Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

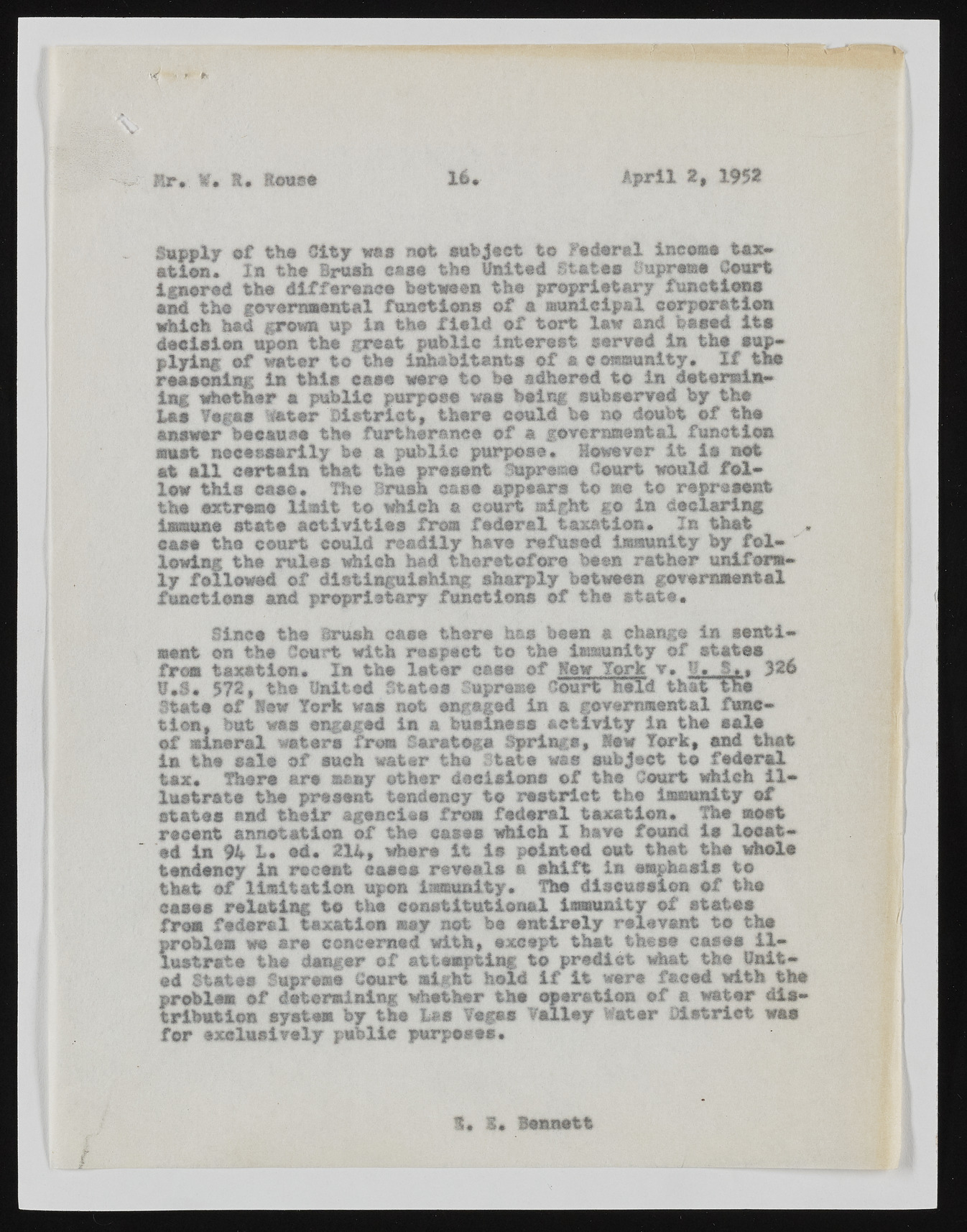

Mr*, i* t# Rons* 14* April % 1952 Supply of the City wan not outlet to federal income tax* ation. la the Bruch case the United States Imprest# Court Ignored the difference between the proprietary functions and the governmental functions of a municipal corporation which had grown up in the field of tort law and based its decision upon the great public interest served la the supplying of water to the inhabitants of a community* If the reasoning In this case were to be adhered to in detsrmim-litg whether a public purpose was being subserved by the las Togas Tatar District, there could be no doubt of the answer because the furtherance of a governmental function aunt necessarily bo a public purpose• However it is not at all certain that the present Supreme Court would follow this case* The Brush case appears to no to represent the extreme limit to which a court night go in declaring Immune state activities from federal taxation. In that ease the court could readily have refused immunity by fol- ' lowing the rules which had theretofore bees rather uniformly followed of distinguishing sharply between governmental functions and proprietary functions of the state* Since the Brush ease there has been a change in sentiment on the louft with respect to the immunity of states from taxation. In the later case of Wow York v. «JV S*« Sift U*$* 572# the United States Supreme Court held that the State of lew fork was not engaged in a governmental function. but was engaged in a business activity in the sale of mineral waters fro® Saratoga Springs# hew fork# and that in the salt of such water the state was subject to federal tax. There are many other decisions of the Court which illustrate the present tendency to restrict the immunity of states and their agencies from federal taxation. The nest recent annotation of the cases which I have found is located in 94 1. ed. 214# where it Is pointed out that the whole tendency in recent caeca reveals a shift in emphasis to that of limitation upon immunity. The discussion of the cases relating to the constitutional immunity of states from federal taxation may not be entirely relevant to the ? robins we are concerned with# except that these case# ii-nstrste the danger of attempting to predict what the United States Supreme Court might hold if it were faced with the problem of determining whether the operation of a water distribution system by the U s ¥«gas Valley Water District was for exclusively public purposes. 1. 1. Sennott