Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

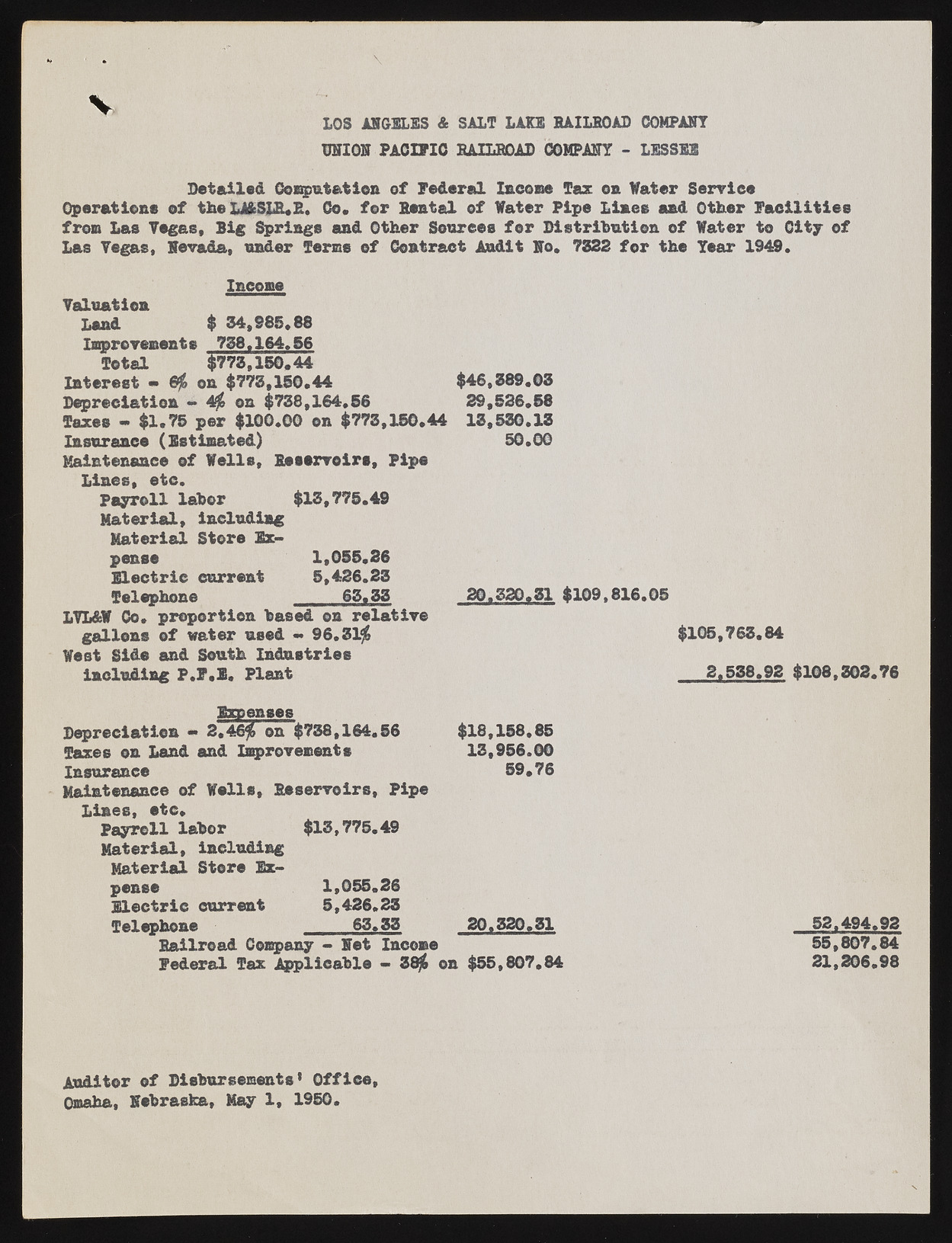

1 V LOS ANGELES A SALT LAKE RAILROAD COMPANY ONION PACIFIC RAILROAD COMPANY - LESSEE Detailed Computation of Federal Income Tax on Water Service Operations of the LAASm.il. Co* for Rental of Water Pipe Lines and Other Facilities from Las Yogas, Big Springs and Other Sources for Distribution of Water to City of Las Yogas, Nevada, under Terns of Contract Audit No. 7832 for the Year 1949. Incone Valuation Land $ 34,985.88 Improvements 788.164.56 Total $778,150*44 Interest • 6$ on $778,150.44 Depreciation - 4$ on $738,164.56 Taxes - $1.75 per $100.00 on $778,150.44 Insurance (Estimated) Maintenance of Wells, Reservoirs, Pipe Lines, etc. Payroll labor $18,775.49 Material, Including Material Store Expense 1,055.26 Electric current 5,426.28 Telephone 65,88 LVL&W Co. proportion based on relative gallons of water used - 96.31$ West Side and South Industries including P.F.E. Plant $46,889.03 29,526.58 18,530.18 50.00 20.820.81 $109,816.05 $105,768.84 2.538.92 $108,802.76 TBrp eases Depredation — 2.46$ on $738,164.56 Taxes on Land and Improvements Insurance Maintenance of Wells, Reservoirs, Pipe $18,158.85 18,956.00 59*76 Lines, etc. Payroll labor $13,775.49 Material, including Material Store Expense 1,055.26 Electric current 5,426.28 Telephone 63.83 20.820.31 Railroad Company - Net Income Federal Tax Applicable - 38$ on $55,807*84 52.494.93 55,807.84 21,206.98 Auditor of Disbursements1 Office, Omaha, Nebraska, May 1, 1950.