Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

More Info

Rights

Digital Provenance

Publisher

Transcription

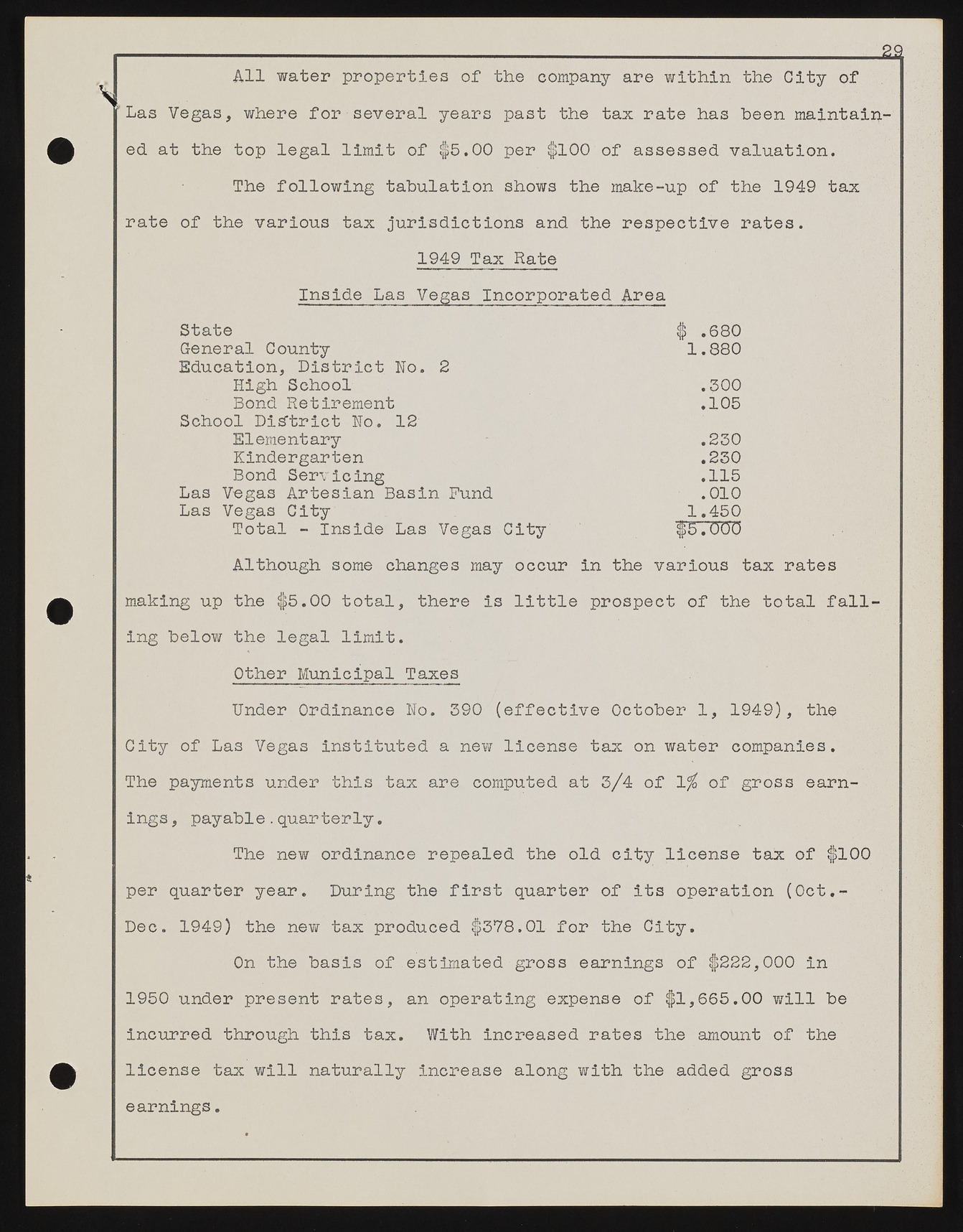

£9 All water properties of the company are within the City of Las Vegas, where for several years past the tax rate has been maintained at the top legal limit of $>5.00 per $5100 of assessed valuation. The following tabulation shows the make-up of the 1949 tax rate of the various tax jurisdictions and the respective rates. 1949 Tax Rate Inside Las Vegas Incorporated Area State $ .680 General County 1.880 Education, District No. 2 High School .300 Bond Retirement .105 School District No. 12 Elementary .230 Kindergarten .230 Bond Servicing .115 Las Vegas Artesian Basin Fund . 0 1 0 Las Vegas City 1.450 Total - Inside Las Vegas City $5. 0 0 0 Although some changes may occur in the various tax rates making up the $>5.00 total, there is little prospect of the total falling below the legal limit. Other Municipal Taxes Under Ordinance No. 390 (effective October 1, 1949), the City of Las Vegas instituted a new license tax on water companies. The payments under this tax are computed at 3/4 of 1 % of gross earnings, payable.quarterly. The new ordinance repealed the old city license tax of $>100 per quarter year. During the first quarter of its operation (Oct.- Dec. 1949) the new tax produced $>378.01 for the City. On the basis of estimated gross earnings of $>222,000 in 1950 under present rates, an operating expense of $1,665.00 will be incurred through this tax. With increased rates the amount of the license tax will naturally increase along with the added gross earnings.