Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

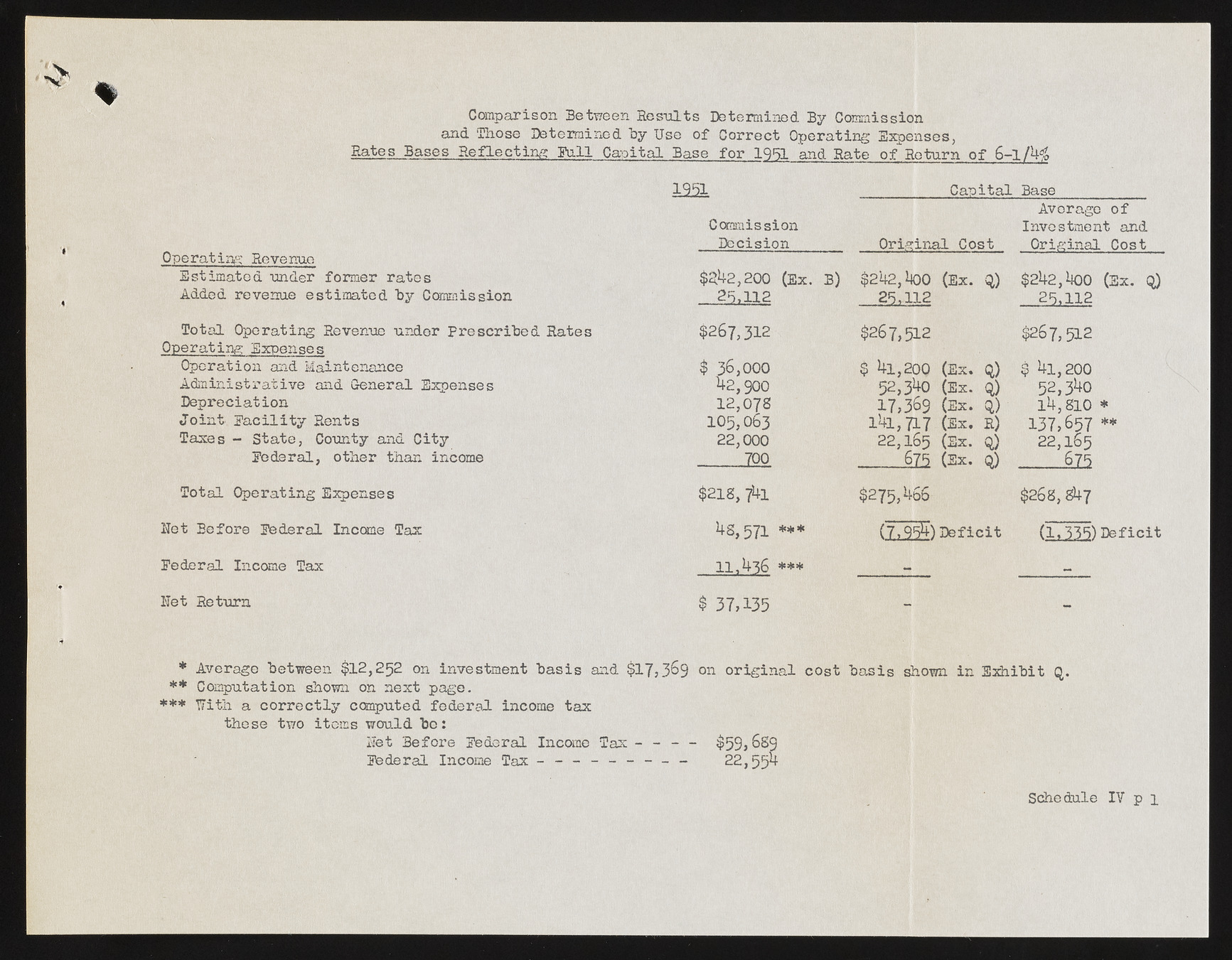

Comparison Between Results Determined By Commission and Those Determined hy Use of Correct Operating Expenses, Bates Bases Reflecting Bail Capital Base for 1951 and Rate of" Be turn of 6-1/4# IBS® Capital Base Commission Average of Investment and Operating Revenue Decision Original Cost Original Cost Estimated under former rates $242,200 (Ex. B) $242, 400 (Ex. Added revenue estimated by Commission 25,112 25,112 Q) $22452,,141oo2 (Ex. q) Total Operating Revenue under Prescribed Rates Operating Expenses $267,312 $267,512 $267, 512 Operation and Maintenance $ 36,000 $ Ul,200 (Ex. q) $ 41,200 Administrative and General Expenses 42,900 52,3^0 (Ex. Q) 52,340 Depreciation 12,078 17,369 1'41,717 Joint Facility Rents 1 0 5 ,063 (Ex. <q) 14,810 * Taxes - State, County and City (Ex. H) 1 3 7 ,6 5 7 ** * 22,000 22,165 (Ex. Q) 2 2,16 5 Federal, other than income 700 ___ 6Z5 (Ex. Q) ___ 615 Total Operating Expenses $218, 7*4-1 $275,466 $268,$47 Ret Before Federal Income Tax 571 *** (7,954)Deficit (1,335) Deficit Federal Income Tax 1 1 i^36 **>1! m , 7 Ret Return $ 37,135 * Average between $12,252 on investment basis and $17,369 on original cost basis shown in Exhibit Q. ** Computation shown on next page. *** With a correctly computed federal income tax these two items would be: Net Before Federal Income Tax - - - - $59,689 Federal Income Tax - - - - - - — - 22,554 Schedule IV p l