Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

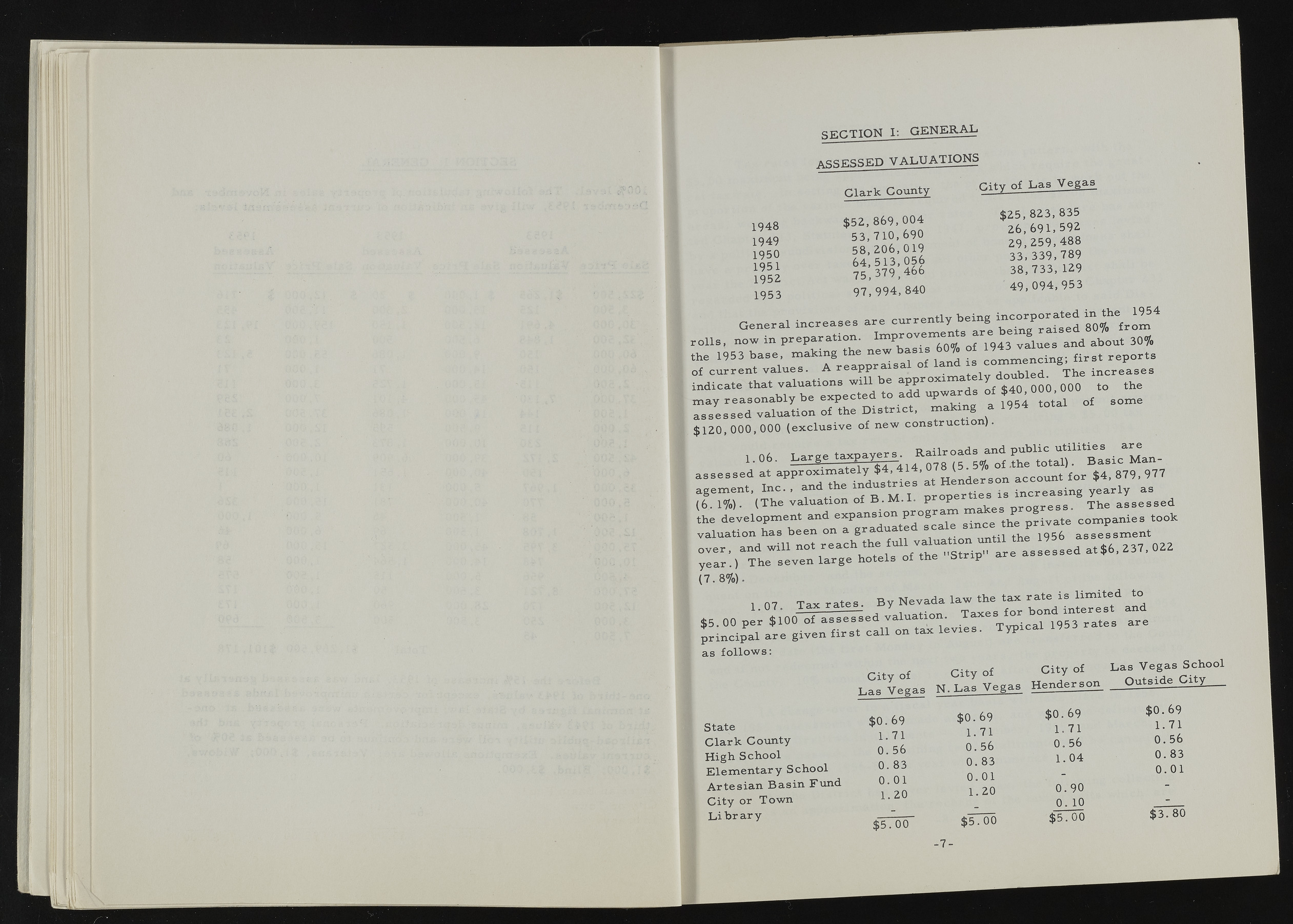

ASSESSED v a l u a t i o n s SECTION 1: G E N E R A L 1948 1949 1950 1951 1952 1953 C la rk County $ 5 2 ,8 6 9 ,0 0 4 5 3 , 710, 690 58, 2 0 6 , 019 6 4 ,5 1 3 ,0 5 6 7 5 ,3 7 9 ,4 6 6 97, 994,840 C ity of L as V ega s $25, 823,835 2 6 ,6 9 1 ,5 9 2 2 9 ,2 5 9 ,4 8 8 3 3 ,3 3 9 ,7 8 9 3 8 ,7 3 3 ,1 2 9 49, 094, 953 G en era l in c r e a s e s a re currently being incorporated ,n the ^ 1 ^ 4 r o lls , now in p rep a ra tion . v f luea and about 30% the 1953 b a s e , m aking the new com m en cin g; fir s t re p o rts of cu rren t v a lu es. A re a p p ra is a o an doub led. The in c r e a s e s in dicate that valuations w ill be approxi the m a y re a so n a b ly be ex p ected to add upw ards of $40 ' 0 0 H a s s e s s e d valuation of the D is tr ic t, m aking a 1954 $ 120, 000,000 (e x clu s iv e of new co n stru ction ). R a ilroa d s and p u b lic u tilities are 1 .0 6 . 14R “ 7 8 ? f 5* of .the tota l). B a s ic M an-a s s e s s e d at *PP mg. in d u strie s at H en d erson accou n t fo r $4, 879, 9 " agem en t, I n c ., t p r o p e r ties is in cre a sin g y e a rly as (6 ,1 % ). (The valuation of B .M . I. p P , _res8. The a s s e s s e d the d evelopm en t and expan sion p ro g ra m p r iv ate com p an ies took valuation has b een on a graduated sca le sin ce § | | | g § g o v e r , and w ill not >tea ch the? j „ H a s s e sse d a t $ 6 , 237, 022 y e a r .) The seven large h otels of the s trip , (7 .8 % ). l 07 T ax r a te s . B y N evada law the tax 1 .0 7 . Tax rates_. * * rate is lim ited to Taxes for bond in te re s t and $5. 00 per $100 of a s s e s s e d va • T v o ica l 1953 ra te s are I p rin cip a l a re given fir s t c a ll on tax le v ie s . T y p ica l as fo llo w s : C ity of C ity of C ity of L a s V ega s S ch ool V egas N. L a i V egas H en d erson _ O utside Cit^ _ State C la rk County H igh S ch ool E lem en ta ry S ch ool A rte sia n B asin Fund f.itv or Tow n $0 . 69 1.71 0 . 56 0. 83 0.01 i 7.0 $ 0 .6 9 1.71 0. 56 0 .8 3 0. 01 11 20 $ 0 .6 9 1.71 0 .56 1 .0 4 0 .9 0 $ 0 .6 9 1.71 0. 56 0 .8 3 0 . 0 1