Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

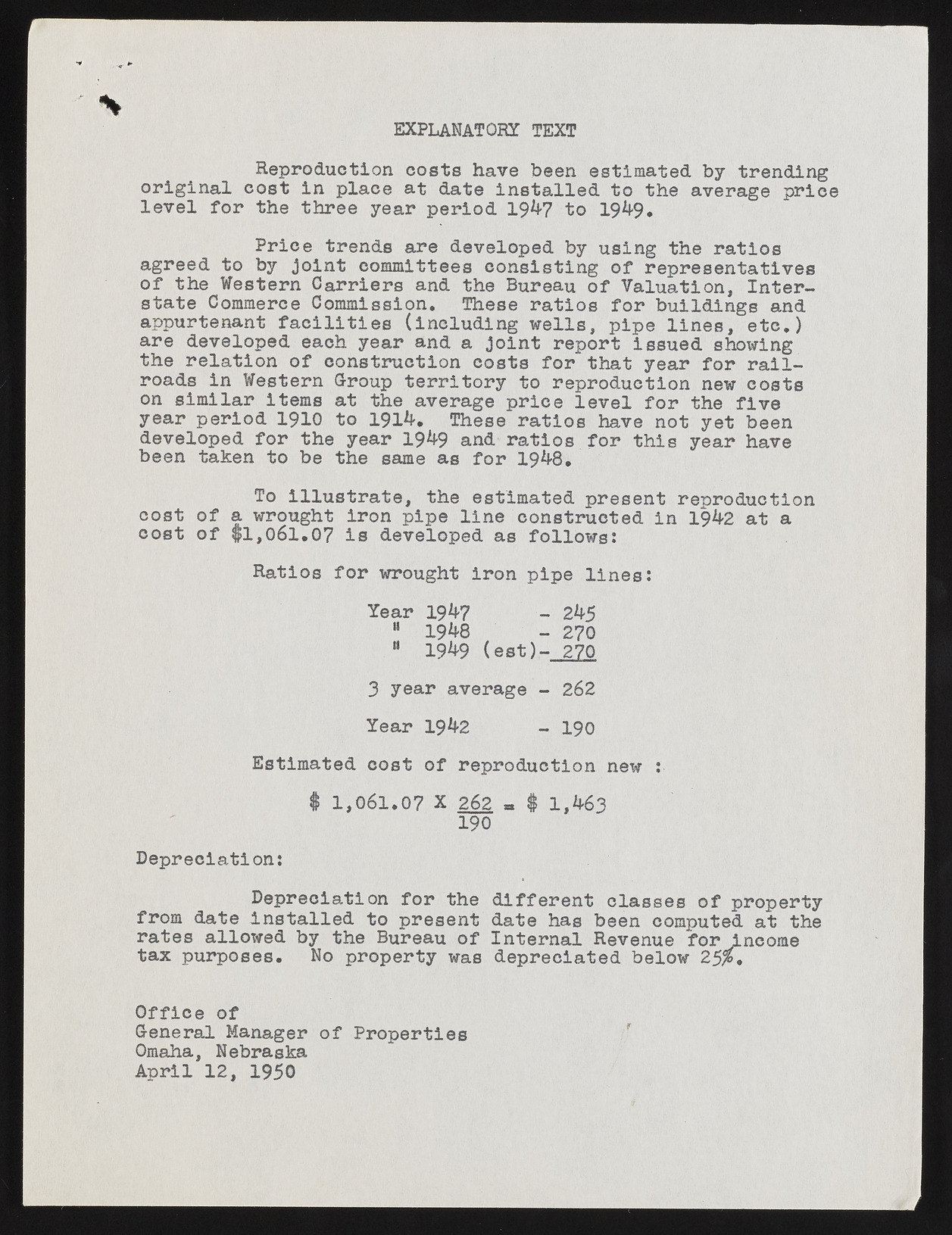

EX PLA NA TO R Y TEXT Reproduction costs have been estimated by trending original cost in place at date installed to the average prlee level for the three year period 19*4-7 to 19*4-9. Price trends are developed by using the ratios agreed to by joint committees consisting of representatives of the Western Carriers and the Bureau of Valuation, Interstate Commerce Commission. These ratios for buildings and appurtenant facilities (including wells, pipe lines, etc.) are developed each year and a joint report issued showing the relation of construction costs for that year for railroads in Western Group territory to reproduction new costs on similar items at the average price level for the five year period 1910 to 191*4-. These ratios have not yet been developed for the year 19*1-9 and ratios for this year have been taken to be the same as for 19*4-8. To illustrate, the estimated present reproduction cost of a wrought iron pipe line constructed in 19*4-2 at a cost of $1,061.07 is developed as follows* Ratios for wrought iron pipe lines: Year 19*1-7 - 2*4-5 * 19*4-8 - 270 " 19*4-9 (est)- 270 3 year average - 262 Year 19*4-2 - 190 Estimated cost of reproduction new : $ 1,061.07 X 262 p $ l,*t-63 190 Depreciation: Depreciation for the different classes of property from date installed to present date has been computed at the rates allowed by the Bureau of Internal Revenue for income tax purposes. No property was depreciated below 25$. Office of General Manager of Properties Omaha, Nebraska April 12, 1950