Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

More Info

Rights

Digital Provenance

Publisher

Transcription

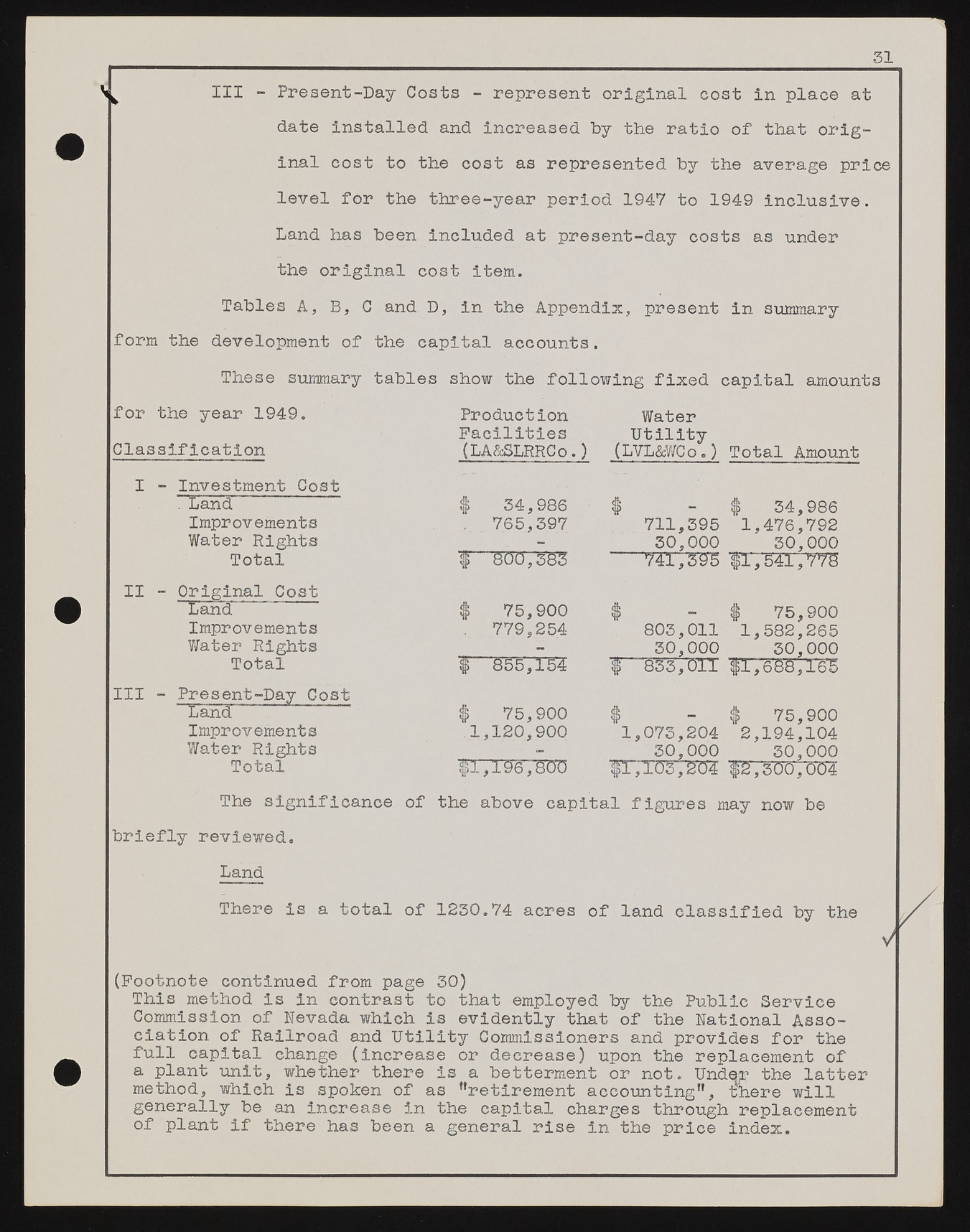

^ III - Present-Day Costs - represent original cost in place at date installed and increased by the ratio of that original cost to the cost as represented by the average price level for the three-year period 1947 to 1949 inclusive. Land has been included at present-day costs as under the original cost item. Tables A, B, C and D, in the Appendix, present in summary form the development of the capital accounts. These summary tables show the following fixed capital amounts for the year 1949. Classification Production Facilities (LA&SLRRCo.) Water Utility (LVL&WCo*) Total Amount Investment Cost II . Land Improvements Water Rights $r 34,986 765,397 1 711,395 30,000 Total 800,383 741,395 Original Cost Land Improvements Water Rights $ 75,900 779,254 1 803,011 30,000 Total i- (355,154 r 833,011 34,986 1-76,792 30.000 *fcj. $ ( (o 75,900 582,265 30.000 iS Land | 75,900 Improvements 1,120,900 Water Rights - Total Si ®1 96 j 800 75,900 1,073,204 2,194,104 .30,000 30,000 $1,103,204 f 2,300,004 The significance of the above capital figures may now be briefly reviewed. Land There is a total of 1230.74 acres of land classified by the (Footnote continued from page 30) This method is in contrast to that employed by the Public Service Commission of Nevada which is evidently that of the National Association of Railroad and Utility Commissioners and provides for the full capital change (increase or decrease) upon the replacement of a plant unit, whether there is a betterment or not. Under the latter method, which is spoken of as Retirement accounting”, there will generally be an increase in the capital charges through replacement of plant if there has been a general rise in the price index.