Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

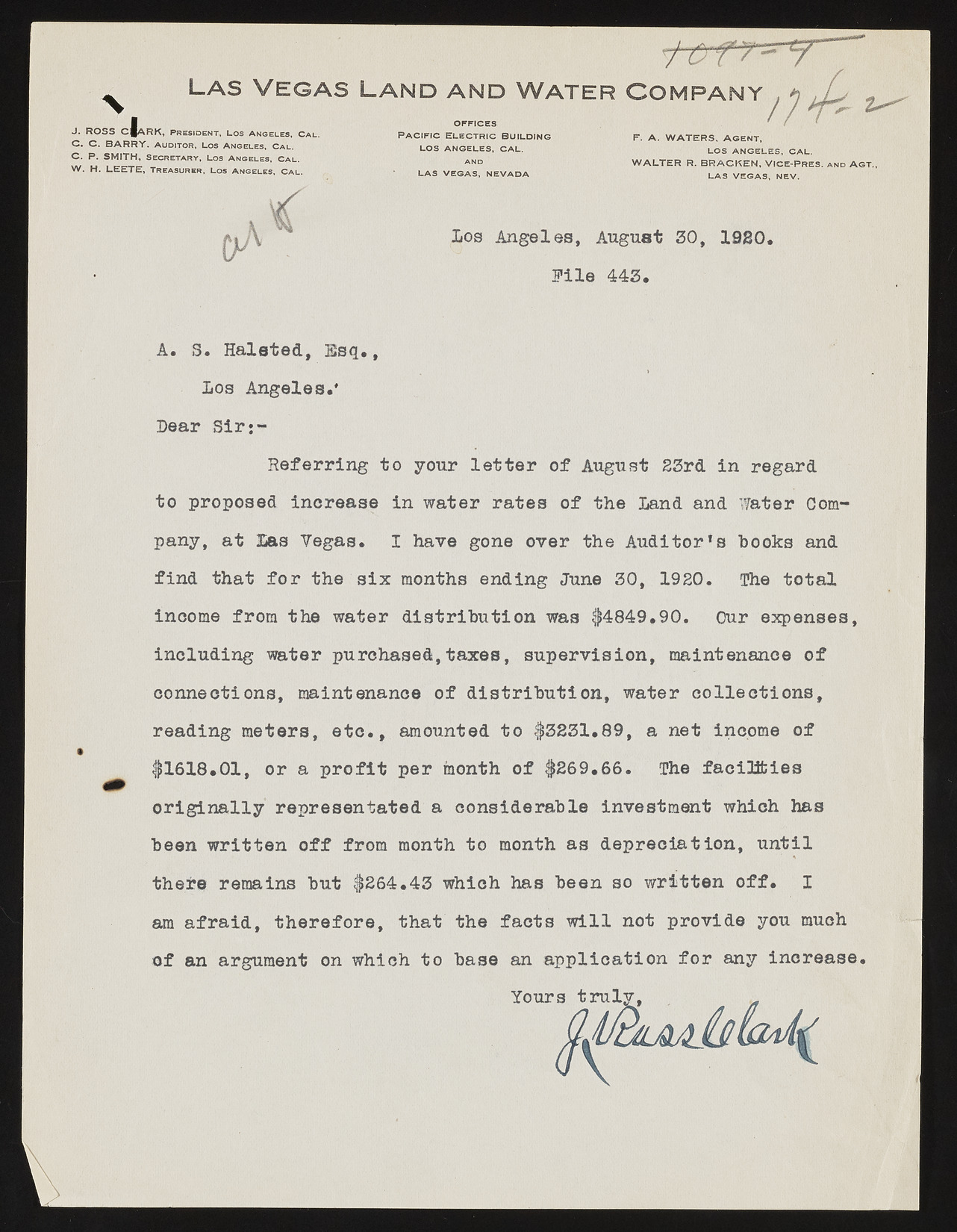

\ L a s V e g a s L a n d a n d W a t e r C o m p a n y O F F IC E S P a c i f i c e l e c t r i c b u i l d i n g L O S A N G E L E S , C A L . J. ROSS C g A R K , P r e s id e n t, L os A n g e le s , Ca l . C . C . B A R R Y , a u d it o r , Los A n ge les, Ca l . C. P. SMITH, Se c r e t a r y , Los A n g e le s , Ca l . W . H. LEETE, Tr e a s u r e r , L os A n g e le s, Ca l . L A S V E G A S , N E V A D A F . A . W A T E R S , A G E N T , L O S A N G E L E S , C A L . W A L T E R R . B R A C K E N , V lC E - P R E S . AND A G T ., L A S V E G A S , N E V . Los Angeles, August 30, 1980. F ile 443. A. S. Halated, E sq., Los Angeles.* Lear Sir Referring to your le tte r of August 23rd in regard to proposed increase in water rates of the Land and Water Company, at Las Vegas. I have gone over the Auditor*s hooks and find that fo r the six months ending June 30, 1920. The total income from the water distribution was $4849.90. Our expenses, including water purchased!,taxes, supervision, maintenance of connections, maintenance of distribution, water collections, reading meters, e tc ., amounted to $3231.89, a net income of $1618.01, or a p ro fit per month of $269.66. The facilities o rig in a lly representated a considerable investment which has been written o ff from month to month as depreciation, u n til there remains but $264.43 which has been so written o ff. I am a fraid , therefore, that the facts w ill not provide you much of an argument on which to base an application fo r any increase. Yours t m l v .