Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

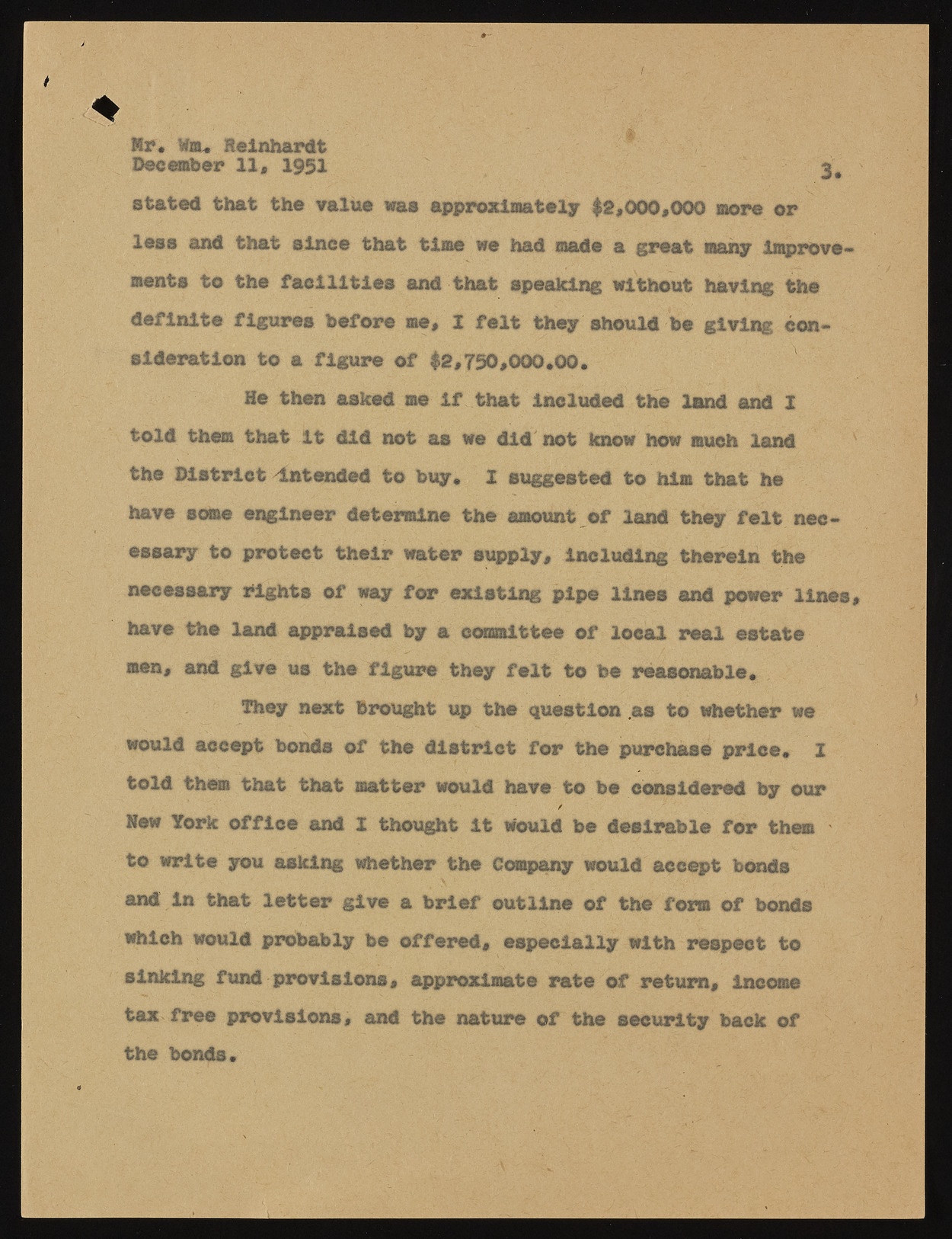

/ ? Hr. Wm. Reinhardt IP- ? December 11, 1951 it stated that the value was approximately $2,000,000 more or less and that since that time we had made a great many improvements to the facilities and that speaking without having the definite figures before me, 2 felt they should be giving consideration to a figure of $2,750,000.00. He then asked me if that included the land and I told them that It did not as we did not know how much land the District intended to buy. I suggested to him that he have some engineer determine the amount of land they felt necessary to protect their water supply, Including therein the necessary rights of way for existing pipe lines and power lines, have the land appraised by a committee of local real estate men, and give us the figure they felt to be reasonable. They next brought up the question as to whether we would accept bonds of the district for the purchase price. I told them that that matter would have to be considered by our New York office and I thought it would be desirable for them to write you asking whether the Company would accept bonds and In that letter give a brief outline of the form of bonds which would probably be offered, especially with respect to sinking fund provisions, approximate rate of return, income tax free provisions, and the nature of the security back of the bonds.