Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

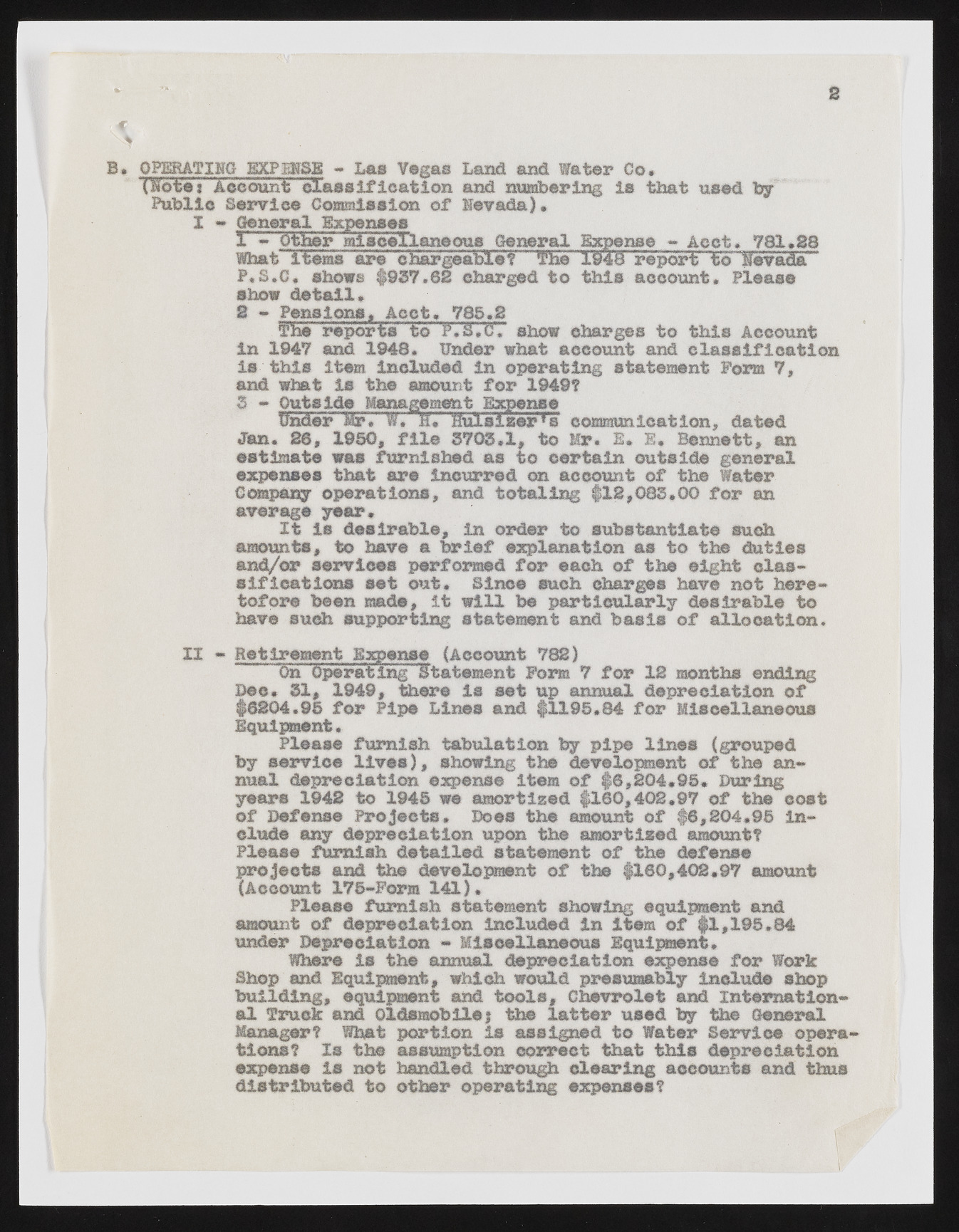

2 B. QPERATIHG E X P O S E - Las Vegas Land and Water Co* (lote * Account classification and numbering is that used by Public Service Commission of Nevada). I - General Expenses IT - Other mseellaneoua General Expense - Aect* 781.28 What items are cbargeable't ¥he 1940 report to^evadeT' P.S.G* shows #937.62 charged to this account* Please show detail* 2 - Pensions * Aect * 785.2 The' reports' to P.S.'GV show charges to this Account In 1047 and 1943* Under what account and classification Is this item included in operating statement Form 7, and what is the amount for 1949? 3 - Outside Management Expense tender' Mr. W. n. Huiaizer'^'s communication, dated Jan* 26, I960, file 3705*1, to Mr* B* E* Bennett, an estimate was furnished as to certain outside general expenses that are incurred on account of the Water Company operations, and totaling #12,083.00 for an average year* It Is desirable, in order to substantiate such amounts, to have a brief explanation as to the duties and/or services performed for each of the eight classifications set out* Since such charges have not heretofore been made, it will be particularly desirable to have such supporting statement and basis of allocation. I II - Retirement Expense (Account 782) "On Operating Statement Form 7 for 12 months ending Dec. 31, 1949, there is set up annual depreciation of #6204.95 for Pipe Lines and #1195.34 for Miscellaneous Equipment* Pleas® furnish tabulation by pipe lines (grouped by service lives), showing the development of the annual depreciation expense item of #6,204*95* During years 1942 to 1945 we amortised #160,402.97 of the cost of Defense Projects* Does the amount of #6,204.95 include any depreciation upon the amortised amount? Please furnish detailed statement of the defense projects and the development of the #160,402*97 amount (Account 175-Fona 141). Please furnish statement showing equipment and amount of depreciation included in item of #1,195.84 under Depreciation « Miscellaneous Equipment* Where is the annual depreciation expense for Work Shop and Equipment, which would presumably include shop building, equipment and tools, Chevrolet and international Truck and Oldsraoblle; the latter used by the General Manager? What portion is assigned to Water Service operations? Is the assumption correct that this depreciation expense is not handled through clearing accounts and thus distributed to other operating expenses? III