Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

More Info

Rights

Digital Provenance

Publisher

Transcription

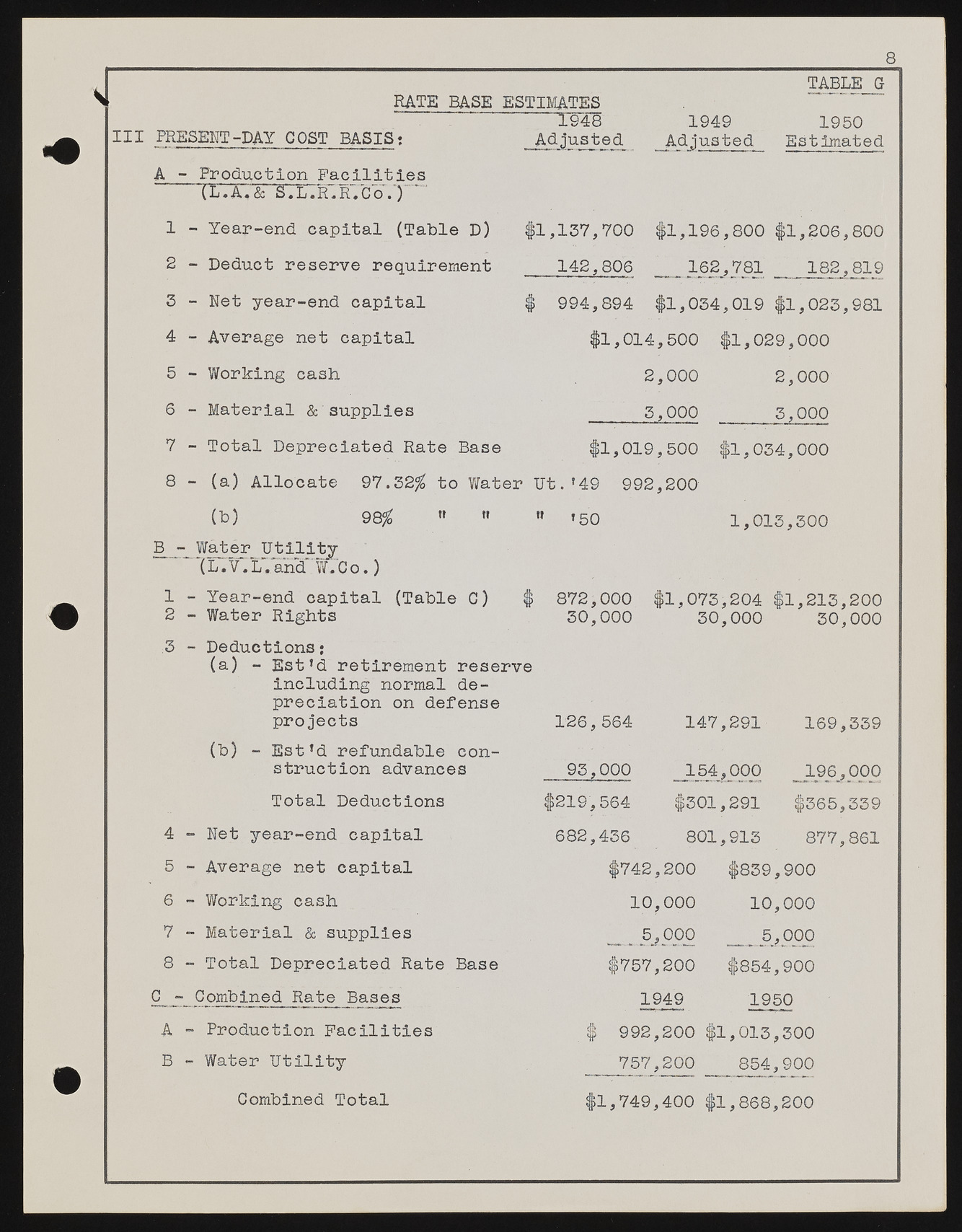

8 RATE BASE ESTIMATES I H PRESENT-DAY GOST BASIS: A - Production Facilities (L.A.& S . L . R . R V C o | 1 - Year-end capital (Table D) 2 - Deduct reserve requirement 3 - Net year-end capital 4 - Average net capital 5 - Working cash 6 - Material & supplies 7 - Total Depreciated Rate Base 8 1945 Adjusted 1949 Adjusted TABLE G 1950 Estimated ,137,700 #1,196,800 #1,206,800 142,806 162,781 182,819 994,894 #1,034,019 #1,023,981 #1,014,500 #1,029,000 2,000 2,000 3,000 5,000 #1,019,500 $1,034,000 (a) Allocate 97.32$ to Water Ut.»49 992,200 (b) B^_- Water Utility (L.V.L.’and W.Co.) 1 - Year-end capital (Table G) # 2 - Water Rights 3 - Deductions; (a) - Est'd retirement reserve including normal depreciation on defense projects (b) - Est’d refundable construction advances Total Deductions 4 - Net year-end capital 5 - Average net capital 6 - Working cash 7 - Material & supplies 8 - Total Depreciated Rate Base C_j-_ Combined Rate Bases A - Production Facilities B - Water Utility Combined Total »50 872,000 30,000 1,013,300 $1,073,204 30,000 .,213,200 30,000 126,564 93,000 $219,564 682,436 147,291 169,339 154,000 $301,291 801,913 _196,000 $365,339 877,861 $742,200 10,000 __ .5,000 $757,200 1949 $839,900 10,000 __ .5,000 #854,900 1950 f 992.200 $1,013,300 757.200 __ 854,900 [>1,749,400 $1,868,200