Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

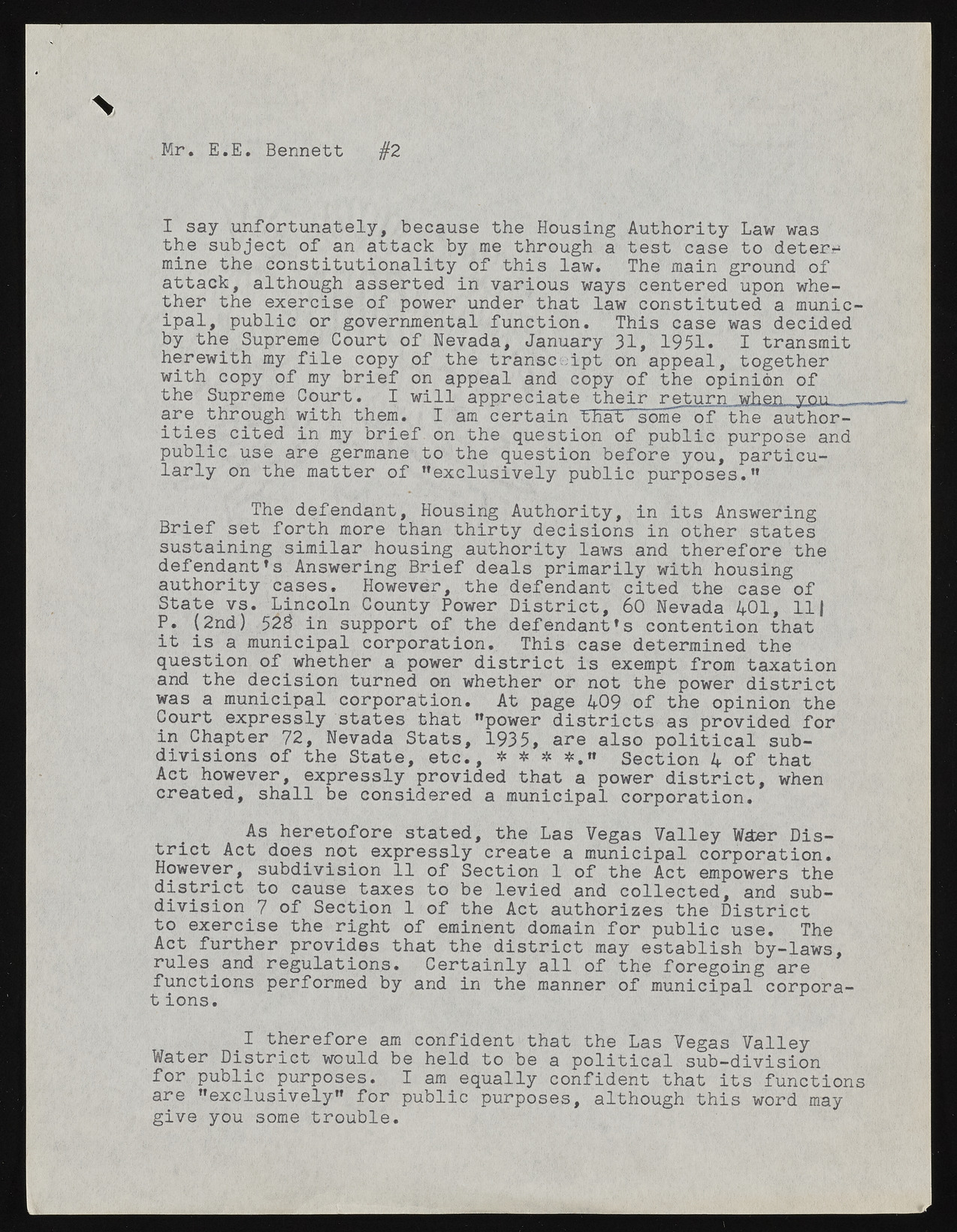

Mr. E.E. Bennett § 2 I say unfortunately, because the Housing Authority Law was the subject of an attack by me through a test case to deters mine the constitutionality of this law. The main ground of attack, although asserted in various ways centered upon whether the exercise of power under that law constituted a municipal, public or governmental function. This case was decided by the Supreme Court of Nevada, January 31, 1951. I transmit herewith my file copy of the transcript on appeal, together with copy of my brief on appeal and copy of the opinion of the Supreme Court. I will appreciate their return when vnn are through with them. I am certain that some of the author- ities cited in my brief on the question of public purpose and public use are germane to the question before you, particularly on the matter of "exclusively public purposes." The defendant, Housing Authority, in its Answering Brief set forth more than thirty decisions in other states sustaining similar housing authority laws and therefore the defendants Answering Brief deals primarily with housing authority cases. However, the defendant cited the case of State vs. Lincoln County Power District, 60 Nevada 401, 1 1 | P. (2nd) 52S in support of the defendants contention that it is a municipal corporation. This case determined the question of whether a power district is exempt from taxation and the decision turned cm whether or not the power district was a municipal corporation. At page 409 of the opinion the Court expressly states that "power districts as provided for in Chapter 72, Nevada Stats, 1935, are also political subdivisions of the State, etc., * * * *." Section 4 of that Act however, expressly provided that a power district, when created, shall be considered a municipal corporation. As heretofore stated, the Las Vegas Valley Wder District Act does not expressly create a municipal corporation. However, subdivision 11 of Section 1 of the Act empowers the district to cause taxes to be levied and collected, and subdivision 7 of Section 1 of the Act authorizes the District to exercise the right of eminent domain for public use. The Act further provides that the district may establish by-laws, rules and regulations. Certainly all of the foregoing are functions performed by and in the t ions. manner of municipal corpora- I therefore am confident that the Las Vegas Valley Water District would be held to be a political sub-division for public purposes. I am equally confident that its functions are "exclusively" for public purposes, although this word may give you some trouble.