Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

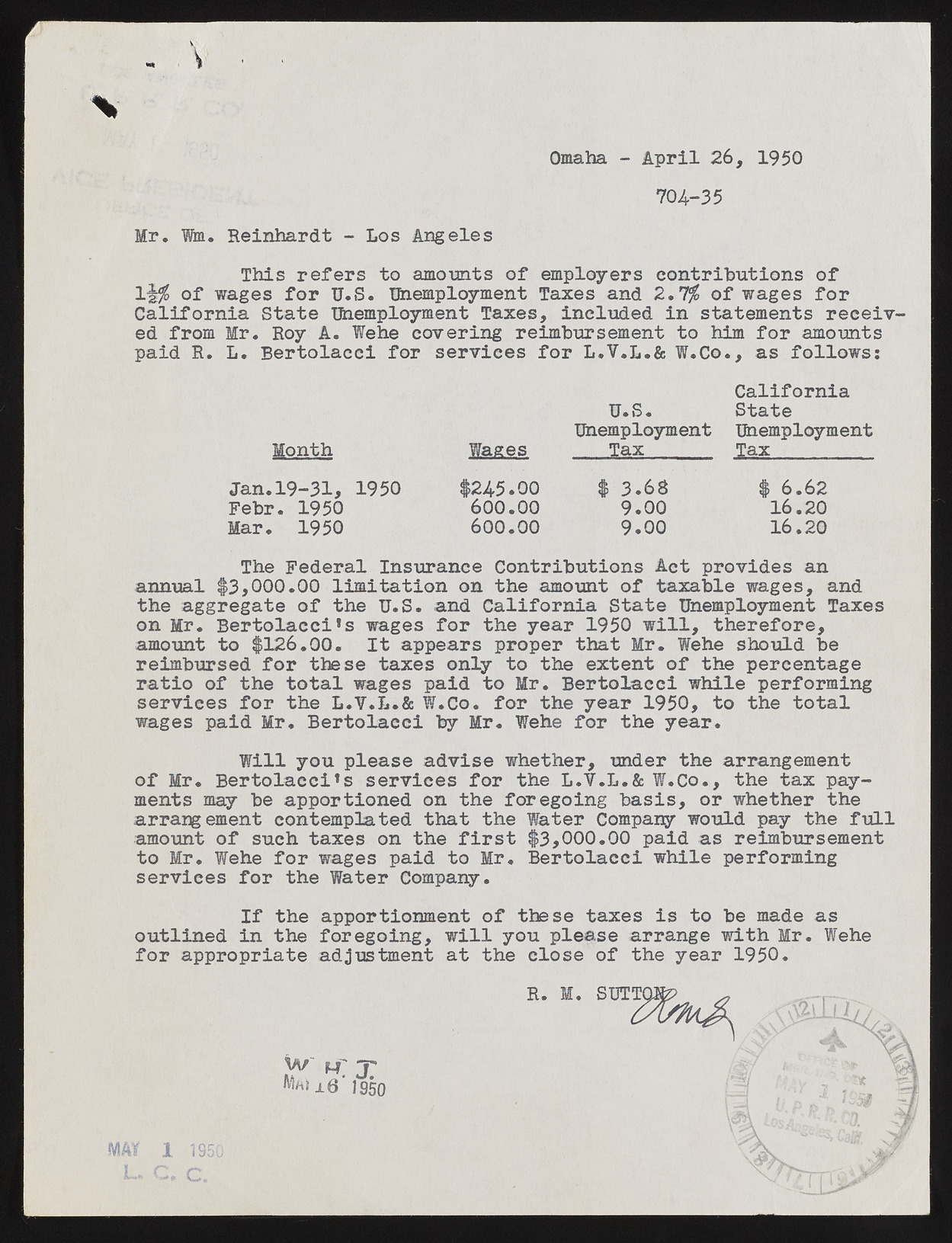

ys Omaha - April 26, 1950 704--35 Mr. Wia. Reinhardt - Los Angeles This refers to amounts of employers contributions of 1|$ of wages for U.S. Unemployment Taxes and 2.7$ of wages for California State Unemployment Taxes, included in statements received from Mr. Roy A. Wehe covering reimbursement to him for amounts paid R. L. Bertolacci for services for L.Y.L.& W.Co., as follows: Month Wages U.S. Unemployment Tax California State Unemployment Tax Jan.19-31, 1950 $24.5.00 $ 3.68 $ 6.62 Febr. 1950 600.00 9.00 16.20 Mar. 1950 600.00 9.00 16.20 The Federal Insurance Contributions Act provides an annual $3,000.00 limitation on the amount of taxable wages, and the aggregate of the U.S. and California State Unemployment Taxes on Mr. Bertolacci^ wages for the year 1950 will, therefore, amount to $126.00. It appears proper that Mr. Wehe should be reimbursed for these taxes only to the extent of the percentage ratio of the total wages paid to Mr. Bertolacci while performing services for the L.Y.L.& W.Co. for the year 1950, to the total wages paid Mr. Bertolacci by Mr. Wehe for the year. Will you please advise whether, under the arrangement of Mr. Bertolacci*s services for the L.Y.L.& W.Co., the tax payments may be apportioned on the foregoing basis, or whether the arrangement contemplated that the Water Company would pay the full amount of such taxes on the first $3,000.00 paid as reimbursement to Mr. Wehe for wages paid to Mr. Bertolacci while performing services for the Water Company. If the apportionment of these taxes is to be made as outlined in the foregoing, will you please arrange with Mr. Wehe for appropriate adjustment at the close of the year 1950. R. M. SUTTi MAY 1. 1950 L* C . C .