Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

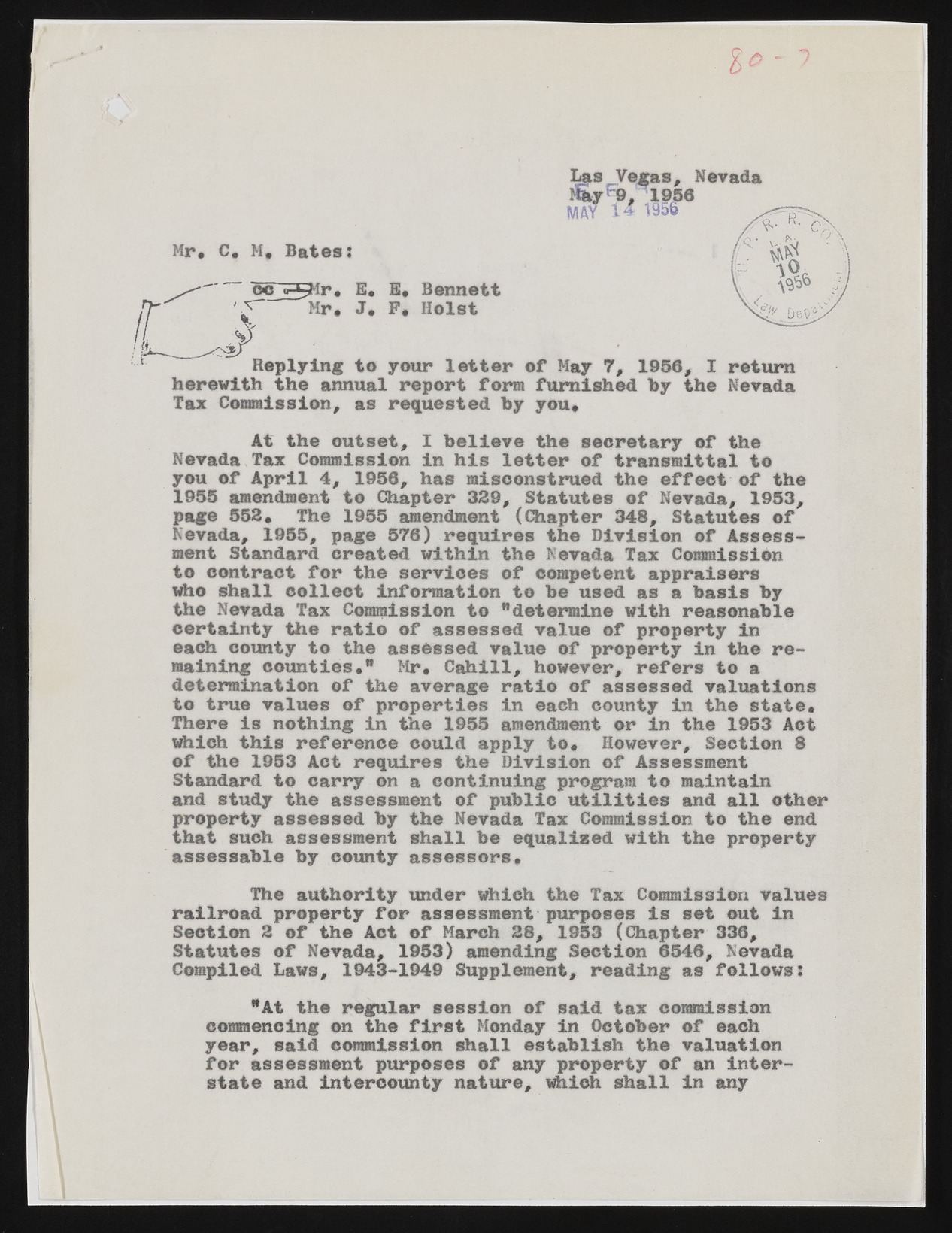

Las Vegas, Nevada Mr* C* M* Bates: oc n-yirt 5* S* Bennett Mr* J* P« Holst V Replying to your letter of May 7, 1950, I return herewith the annual report form furnished h y the Nevada Tax Commission, as requested by you* At the outset, I believe the secretary of the Nevada Tax Commission in his letter of transmittal to you of April 4, 1956, has misconstrued the effect of the 1955 amendment to Chapter 329, Statutes of Nevada, 1953, page 552* The 1955 amendment (Chapter 343, Statutes of Nevada, 1955, page 576) requires the Division of Assessment Standard created within the Nevada Tax Commission to contract for the services of competent appraisers who shall collect information to be used as a basis by the Nevada Tax Commission to "determine with reasonable certainty the ratio of assessed value of property in each county to the assessed value of property in the remaining counties." Mr* Cahill, however, refers to a determination of the average ratio of assessed valuations to true values of properties in each county in the state* There is nothing in the 1955 amendment or in the 1953 Act whleh this reference could apply to* However, Section 8 of the 1953 Act requires the Division of Assessment Standard to carry on a continuing program to maintain and study the assessment of public utilities and all other property assessed by the Nevada Tax Commission to the end that such assessment shall be equalised with the property assessable by county assessors. The authority under which the Tax Commission values railroad property for assessment purposes is set out in Seetion 2 of the Act of March 28, 1953 (Chapter 336, Statutes of Nevada, 1953) amending Section 6546, Nevada Compiled Laws, 1943-1949 Supplement, reading as follows: "At the regular session of said tax commission commencing on the first Monday in October of eaoh year, said commission shall establish the valuation for assessment purposes of any property of an interstate and intercounty nature, iftilch shall in any