Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

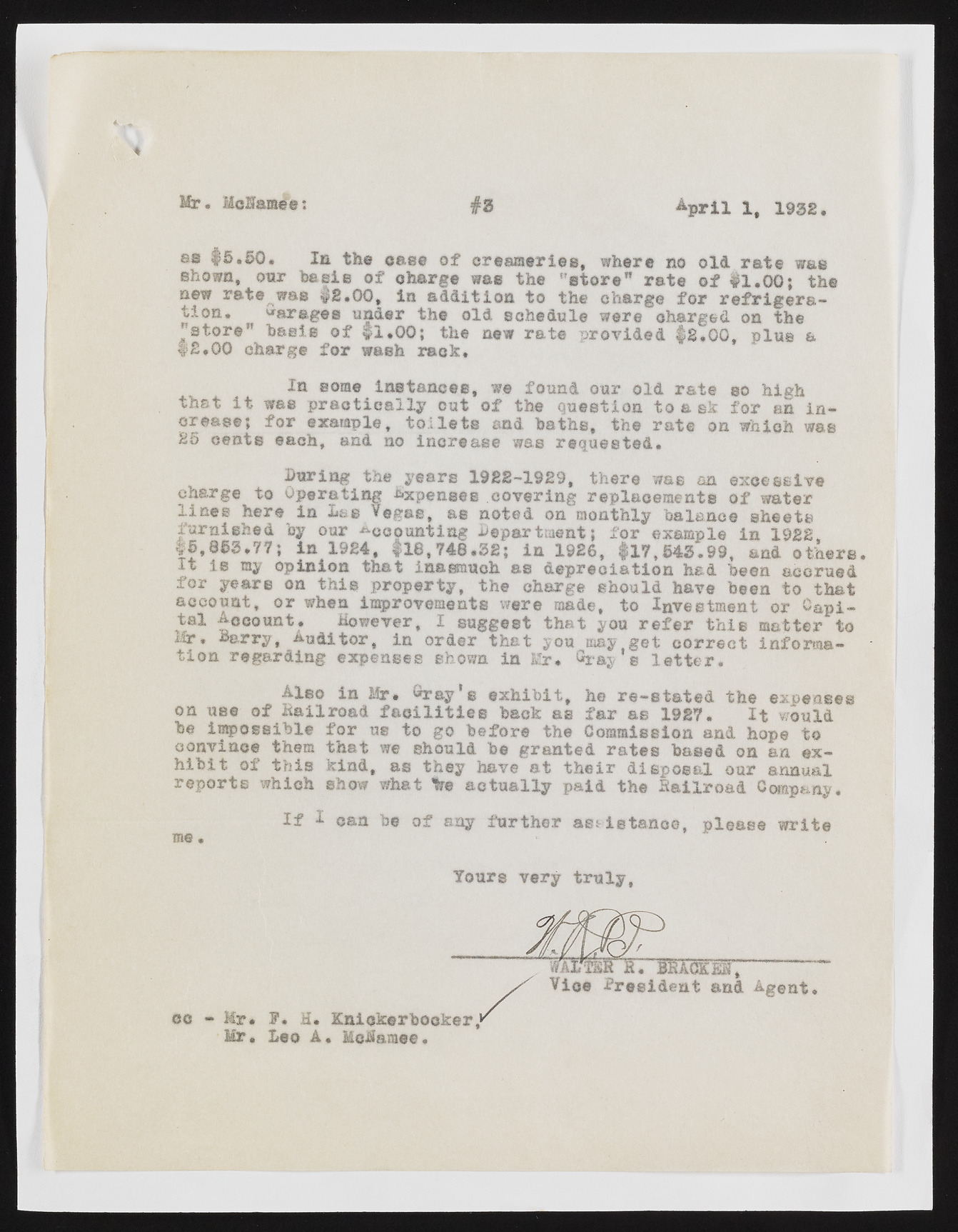

Mr. Mclamee; #0 April 1, 1932. es $ 5 .5 0 . la the case o f cream eries, where no old r a te was shown, our heels of charge was the 's t o r e ” ra te o f $ 1 .0 0 ; the new ra te was # 2.00, In ad d ition to the oharge fo r r e f r ig e r a tio n . ^aragee under the old schedule were charged on the '’s to r e ” b a sis o f # 1.00; the new ra te provided # 2,00, plus & # 2.00 charge fo r wash rack . In some in stan ces, w@ found our old ra te so high th a t i t was p r a c tic a lly out o f the question to a ek fo r an in cre a se ; fo r example, t o i l e t s and baths, the ra te on whioh was 25 cen ts each, and no in crease was requested. Poring the years 1922-1929, there was an excessive charge to Operating Expenses covering replacem ents o f water lin e s here in Las Vegas, as noted on monthly balance sheets furnished by our Accounting department; for example in 1922, $ 5 ,8 5 3 .7 7 ; in 1924, $18,748*32; in 1926, $ 1 7 ,5 4 3 .9 9 , and others I t is ray opinion th at inasmuch as d ep reciatio n had been accrued for years on th is property, the charge should have been to th at account, or when improvements were made, to Investment or 0&pi« ta l Account. however, I suggest th a t you r e f e r th is m atter to Mr, harry, Auditor, in order th a t you may,g et c o r r e c t informatio n regarding expenses shown in Mr, Gray a l e t t e r . Also in Mr, Gray g e x h ib it, he r e -s ta te d the expenses on use of h a il road f a c i l i t i e s back as fa r as 1927. I t would be im possible fo r us to go before the Commission and hope to convince them th a t we should be granted r a te s based on an exh ib it of th is kind, as they have a t th e ir d isp osal oar annual rep o rts which show what a c tu a lly paid the R ailroad Company. I f I can be of any fu rth er a s s is ta n c e , please w rite me. : a Yours very tru ly , I M f i . BRACK H 8, Vic# ^ resid en t and Agent. ce - Mr. F. H. K nickerbocker* Mr. Leo A. MeJSaraee.