Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

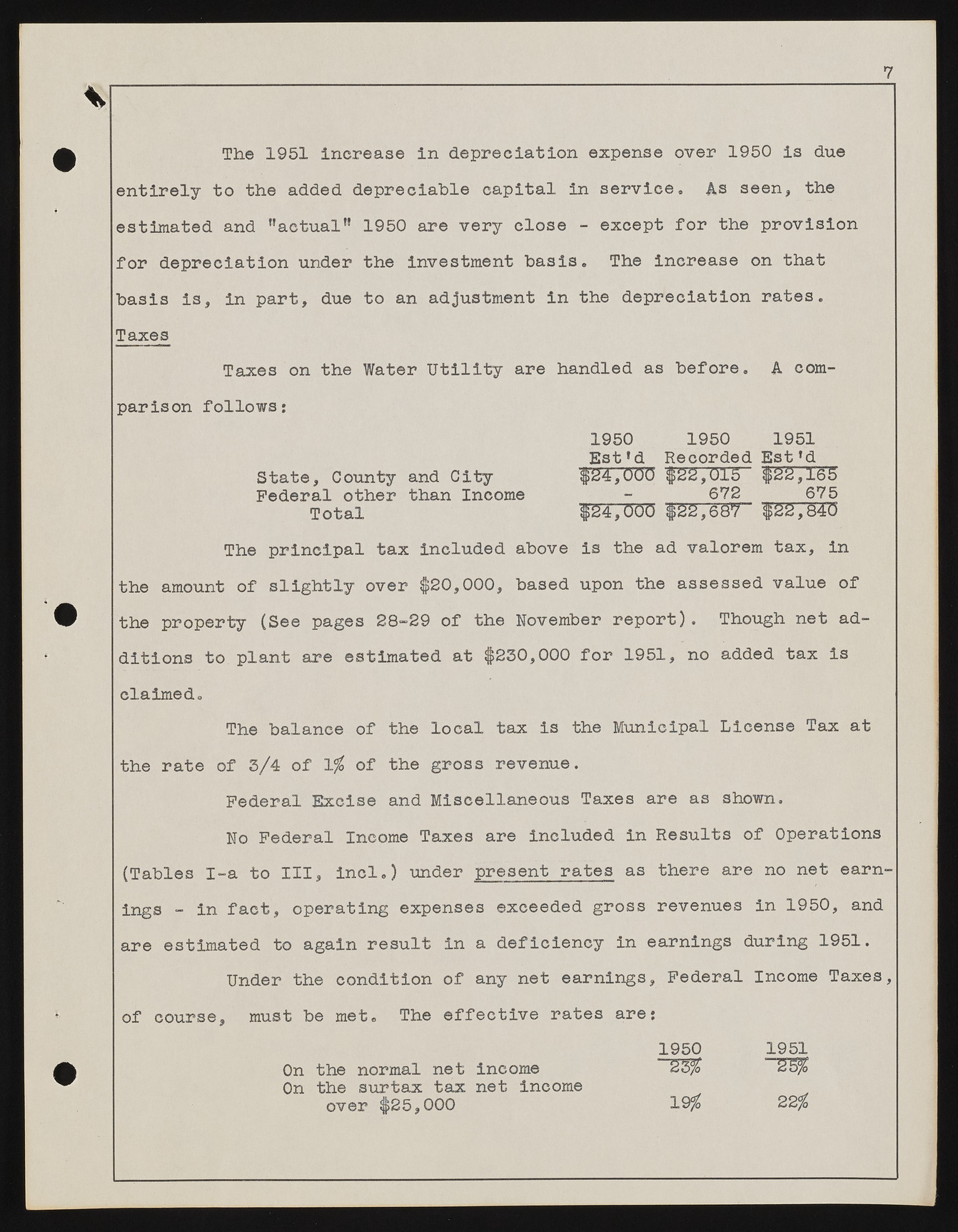

7 The 1951 increase in depreciation expense over 1950 is due entirely to the added depreciable capital in service. As seen, the estimated and "aetualM 1950 are very close - except for the provision for depreciation under the investment basis. The increase on that basis is, in part, due to an adjustment in the depreciation rates. Taxes Taxes on the Water Utility are handled as before. A comparison follows: 1950 1950 1951 Est’d Recorded Est*d State, County and City '$'24,000 $22,010“ f ^ T e S Federal other than Income - 672 675 Total $24,000 $22,687" $22,040 The principal tax included above is the ad valorem tax, in the amount of slightly over $2 0 ,000, based upon the assessed value of the property (See pages 28-29 of the November report). Though net additions to plant are estimated at $250,000 for 1951, no added tax is claimed. The balance of the local tax is the Municipal License Tax at the rate of 5/4 of 1$ of the gross revenue. Federal Excise and Miscellaneous Taxes are as shown. No Federal Income Taxes are Included in Results of Operations (Tables I-a to III, incl.) under present rates as there are no net earnings - in fact, operating expenses exceeded gross revenues in 1950, and are estimated to again result in a deficiency in earnings during 1951. Under the condition of any net earnings, Federal Income Taxes, of course, must be met. The effective rates are: On the normal net income 1950 “25$ 1951 On the surtax tax over $25,000 net income 19$ 22$