Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

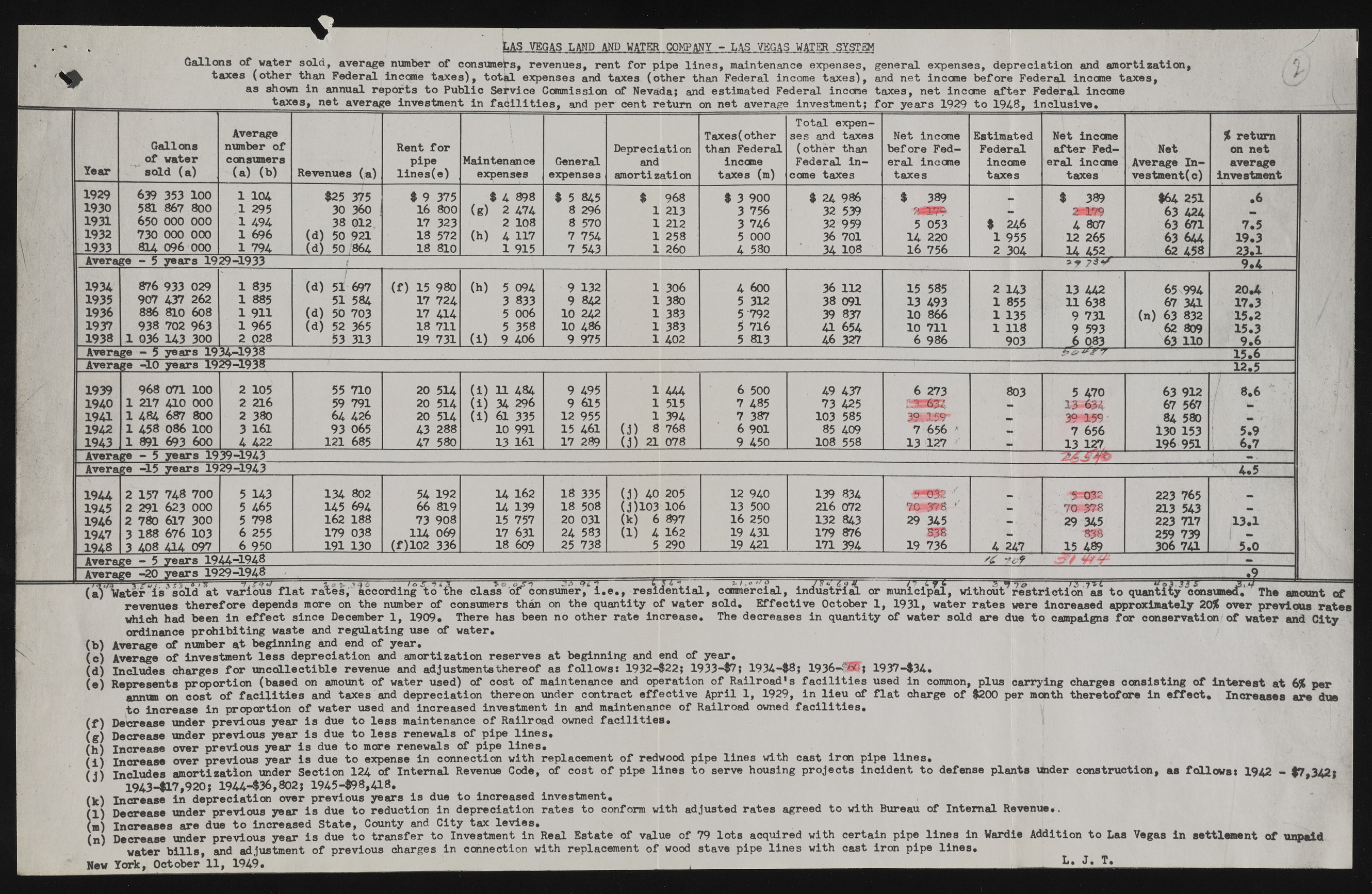

Gallons of water sold, average number of consumers, revenues, rent for pipe lines, maintenance expenses, general expenses, depreciation and amortization, taxes (other than Federal inccrae taxes), tothl expenses and taxes (other than Federal income taxes), and net income before Federal income taxes, as shown in annual reports to Public Service Commission of Nevada; and estimated Federal income taxes, net income after Federal income LAS VEGAS LAND AND WATER COMPANY - LAS VEGAS WATER SYSTEM Year Gallons of water sold (a) Average number of consumers (a) (b) Revenues (a) Rent for pipe lines(e) Maintenance expenses General expenses Depreciation and amortization Taxes(other than Federal income taxes (m) Total expenses and taxes (other than Federal income taxes Net income before Federal income taxes Estimated Federal income taxes Net income after Federal income taxes Net Average Investment c) % return on net average investment 1929 639 353 100 1 104 $25 375 $ 9 375 $ 4 898 $ 5 845 $ 968 $ 3 900 $ 24 986 $ 389 $ 389 $64 251 .6 1930 581 867 800 1 295 30 360 16 800 (g) 2 474 8 296 1 213 3 756 32 539 am j 1931 650 000 000 25-179 63 424 1 494 38 012 17 323 2 108 8 570 1 212 3 746 32 959 5 053 $ 246 4 807 63 671 7.5 1932 730 000 000 1 696 (d) 50 921 18 572 (h) 4 H 7 7 754 1 258 5 000 36 701 14 220 1 955 12 265 63 644 19.3 1933 814 096 000 1 794 (d) 50 ,864 18 810 1 915 7 543 1 260 4 580 34 108 16 756 2 304 14 452 62 458 23.1 Average - 5 years 1929-1933 | ay 9.4 1934 876 933 029 1 835 (d) 51 697 (f) 15 980 (h) 5 094 9 132 1 306 4 600 36 112 15 585 2 143 13 442 65 994 20.4 1935 907 437 262 1 885 51 584 17 724 3 833 9 842 1 380 5 312 38 091 13 493 1 855 11 638 67 3 a 17.3 1936 886 810 608 1 911 (d) 50 703 17 U 4 5 006 10 242 1 383 5 792 39 837 10 866 1 135 9 731 (n) 63 832 15.2 1937 938 702 963 1 965 (d) 52 365 18 711 5 358 10 486 1 383 5 716 a 654 10 711 1 118 9 593 62 809 15.3 1938 1 036 143 300 2 028 53 313 19 731 (i) 9 406 9 975 1 402 5 813 46 327 6 986 903 6 083 63 110 9.6 Average - 5 years 1934-1938 — — 15.6 Average -10 years 1929-1938 12,5 1939 968 071 100 2 105 55 710 20 514 (i) 11 484 9 495 1 444 6 500 49 437 6 273 803 5 470 63 912 8.6 1940 1 217 410 000 2 216 59 791 20 514 (i) 34 296 9 615 1 515 7 485 73 425 ' | 13 634 67 567 19a 1 484 687 800 2 380 64 426 20 514 (i) 61 335 12 955 1 394 7 387 103 585 30 3 59 * -Ji 39 159 84 580 . 1942 1 458 086 100 3 161 93 065 43 288 10 991 15 461 (j) 8 768 6 901 85 409 7 656 * 7 656 130 153 5.9 1943 1 891 693 600 4 422 121 685 47 580 13 161 17 289 (j) 21 078 9 450 108 558 13 127 | — 13 127 196 951 6.7 Average - 5 years 1939-1943 Average -15 years 1929-1943 4.5 1944 2 157 748 700 5 143 134 802 54 192 14 162 18 335 (j) 40 205 12 940 139 834 y 5 032 223 765 1945 2 291 623 000 5 465 145 694 66 819 14 139 18 508 ( j)103 106 13 500 216 072 70- 378 70 378 213 543 — . 1946 2 780 617 300 5 798 162 188 73 908 15 757 20 031 (k) 6 897 16 250 132 843 29 345 .«* . 29 345 223 717 13.1 1947 3 188 676 103 6 255 179 038 114 0(f) 17 631 24 583 (1) 4 162 19 431 179 876 838 Pl» 838 259 739 1948 3 408 414 097 6 950 191 130 (f)102 336 18 609 25 738 5 290 19 421 171 394 19 736 4 247 15 489 306 7 a 5.0 Average — 5 years 1944-1948 — I1 Av.e. .r age . -=•2—0!— yea—rTs- rw1-9--2--9----1Jt9 4f 8i j 1*’ ------ r n --------------rnr^TT « w * a a/ * t * i -> 1.1 o ^ o ID J /.a a " m L w t 1 s 1 ------ .9 1 1 n r 1 --- -ir« s sap 9 J — 1 (a) Water is sold at various flat rates,' according to the class of consumer, i.e., residential, commercial, industrial or municipal, without restriction as to quantity consumed. The amount of revenues therefore depends more on the number of consumers than on the quantity of water sold. Effective October 1, 1931, water rates were increased approximately 20% over previous ratesl which had been in effect since December 1, 1909, There has been no other rate increase. The decreases in quantity of water sold are due to campaigns for conservation of water and City ordinance prohibiting waste and regulating use of water, (b) Average of number at beginning and end of year, (c) Average of investment less depreciation and amortization reserves at beginning and end of year, (d) Includes charges for uncollectible revenue and adjustments thereof as follows: 1932-$22; 1933-$7; 1934-$8; 1936T-$Kfj 1937-$34. (e) Represents proportion (based on amount of water used) of cost of maintenance and operation of Railroad's facilities used in common, plus carrying charges consisting of interest at 6% per annum on cost of facilities and taxes and depreciation thereon under contract effective April 1, 1929, in lieu of flat charge of $200 per month theretofore in effect. Increases are due to increase in proportion of water used and increased investment in and maintenance of Railroad owned facilities, (f) Decrease under previous year is due to less maintenance of Railroad owned facilities, (g) Decrease under previous year is due to less renewals of pipe lines, (h) Increase over previous year is due to more renewals of pipe lines, (i) Increase over previous year is due to expense in connection with replacement of redwood pipe lines with cast iron pipe lines, ) A includes amortization under Section 124. of Internal Revenue Code, of cost of pipe lines to serve housing projects incident to defense plants vtader construction, as follows: 1942 - $7,342; U 1943-H7,920; 1944-$36,802j 1945-$98,418. (k) Increase in depreciation over previous years is due to increased investment, (l) Decrease under previous year is due to reduction in depreciation rates to conform with adjusted rates agreed to with Bureau of Internal Revenue*. (m) Increases are due to increased State, County and City tax levies, (n) Decrease under previous year is due to transfer to Investment in Real Estate of value of 79 lots acquired with certain pipe lines in Wardie Addition to Las Vegas in settlement of unpaid water bills, and adjustment of previous charges in connection with replacement of wood stave pipe lines with cast iron pipe lines. New York, October 11, 1949. L, J, T.