Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

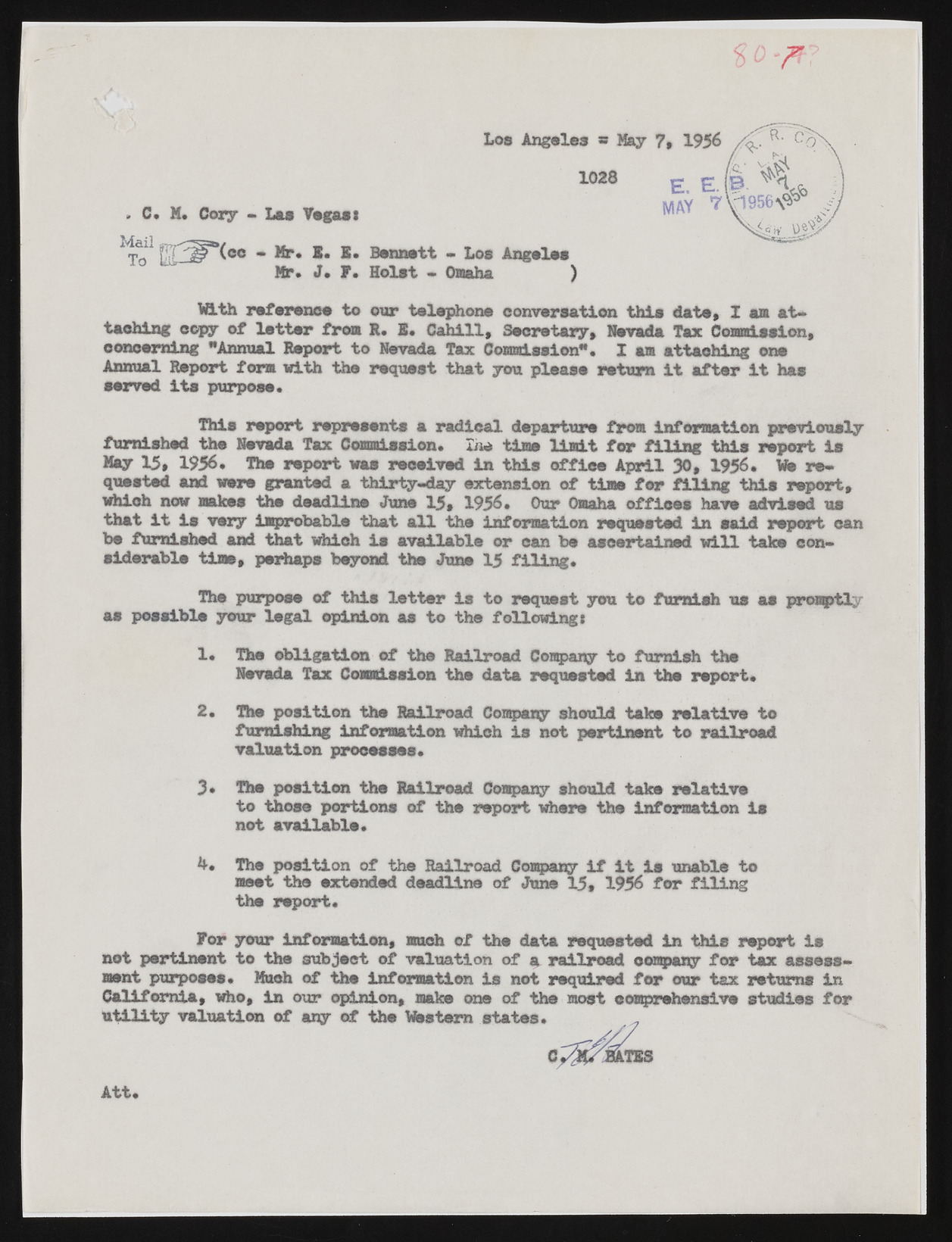

$ 0 7*P? Mail To . C. M. Cozy - Las Vegas: Los Angeles = Hay 7 1028 cc m Mr* E. E. Bennett - Los Angeles Hr. J. F. Holst - Omaha ) With reference to our telephone conversation this date* Z an at* taching copy of letter froa R. 8* Cahill* Secretary* Nevada Tax Commission, concerning "Annual Report to Nevada Tax Commission"• X an attaching one Annual Report for* with the request that you please return it after it has served its purpose. This report represents a radical departure froa information previously furnished the Nevada Tax Commission. Tae tine limit for filing this report is May 15* 1956. The report was received in this offiee April 30, 1956. We ire* quested and were granted a thirty-day extension of tins for filing this report, which now makes the deadline June 15* 1956. Our Omaha offioes have advised us that it is very improbable that all the information requested in said report can be furnished and that which is available or can be ascertained will tain eon* siderable tine* perhaps beyond the June 15 filing. The purpose of this letter is to request you to furnish us as promptly as possible your legal opinion as to the following: 1. The obligation of the Railroad Company to furnish the Nevada Tax Commission the data requested in the report. 2. The position the Railroad Company should take relative to furnishing information which is not pertinent to railroad valuation processes. 3* The position the Railroad Company should take relative to those portions of the report where the information is not available. The position of the Railroad Company if it is unable to meet the extended deadline of June 15* 1956 for filing the report. For your information* much of the data requested in this report le net pertinent to the subject of valuation of a railroad company for tax assess* nsnt purposes. Much of the Information is not required for our tax returns in California* who, in our opinion* sake one of the most comprehensive studies for utility valuation of any of the Wastern states. Att.