Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

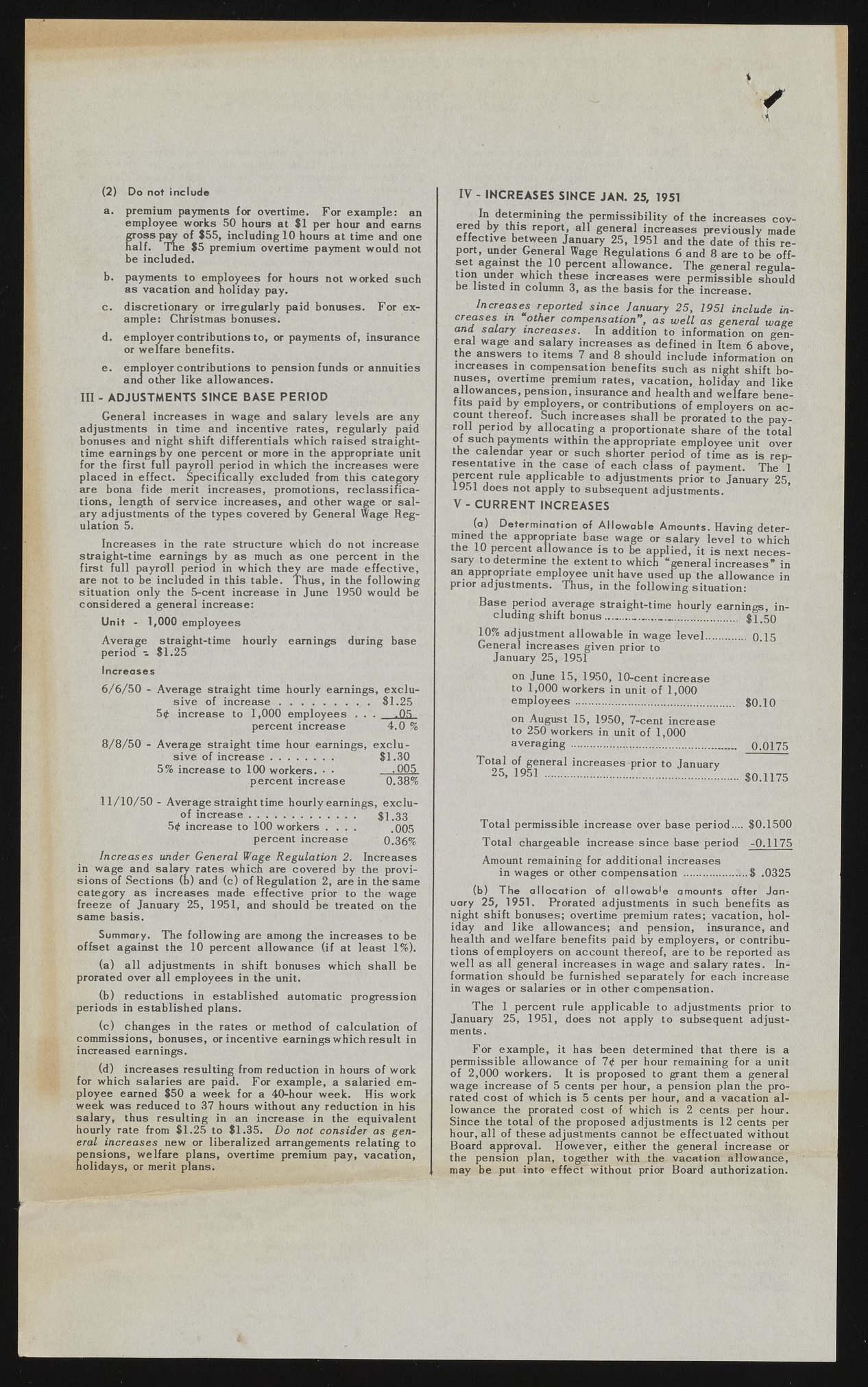

? (2) Do not include a. premium payments for overtime. For example: an employee works 50 hours at $1 per hour and earns gross pay of $55, including 10 hours at time and one half. The $5 premium overtime payment would not be included. b. payments to employees for hours not worked such as vacation and holiday pay. c. discretionary or irregularly paid bonuses. For example: Christmas bonuses. d. employer contributions to, or payments of, insurance or welfare benefits. e. employer contributions to pension funds or annuities and other like allowances. Ill - ADJUSTMENTS SINCE BASE PERIOD General increases in wage and salary levels are any adjustments in time and incentive rates, regularly paid bonuses and night shift differentials which raised straight-time earnings by one percent or more in the appropriate unit for the first full payroll period in which the increases were placed in effect. Specifically excluded from this category are bona fide merit increases, promotions, reclassifications, length of service increases, and other wage or salary adjustments of the types covered by General Wage Regulation 5. Increases in the rate structure which do not increase straight-time earnings by as much as one percent in the first full payroll period in which they are made effective, are not to be included in this table. Thus, in the following situation only the 5-cent increase in June 1950 would be considered a general increase: Unit - 1,000 employees Average straight-time hourly earnings during base period - $1.25 Increases 6/6/50 - Average straight time hourly earnings, exclusive of in c rea s e ...........................$1.25 54 increase to 1,000 employees . . . .05 percent increase 4.0 % 8/8/50 - Average straight time hour earnings, exclusive of increase $1.30 5% increase to 100 workers. • • .005 percent increase 0.38% 11/10/50- Average straight time hourly earnings, exclu-of increase............................... $1.33 54 increase to 100 workers . . . . .005 percent increase 0.36% Increases under General Wage Regulation 2. Increases in wage and salary rates which are covered by the provisions of Sections (b) and (c) of Regulation 2, are in the same category as increases made effective prior to the wage freeze of January 25, 1951, and should be treated on the same basis. Summary. The following are among the increases to be offset against the 10 percent allowance (if at least 1%). (a) all adjustments in shift bonuses which shall be prorated over all employees in the unit. (b) reductions in established automatic progression periods in established plans. (c) changes in the rates or method of calculation of commissions, bonuses, or incentive earnings which result in increased earnings. (d) increases resulting from reduction in hours of work for which salaries are paid. For example, a salaried employee earned $50 a week for a 40-hour week. His work week was reduced to 37 hours without any reduction in his salary, thus resulting in an increase in the equivalent hourly rate from $1.25 to $1.35. Do not consider as general increases new or liberalized arrangements relating to eensions, welfare plans, overtime premium pay, vacation, olidays, or merit plans. IV - INCREASES SINCE JAN. 25, 1951 In determining the permissibility of the increases cov-ered by this report, all general increases previously made effective between January 25, 1951 and the date of this report, under General Wage Regulations 6 and 8 are to be offset against the 10 percent allowance. The general regulation under which these increases were permissible should be listed in column 3, as the basis for the increase. Increases reported since January 25, 1951 include increases in other compensation” , as well as general wage and salary increases. In addition to information on general wage and salary increases as defined in Item 6 above, the answers to items 7 and 8 should include information on increases in compensation benefits such as night shift bonuses, overtime premium rates, vacation, holiday and like allowances, pension, insurance and health and welfare benefits paid by employers, or contributions of employers on account thereof. Such increases shall be prorated to the payroll period by allocating a proportionate share of the total of such payments within the appropriate employee unit over the calendar year or such shorter period of time as is representative in the case of each class of payment. The 1 Percent rule applicable to adjustments prior to January 25, 1951 does not apply to subsequent adjustments. V - CURRENT INCREASES (a) Determination of Allowable Amounts. Having determined the appropriate base wage or salary level to which the 10 percent allowance is to be applied, it is next necessary to determine the extent to which “ general increases” in an appropriate employee unit have used up the allowance in prior adjustments. Thus, in the following situation: f _------— . —- uMUjgJH-ujug 11U U11J eluding shift bonus ............... .............. 10% adjustment allowable in wage level. General increases given prior to January 25, 1951 $1.50 - 0.15 on June 15, 1950, 10-cent increase to 1,000 workers in unit of 1,000 employees ............................................... $0.10 on August 15, 1950, 7-cent increase to 250 workers in unit of 1,000 averaging ................... ............................. Q.Q175 Total of general increases prior to January 25> 1951 ......................................................... $0.1175 Total permissible increase over base period.... $0.1500 Total chargeable increase since base period -0.1175 Amount remaining for additional increases in wages or other compensation .................. $ .0325 (b) The allocation of allowab'e amounts after January 25, 1951. Prorated adjustments in such benefits as night shift bonuses; overtime premium rates; vacation, holiday and like allowances; and pension, insurance, and health and welfare benefits paid by employers, or contributions of employers on account thereof, are to be reported as well as all general increases in wage and salary rates. Information should be furnished separately for each increase in wages or salaries or in other compensation. The 1 percent rule applicable to adjustments prior to January 25, 1951, does not apply to subsequent adjustments. For example, it has been determined that there is a permissible allowance of 74 per hour remaining for a unit of 2,000 workers. It is proposed to grant them a general wage increase of 5 cents per hour, a pension plan the prorated cost of which is 5 cents per hour, and a vacation allowance the prorated cost of which is 2 cents per hour. Since the total of the proposed adjustments is 12 cents per hour, all of these adjustments cannot be effectuated without Board approval. However, either the general increase or the pension plan, together with the vacation allowance, may be put into effect without prior Board authorization.