Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

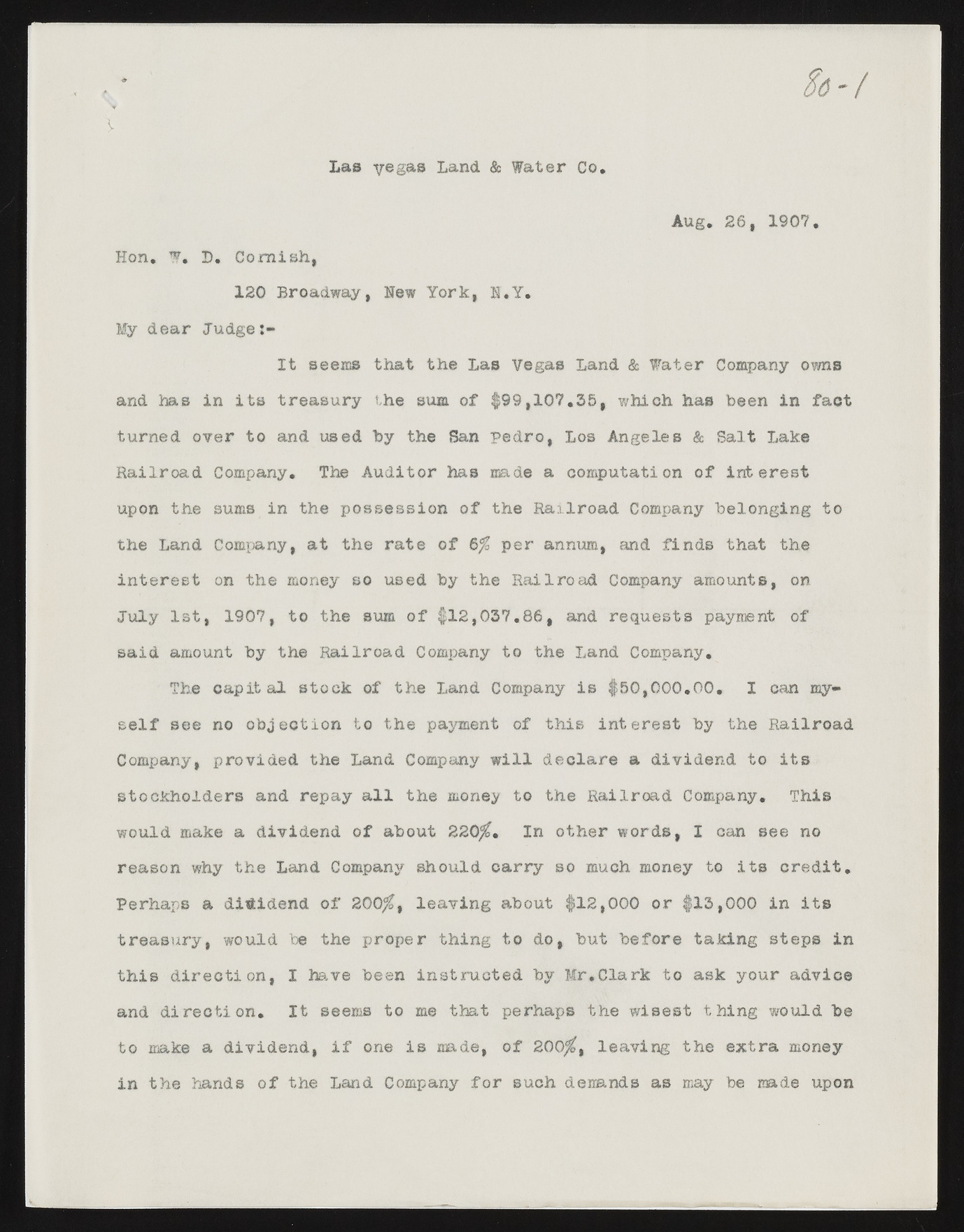

Las yegas Land & Water Co Aug. 26, 1907. Hon. H D. Cornish, 120 Broadway, Hew York, B.Y. My dear Judge It seems that the Las Vegas Land & Water Company owns and has in its treasury the sum of $99,107.35, which has been in fact turned over to and used by the San pedro, Los Angeles & Salt Lake Railroad Company. The Auditor has made a computation of Interest upon the sums in the possession of the Railroad Company belonging to the Land Company, at the rate of 6% per annum, and finds that the interest on the money so used by the Railroad Company amounts, on July 1st, 1907, to the sum of $12,037.86, and requests payment of said amount by the Railroad Company to the Land Company. The capital stock of the Land Company is $50,000.00. I can myself see no objection to the payment of this interest by the Railroad Company, provided the Land Company will declare a dividend to its stockholders and repay all the money to the Railroad Company. This would make a dividend of about 220$. In other words, I can see no reason why the Land Company should carry so much money to its credit. Perhaps a dividend of 200$, leaving about $12,000 or $13,000 in its treasury, would be the proper thing to do, but before taking steps in this direction, I have been instructed by Mr.Clark to ask your advice and direction. It seems to me that perhaps the wisest thing would be to make a dividend, if one is made, of 200$, leaving the extra money in the hands of the Land Company for such demands as may be made upon