Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

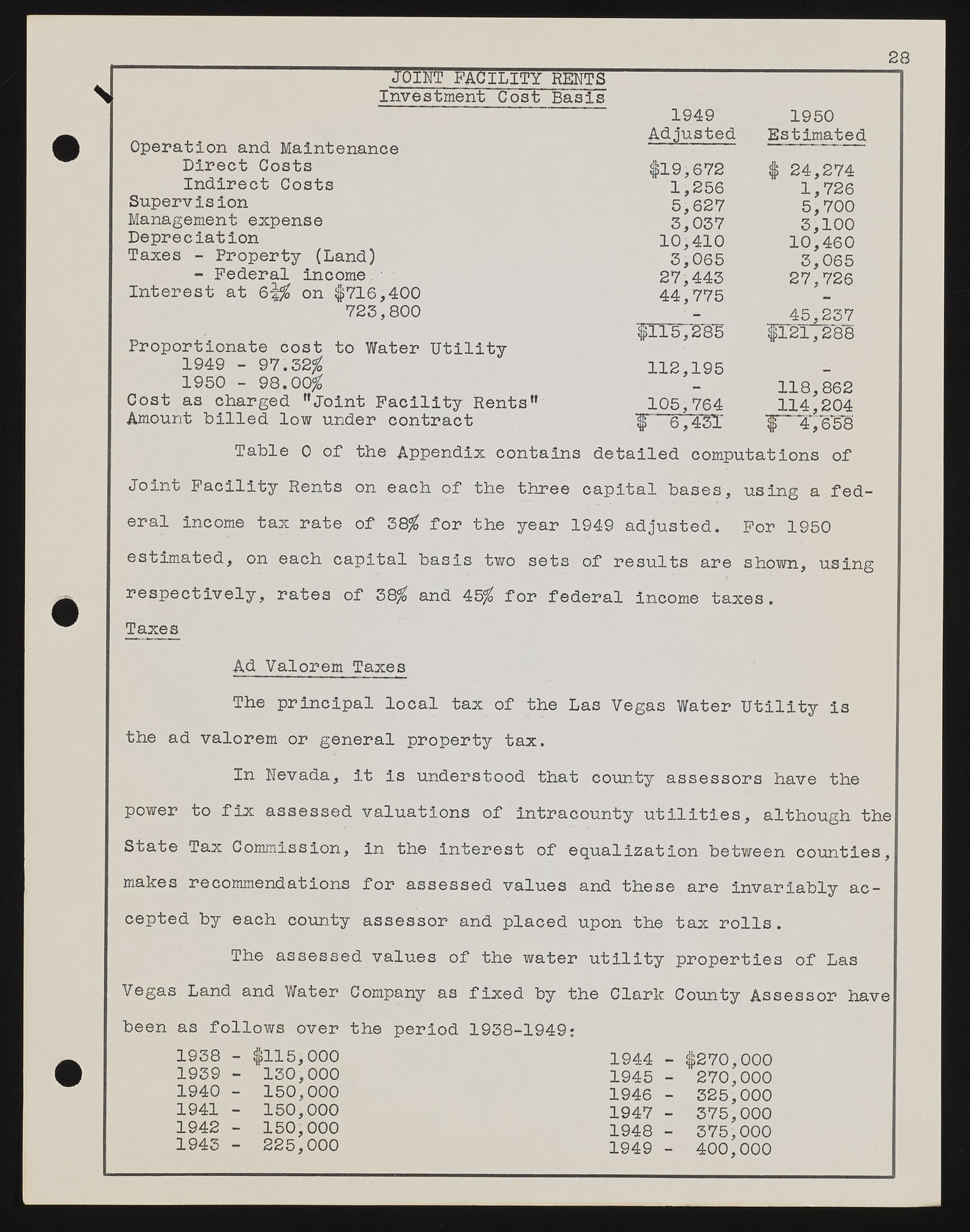

N JOINT FACILITY RENTS Investment Cost Basis Operation and Maintenance 1949 Adjusted 1950 Estimated Direct Costs Indirect Costs $19,672 $ 24,274 Supervision 1,256 1,726 Management expense 5,627 5,700 Depreciation 5,057 5,100 Taxes - Property (Land) 10,410 10,460 - Federal income ' 5,065 5,065 Interest at 65# on $716,400 27,445 27,726 44,775 725,800 ' — 45,257 Proportionate cost to Water Utility $115,285 $I2l,2 8 8 1949 - 97.52# 112,195 1950 - 98.00# — 118,862 Cost as charged ’’Joint Facility Rents’* 105,764 114,204 Amount billed low under contract | 67431 W ~ 4,60S Table 0 of the Appendix contains detailed computations of Joint Facility Rents on each of the three capital bases, using a federal income tax rate of 58# for the year 1949 adjusted. For 1950 estimated, on each capital basis two sets of results are shown, using respectively, rates of 58# and 45# for federal income taxes. Taxes Ad Valorem Taxes The principal local tax of the Las Vegas Water Utility is the ad valorem or general property tax. In Nevada, it is understood that county assessors have the power to fix assessed valuations of intracounty utilities, although the State Tax Commission, in the interest of equalization between counties, makes recommendations for assessed values and these are invariably accepted by each county assessor and placed upon the tax rolls. The assessed values of the water utility properties of Las Vegas Land and Water Company as fixed by the Clark County Assessor have been as follows over the period 1958-1949: 1958 - $115,000 1959 - 150,000 1940 - 150,000 1941 - 150,000 1942 - 150,000 1945 - 225,000 1944 - $270,000 1945 - 270,000 1946 - 525,000 1947 - 575,000 1948 - 575,000 1949 - 400,000