly observed and adhered to by carriers gen erally, and by our Company in p articu lar, and has been used as the basis of fix in g such charges* 3, That the recent t a r i f f amendment on this behalf was made fo r the purpose of cla rify in g the situation, as w ell as to obviate uncertainty, and was declaratory of the practice of the Company under existing t a r iff^ and said regulation. I t resu lts, therefore, in th is view, that it w ill not be necessary to disturb the status in quo of shipments moving hitherto, K-M. CC-TO.. Yours very truly,