Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

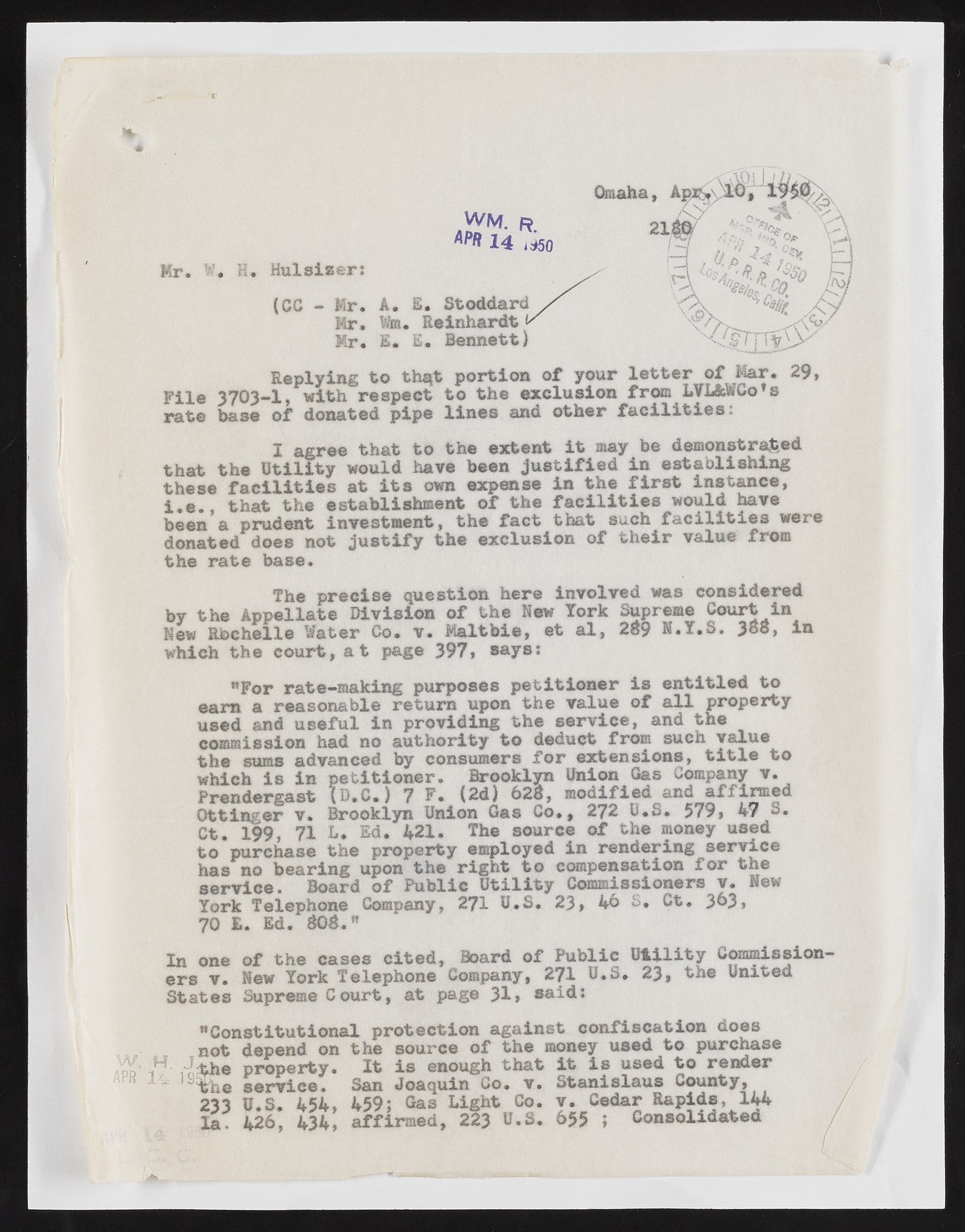

WM. R AfH 14 ,*50 Mr, Hn i Hulsizer: (CC - Mr. Mr. Mr. A. E. Stoddard $». Reinhardt ^ 1. E. Bennett) Replying to thqt portion of your letter of Mar. 29, File 3703-1, with respect to the exclusion from LYL&WCo’s rate base of donated pipe lines and other facilities. I agree that to the extent it may be demonstrated that the Utility would have been justified in establishing these facilities at its own expense in the first Instance, i.e., that the establishment of the facilities would have been a prudent investment, the fact that such facilities were donated does not justify the exclusion of their value from the rate base* The precise question here involved was considered by the Appellate Division of the Hew fork Supreme Court in Hew Rbchelle Water Co. v. Maltble, et al, 289 M.T.S. 388, in which the court, at page 397, says; **For rate—making purposes petitioner is entitled to earn a reasonable return upon the value of all property used and useful in providing the service, and the commission had no authority to deduct from such value the sums advanced by consumers for extensions, title to which is in petitioner. Brooklyn Union Gas Company v. Prendergast (D.C.) 7 F. (2d) 628, modified and affirmed Qttinger v. Brooklyn Union Gas Co., 272 U.S. 579, 47 S. Ct. 199, 71 L. Ed. 421. The source of the money used to purchase the property employed in rendering service has no bearing upon the right to compensation for the service. Board of Public Utility Commissioners v. Hew York Telephone Company, 271 U.S. 23, 4o S. Ct. 3&3» 70 £. Ed. 808." In one of the cases cited, Board of Public Utility Commissioners v. Hew York Telephone Company, 271 U.S. 23, the United States Supreme Court, at page 31, H. J 14 191 nConstitutional protection against confiscation does not depend on thIet sios urecneo uogfh tthhaet moint eyi su suesde dt ot op urrecnhdaesre San Joaquin Co. v. Stanislaus County, 459: Gas light Go. v. Cedar Rapids, 144 affirmed, 223 655 I Consolidated the 'the property, service. 233 U.S. 454, la. 426, 434,