Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

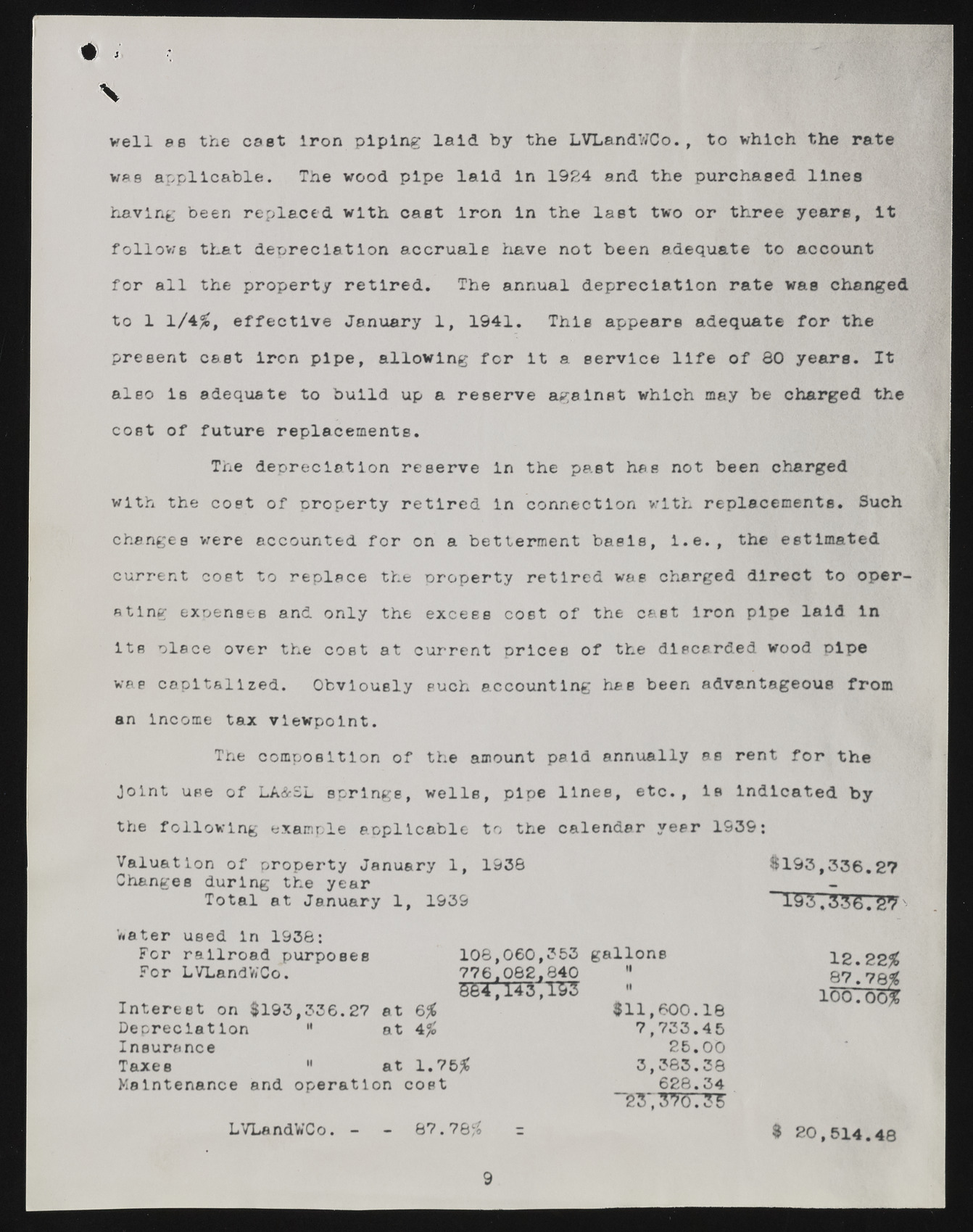

well ee the cast Iron piping laid by the LVLandVJCo., to which the rate was applicable. The wood pipe laid In 1924 and the purchased lines having been replaced with cast Iron In the last two or three years, It follows that depreciation accruale have not been adequate to account for all the property retired. The annual depreciation rate was changed to 1 1/4$, effective January 1, 1941. This appears adequate for the present cast Iron pipe, allowing for It a service life of 80 years. It also Is adequate to build up a reserve against which may be charged the cost of future replacements. with the cost of property retired In connection with replacements. Such changes were accounted for on a betterment basis, i.e., the estimated current cost to replace the property retired was charged direct to operating expenses and only the excees cost of the cast iron pipe laid In Its place over the cost at current prices of the discarded wood pipe wae capitalized. Obviously such accounting has been advantageous from an Income tax viewpoint. Joint use of LA&SL springs, wells, pipe lines, etc., Is Indicated by the following example applicable to the calendar year 1939: Valuation of property January 1, 1936 $193,336. Changes during the year Total at January 1, 1939 ~I9&,336. 'water used In 1938: The depreciation reserve In the past has not been charged The composition of the amount paid annually as rent for the For railroad purposes For LVLandViCo. 108,060,353 776.082.840 664; m , T 5 3 gallons 1 2 .2 2 # 87.78# II 10 0 .00# Interest on $193,336.27 at 6# Depreciation " at 4# Insurance $11,600.18 7,733.45 26.00 3,383.38 628.34 23~, 3?0.35 Taxes " at 1.75# Maintenance and operation cost LTLandWCo. 67.78# $ 20,514.48 9