Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

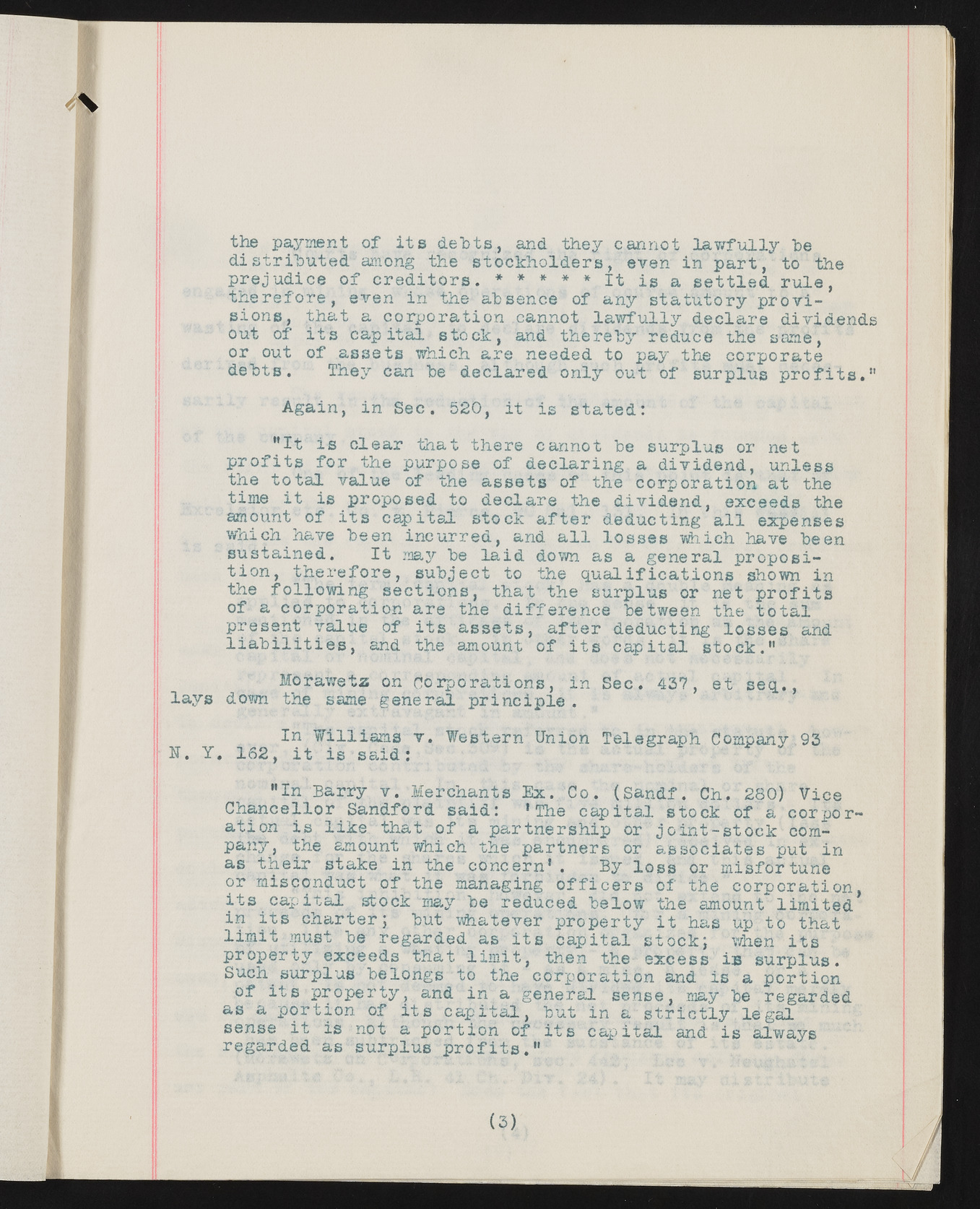

the payment o f i t s debts, and they cannot la w fu lly he d is trib u te d among the stock h old ers, even in p a rt, to the p reju d ice o f c r e d ito r s . * * * * * I t is a s e t t le d r u le , th e r e fo r e , even in the absence of any sta tu to ry p r o v ision s, th at a corp oration cannot la w fu lly d ecla re dividends out of i t s c a p ita l stock, and thereby reduce the same, or out o f assets which are needed to pay the corporate debts. They can be declared only out of surplus p r o f i t s . " Again, in Sec. 520, i t is s ta te d : MI t is c le a r th at there cannot be surplus or net p r o f it s fo r the purpose of d e cla rin g a d ividen d, unless the t o t a l value of the assets of the corp ora tion a t the time i t is proposed to d ecla re the d ividen d, exceeds the amount^ o f i t s c a p ita l stock a f t e r deducting a l l expenses which have been incu rred, and a l l lo s s e s which have been sustained. I t may be la id down as a gen eral p ro p o sitio n , th e r e fo r e , su bject to the q u a lific a tio n s shown in the fo llo w in g s ectio n s, th at the surplus or net p r o f it s o f a corp ora tion are the d iffe r e n c e between the t o t a l present value of i t s a s s e ts , a ft e r deducting lo sses and l i a b i l i t i e s , and the amount o f i t s c a p ita l sto ck ." Morawetz on co rp ora tion s, in Sec. 437, e t s e q ., la y s down the same gen eral p rin c ip le . In W illiam s v . Western Union Telegraph Company.93 U. Y. 162, i t is s a id : "In Barry v . Merchants Ex. Co. (Sandf. Ch. 280) Vice C hancellor Sandford sa id : ’ The c a p ita l stock of a corijor-ation is lik e that o f a partn ersh ip or jo in t - s t o c k company, the amount which the partners or a sso cia tes put in as th e ir stake in th e'co n cern ’ . By lo s s or m isfortune or misconduct o f the managing o f f i c e r s o f the corp o ra tio n , i t s c a p ita l stock may be reduced below the amount lim ite d in i t s c h a rte r; but whatever p ro p erty i t has up.to that lim it must be regarded as i t s c a p ita l sto ck ; when i t s p ro p erty exceeds th at lim it , then the excess is surplus. Such surplus belongs to the co rp o ra tio n and is a p o rtio n o f i t s p ro p erty , and in a general sense, may be regarded as a p o rtio n of i t s c a p it a l, but in a s t r i c t l y le g a l sense i t is not a p o rtio n o f i t s c a p ita l and is always regarded as surplus p r o f i t s . " (3)