Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

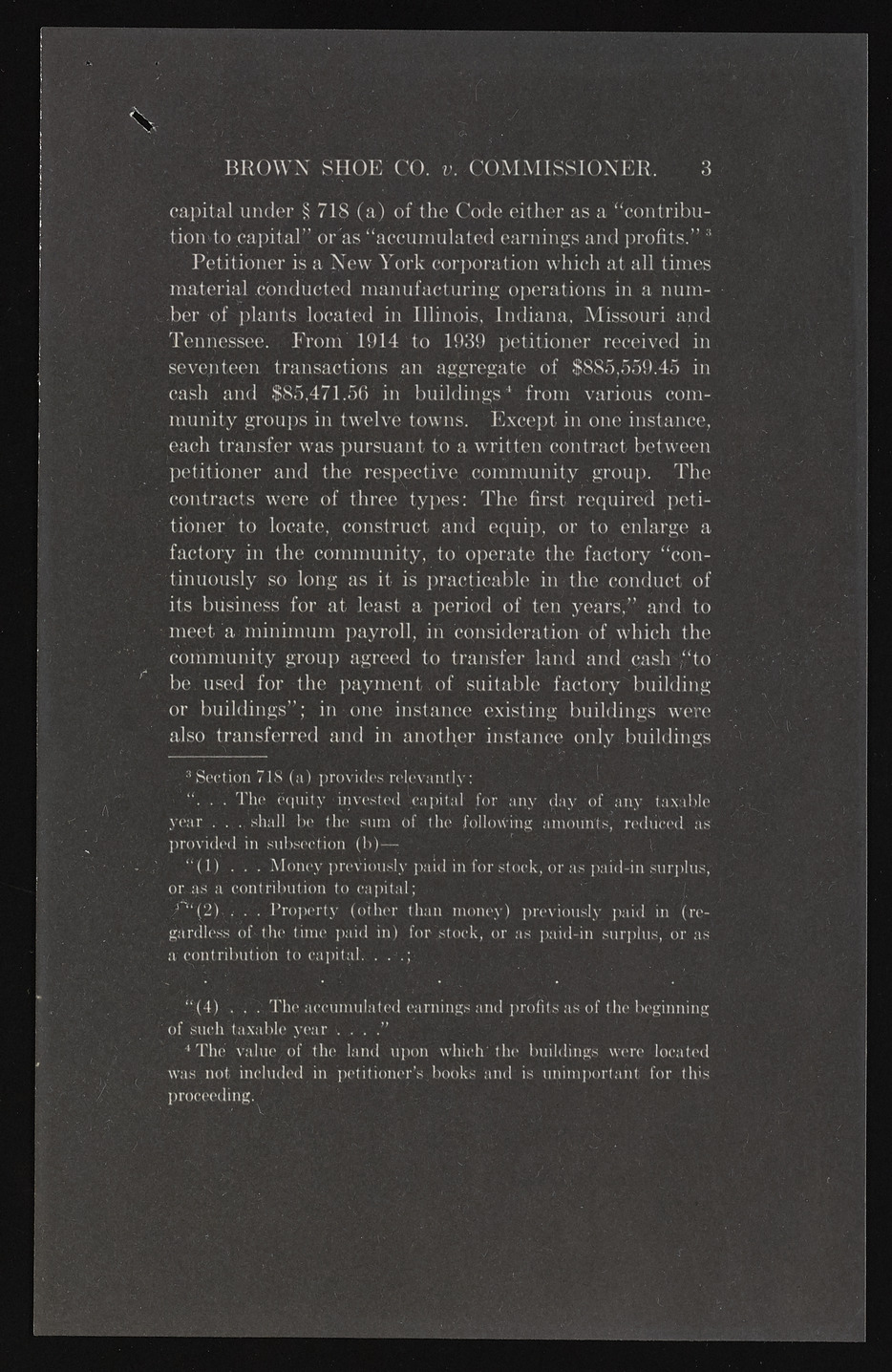

3 capital under § 718 (a) of the Code either as a “contribution to capital” or as “accumulated earnings and profits.” Petitioner is a New York corporation which at all times material conducted manufacturing operations in a number of plants located in Illinois, Indiana, Missouri and Tennessee. From 1914 to 1939 petitioner received in seventeen transactions an aggregate of $885,559.45 in cash and $85,471.56 in buildings * from various community groups in twelve towns. Except in one instance, each transfer was pursuant to a written contract between petitioner and the respective community group. The contracts were of three types: The first required petitioner to locate, construct and equip, or to enlarge a factory in the community, to operate the factory “continuously so long as it is practicable in the conduct of its business for at least a period of ten years,” and to meet a minimum payroll, in consideration of which the community group agreed to transfer land and cash “to be used for the payment, of suitable factory building or buildings” ; in one instance existing buildings were also transferred and in another instance only buildings 3 Section 71S (a) provides “. . . The equity invest erde lceavpainttally :for any day of any taxable year . . . shall be the sum of the following amounts, reduced as provided in subsection (b)— \ “ (1) . . . Money previously paid in for stock, or as paid-in surplus, or as a1 c: o. nt. riPbruotpieornt yt o (coatphietra lt;han money) previously paid in (reag acrodnletsrsi bouft itohne tto icmaep iptaali.d .i n. ) .;for stock, or as paid-in Surplus, or as of “s (u4c)h .t a. xa. bTleh ey eaacrc u.m u. l.ated earnings and profits as of the beginning wa4s Tnhoet vianlculeu doefd tihn e peltaintdi ounepro’sn bwohoikcsh 'atnhde isb uuinlidimnpgosr twaenrte floorc attheids proceeding. BROWN SHOE CO. v. COMMISSIONER.