Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

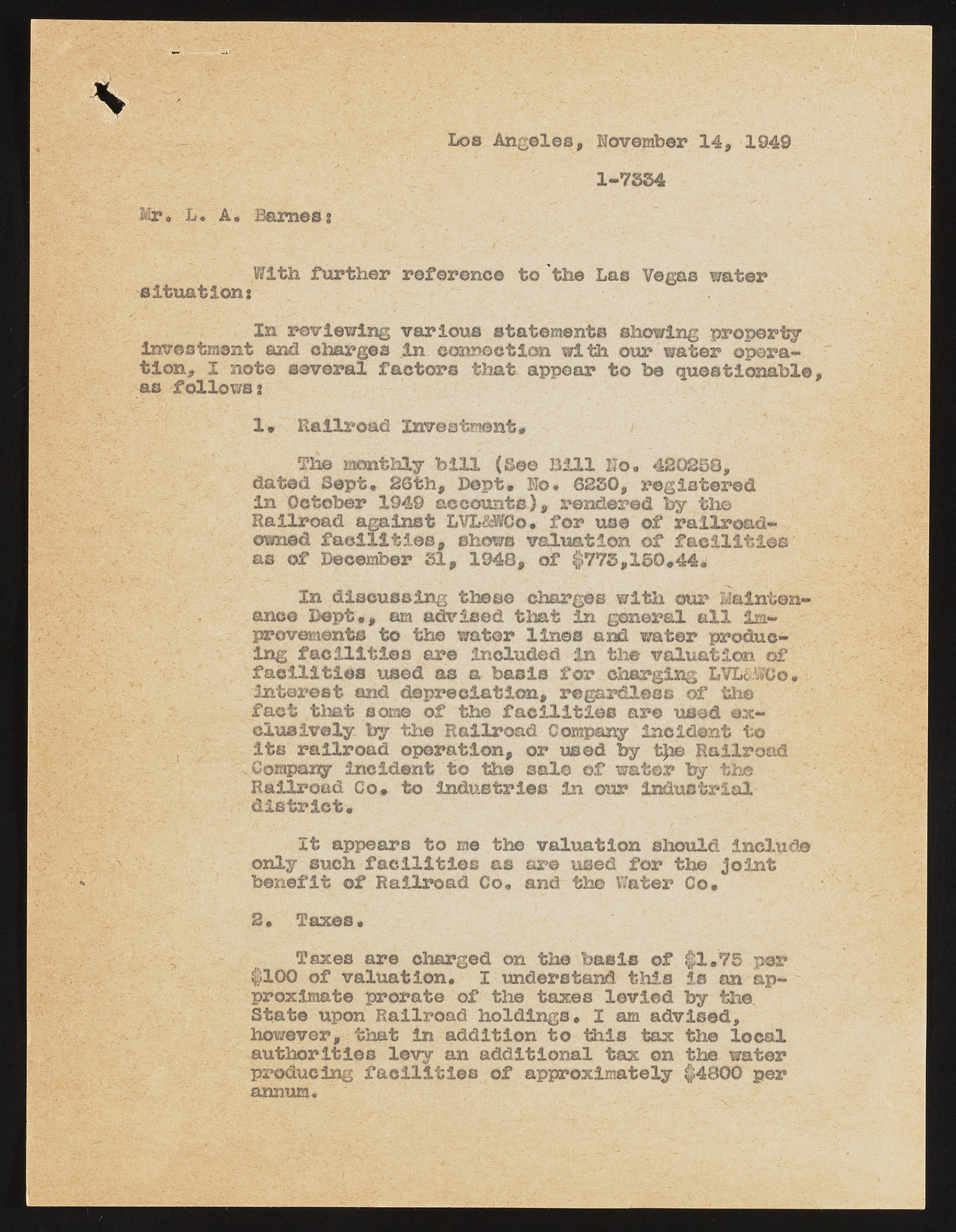

Los Angeles, November 14, 19.49 1-7334 Mr. L. A. Barnesi With further reference to the Las Vegas water situation; In reviewing various statements showing property investment and charges in connect ion with our water operation, I note several factors that appear to be questionable as follows; 1. Railroad Investment* The monthly bill (See Bill No. 420258, dated Sept, 26th, Dopt. No* 6230, registered in October 1949 accounts), rendered by the Railroad against LVL&WCo* for use of railroad-owned facilities, shows valuation of facilities as of December 31, 1948, of $773,150*44. In discussing these charges with our Maintenance Dept., am advised that in general all Improvements to the water lines and water producing facilities are included in the valuation of facilities used as a basis for charging LVL&WCo. interest and depreciation, regardless of the fact that some of the facilities are used exclusively by the Railroad Company incident to its railroad operation, or used by fcjae Railroad Company incident to the sal© of water by the Railroad Co. to industries in our industrial district. It appears to me the valuation should include only such facilities as are used for the joint benefit of Railroad Co, and the Water Co. 2, Taxes. Taxes are charged on the basis of $1,75 per $100 of valuation, I understand this is an approximate prorate of the taxes levied by the State upon Railroad holdings, I am advised, however, that in addition to this tax the local authorities levy an additional tax on the water producing facilities of approximately $4800 per annum.