Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

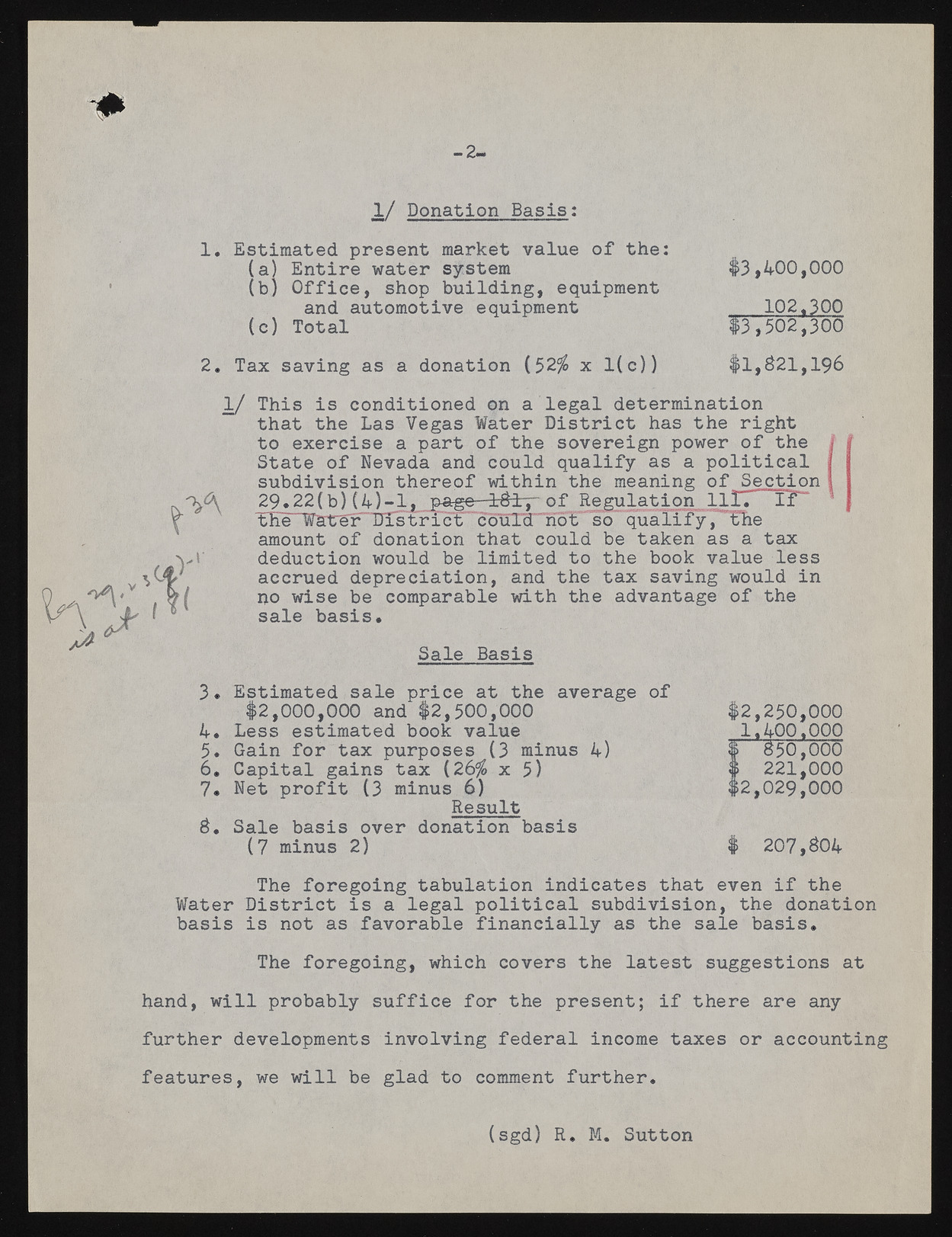

1/ Donation Basis: 1. Estimated present market value of the: (a) Entire water system (b) Office, shop building, equipment #3,400,000 and automotive equipment 102.300 (c) Total #3,502,300 2. Tax saving as a donation (52% x 1(c)) #1, $ 21,196 1/ This is conditioned on a legal determination that the Las Vegas Water District has the right to exercise a part of the sovereign power of the | t State of Nevada and could qualify as a political I subdivision thereof within the meaning of Section I I v'V'X 29.22(b) (4)-1, pabge lSl^- of Regulation H I T lT~ ^ tahmeo uWngtr torefF "dTofnTsattriiocnt tcohaalt'd 'c”noouTl*ds ob"e' qtuaikreinf yaTs^ Thae tax deduction would be limited to the book value less n a v»n /n /4 v * o +? i a m o +? Q v e o*tr t m re r ta I « T n The foregoing tabulation indicates that even if the Water District is a legal political subdivision, the donation basis is not as favorable financially as the sale basis. The foregoing, which covers the latest suggestions at hand, will probably suffice for the present; if there are any further developments involving federal income taxes or accounting features, we will be glad to comment further. accrued depreciation, and the tax saving would in rjo wise be comparable with the advantage of the sale basis. Sale Basis 3. Estimated sale price at the average of #2,000,000 and #2,500,000 #2,250,000 4. Less estimated book value 5. Gain for tax purposes (3 minus 4) 6. Capital gains tax (26% x 5) 7. Net profit (3 minusR e6)sult B. Sale basis over donation basis (7 minus 2) # 207,B04 (sgd) R. M. Sutton