Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

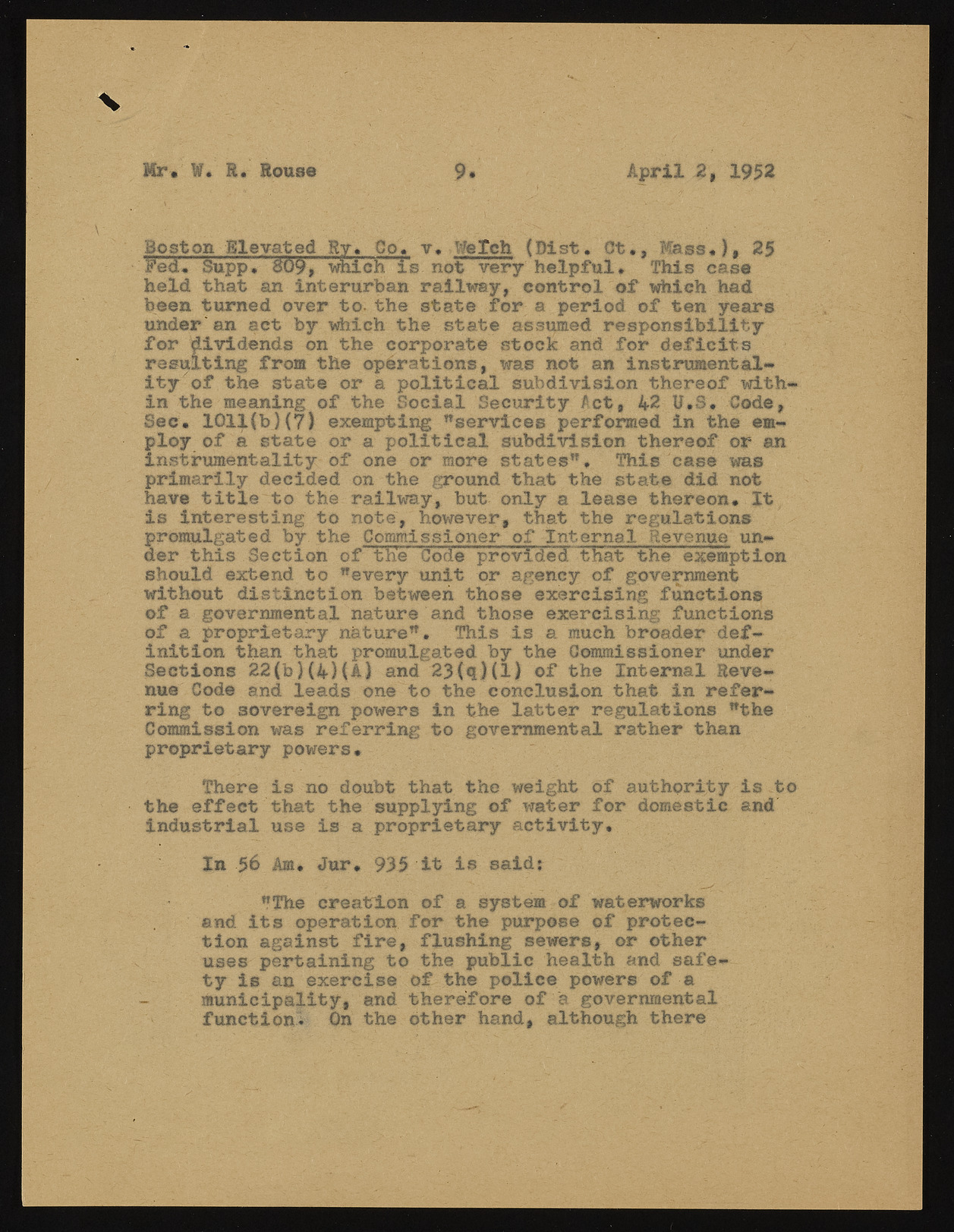

Mr. W. R. Rouse 9* April 2, 1952 Boston Elevated Ry. Co . v . Welch (Dist. Ct., Mass.), 25 3?ed. Supp• 809, which is not very helpful. This case held that an interurban railway, control of which had been turned over to- the state for a period of ten years under'an act by which the state assumed responsibility for dividends on the corporate stock and for deficits resulting from the operations, was not an instrumentality of the state or a political subdivision thereof within the meaning of the Social Security Act, 42 U.S. Code, Sec. 1011(b)(7) exempting "services performed In the employ of a state or a political subdivision thereof or an in s t r u m e n ta lity of one or more states”. This case was primarily decided on the ground that the state did not have title to the railway, but only a lease thereon. It is interesting to note, however, that the regulations promulgated by the Commissioner of Internal Revenue under this Section of the Code provided that the exemption should extend to "every unit or agency of government without distinction between those exercising functions of a governmental nature and those exercising functions of a proprietary nature". This is a much broader definition than that promulgated by the Commissioner under Sections 22(b)(4)(A) and 23(q)(l) of the Internal Revenue Cod© and leads one to the conclusion that in referring to sovereign powers in the latter regulations "the Commission was referring to governmental rather than proprietary powers. There is no doubt that the weight of authority is to the effect that the supplying of water for domestic and industrial use Is a proprietary activity. In 56 Am* «Jur. 935 it is said; "The creation of a system of waterworks and its operation for the purpose pf protection against fire, flushing sewers, or other uses pertaining to the public health and safety is an exercise of the police powers of a municipality, and therefore of a governmental function. On the other hand, although there