Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

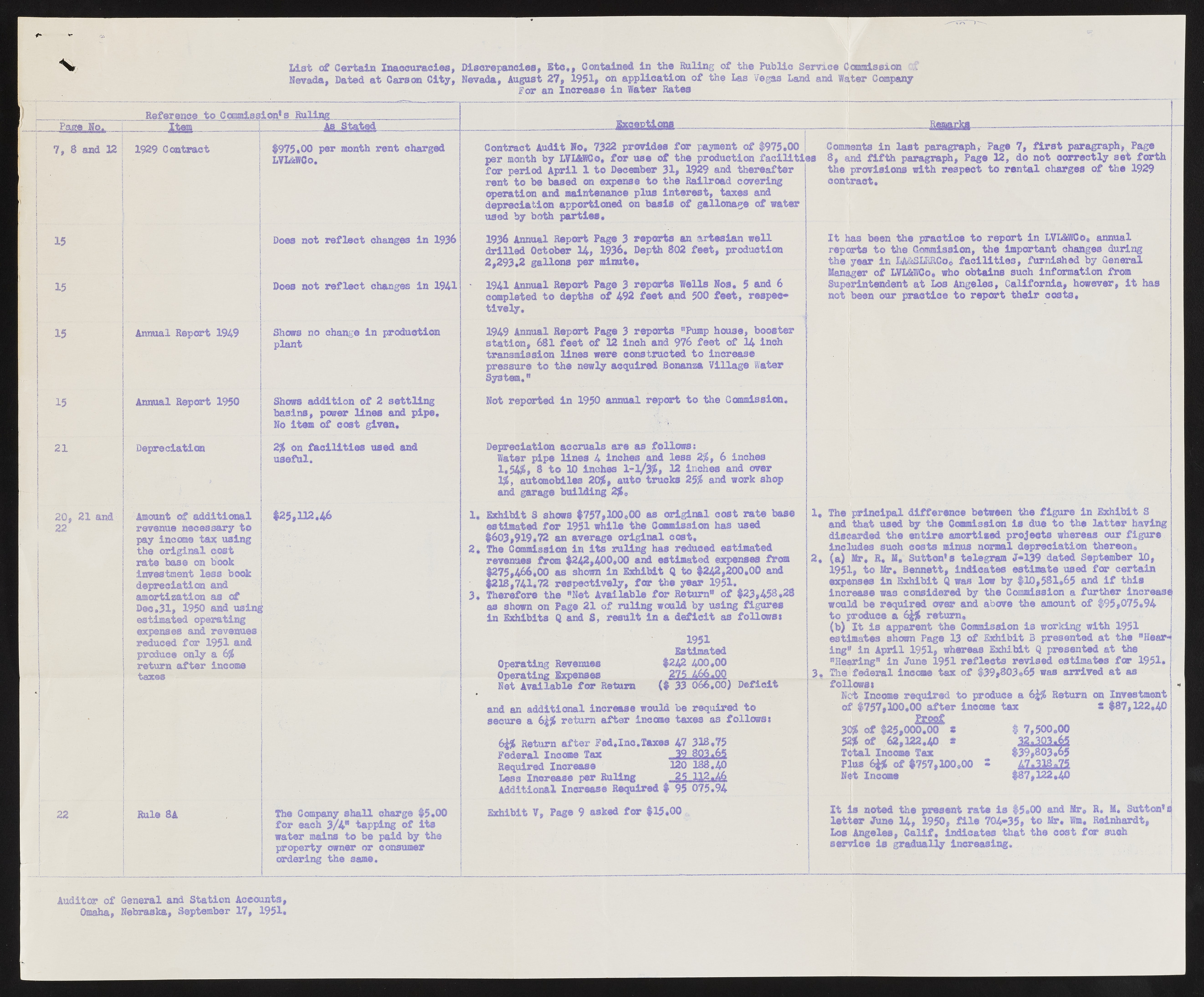

List of Certain Inaccuracies, Discrepancies, Etc,, Contained in the Ruling of the Public Service Commission Nevada, Dated at Carson City, Nevada, August 27, 1951, on application of the Las Vegas Land For an Increase in Water Rates and Water Company Paflg-JSi Reference to Commissions Ruling A&.S1atgd 7, 3 and 12 1929 Contract $LV9L7&5W,0Co0. per month rent charged 15 15 15 15 21 21 and 22 Annual Report 1949 Annual Report 1950 1 Depreciation Armeoveunnute onfe acdedsistairoyn taol ptahey ionrciogmien atla cxo ussting irnavtees btamseen t onle bsso obko ok admeoprrteicziaattiioonn aansd of Desetci,m3a1,t ed1 95o0p earnadti unsging expenses and revenues | rperdoudcuecde foonrl y1 a9 561$ and j return after inco me taxes Does not reflect changes in 1933 Does not reflect changes in 1941 Shows no change in production plant Shows addition of 2 settling basins, power lines and pipe. No item of cost given, 2$ on facilities used and useful. $25, 112.46 Rule 8A The Company shall charge $5,00 wfaotre era mcahi n3s/4 ”t ot baepp ipnagi do bf yi ttsh e property owner or consumer ordering the same* JSgggg.jA.saaa Remarks_ 4 OOppeerraattiinngg ERxepveennsueess Net Available for Return Est1i9m5a1ted $242 400,00 ($23735 406666,.0000) Deficit asnedcu arne aad 6d£it$i roentaulr inn acfrteears e iwnocuolmde bteax erse quasi rfeodl ltoow s; 6£$ Return after Fed,Ino.Taxes 47 318,75 FReedqueirraeld I nIcnocmreea Tsae x 12309 810838.,6450 ALdesdsi tIinocnraela Isnec rpeears Reu Rleiqnugi red $ 9255 017152..4964 Exhibit V, Page 9 asked for $15,00 Contract Audit No, 7322 provides for payment of $975,00 I pfeorr mpoenrtiho db Ayp rLViLl& W1C ot*o fDeocre umsbeer o3f1 ,t he19 p2r9o adnudc titohenr feaacfitleirt ieJ s roepnetr attoio bne a bnads meadi nctme neaxnpecnes pel utso tinhtee rReasitl,r oatdax ecso vearnidng depreciation apportioned on basis of gallonage of w ater j used by both parties, d1r9i3l6l Aendn uOaclt oRbeepro rHt, Pa1g93e6 ,3 rDeeppotrht 8s 0a2 nf eaertt,e spiraond wuectlilo n 2 ,293*2 gallons per minute, 1941 Annual Report Page 3 reports Wells Nos, 5 and 6 completed to depths of 492 feet and 500 feet, respectively, 1949 Annual Report Page 3 reports "Pump house, booster sttraatnisomni,s s6i8on1 fleienets owfe r1e2 icnoonhs tarnudc t9ed7 6t foe eitn croefa s1e4 inch pressure to the newly acquired Bonanza Village W ater System." Not reported in 1950 animal report to the Commission. DeWparteecria ptiipoen alcicnreusa 4ls ianrcehe ass afnodl lloewsss; 2$, 6 inches 1 .545&, 8 to 30 Inches 1- 1/ 3%, 12 inches and over 1$, automobiles 20$, auto trucks 25$ and work shop and garage building 2 $ 0 Comments in last paragraph, Page 7, first paragraph, Page 8 , and fifth paragraph, Page 32, do not oorrectly set forth the provisions with respect to rental charges of the 1929 oontraet. Irte phoarst s bteeon thteh eC opmrmaicstsiicoen ,t o trheep oirmpto irnt aLnVtL ScthWaCno.g esa nnduurailn g the year in LA&SUiHCo0 facilities, furnished by General Manager of LVLSeWCo, who obtains such information from Snuopt ebreiennte onudre nptr aactt iLocse Atnog erleepso,r t Catlhiefiorr ncioas,t s.however, it has 1, Eexshtiimbaitte Sd fsohorw s1 9$5715 w7h,i30l0e, 0t0h ea sC omomriisgsiinoanl hcaoss tu sreadte base $603,919.72 an average original oost. 2, rTehvee nCuoemsm ifsrsoimo n$ 2i4n 2i,t4s0 0r,0u0li anngd h aess triemdautceedd eexspetnismeast efdr om $275,466,00 as shown in Exhibit Q to $242,200,00 and 3, $T2h3e8r,e7f4o1r,e7 2t hree s"pNeectt iAvvealiyl,a bfloer f otrhe R eyteuarrn "1 95o1f. $23,458,28 aisn Esxhhoiwbni tosn PQa agne d2 S1, orfe rsuullitn ign w oau dledf biyci uts aisn gf oflilgouwrse;s 1, 2. Tahned ptrhiatn cuispeadl dbiyf ftehree nCcoem mbiestswieoenn ist hde ufei gtuor et hien lEaxthtiebri hta Sv ing discarded the entire amortised projects whereas our figure includes such costs minus normal depreciation thereon, 1(9a)5 1,M r,t oR ,M r,M , BeSnuntettotn,1 s Intdeilceagtreasm Je*s1t3i9m adtaet uesde dS epftore mcbeerrt a10i,n j ienxcprenesaesse wians Exchoinbsiitd erQe wda sb yl otwh eb Cyo $m1m0i,s5s3i1o,n6 5a faunrdt ihefr tihinsc rease would be required over and above the amount of $95,075,94 t(ob) prIotd iusc ea app a6£r$e nrte ttuhren ,Commission is working with 1951 estimates shown Page 13 of Exhibit B presented at the "Hear*! i"nHge"a riinng "A pirinl J u1n95e1 ,1 9w5h1e rreeafsle cEtxsh irbietv isQe pdr eessteinmtaetde sa t fatrhe 1951, j The federal income tax of $39,803,65 was arrived at as folNleotw sI;ncome required to produce a 6£$ Return on Investment j of $757,300,00 after income tax 8 $87,322,40 | 30$ of $25,00E0Ef.0if0fi g 8 T5o2$t aolf I n6c2o,m3e2 T2a,4x0 * NPeluts I6n£co$m eof $757,300.00 2 $ 7,500.00 22*22245 $39,803.65 $8477*,231232*,2450 Ilte titse rn oJtuende t14h,e p1r9e50s,e nfti rlaet e70 4i*s3 5$,5 ,0t0o aMrn,d WMmr,, RR.e inM.h arSdutt,ton*a sLeors vAincgee liess ,g rCaadluiafl,l y iinndcirceaatseisn gt.hat the cost far such Auditor of General and Station Accounts, Omaha, Nebraska, September 17, 1951*