Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

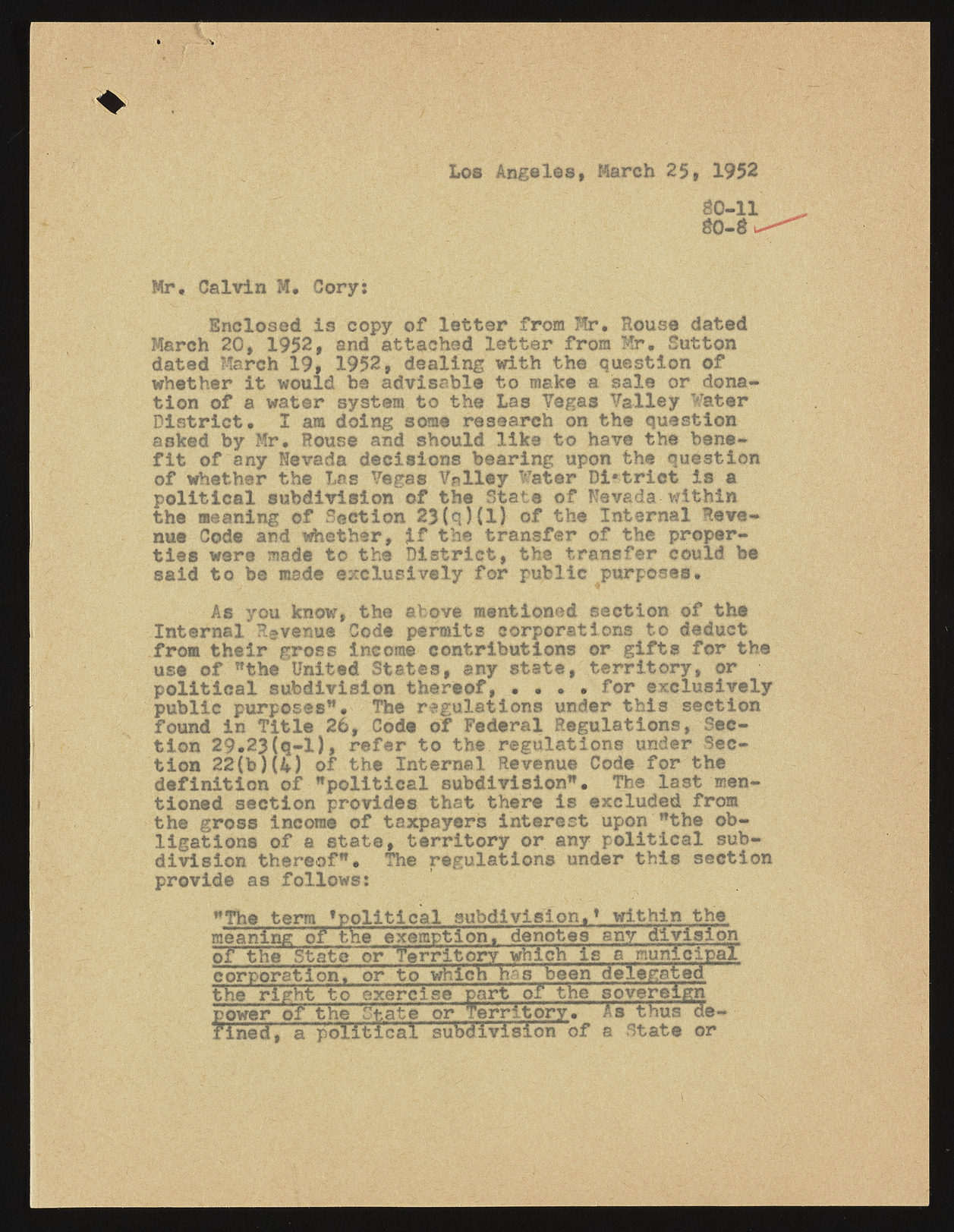

Los Angeles, March 25, 1952 30-11 80 Mr# Calvin M, Gory: Enclosed is copy of letter from Mr, House dated March 20, 1952, and attached letter from Mr. Sutton dated March 19, 1952, dealing with the question of whether it would be advisable to make a sale or donation of a water system to the Las Vegas Valley Water District, I am doing some research on the question asked by Mr, House and should like to have the benefit of any Nevada decisions bearing upon the question of whether the Las Vegas Valley Water District is a political subdivision of the State of'Nevada-within the meaning of Section 23(q)(l) of the Internal Revenue Code and whether, if the transfer of the properties were made to the District, the transfer could be said to be made exclusively for public purposes. As you know, the above mentioned section of the Internal Revenue Code permits corporations to deduct from their gross income contributions or gifts for the use of "the United States, any state, territory, or political subdivision thereof, • . • , for exclusively public purposes". The regulations under this section found in Title 26, Code of Federal Regulations, Section 29.23(q-l), refer to the regulations under Section 22(b)(4) of the Internal Revenue Code for the definition of "political subdivision". The last mentioned section provides that there is excluded from the gross income of taxpayers interest upon "the obligations of a state, territory or any political subdivision thereof". The regulations under this section provide as follows: "The term Apolitical subdivision,* within the meaning of the exemption, denotes any division off- the State or Territory, which is a municipal corporation, or to which has been delegated the right to exercise part of the sovereign fower of the fftate or Territory, As thus de-? ined, a political subdivisionof a State or