Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

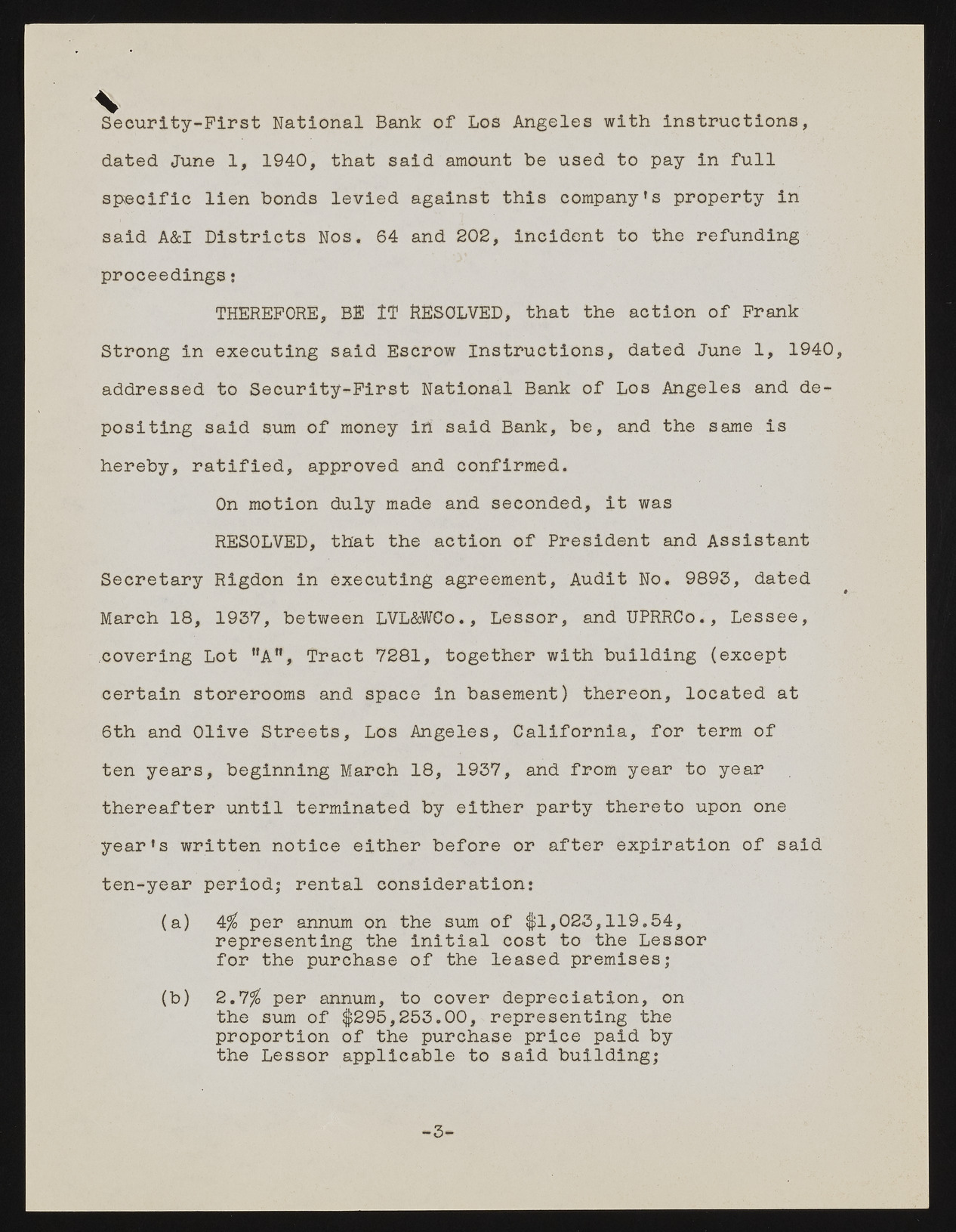

? Security-First National Bank of Los Angeles with instructions, dated June 1, 1940, that said amount be used to pay in full specific lien bonds levied against this company's property in said A&I Districts Nos. 64 and 202, incident to the refunding proceedings: THEREFORE, BE IT RESOLVED, that the action of Frank Strong in executing said Escrow Instructions, dated June 1, 1940, addressed to Security-First National Bank of Los Angeles and depositing said Siam of money irt said Bank, be, and the same is hereby, ratified, approved and confirmed. On motion duly made and seconded, it was RESOLVED, that the action of President and Assistant Secretary Rigdon in executing agreement, Audit No. 9893, dated March 18, 1937, between LVL&WCo., Lessor, andUPRRCo., Lessee, covering Lot "A", Tract 7281, together with building (except certain storerooms and space in basement) thereon, located at 6th and Olive Streets, Los Angeles, California, for term of ten years, beginning March 18, 1937, and from year to year thereafter until terminated by either party thereto upon one year's written notice either before or after expiration of said ten-year period; rental consideration: (a) 4$ per annum on the sum of $1,023,119.54, representing the initial cost to the Lessor for the purchase of the leased premises; (b) 2.7$ per annum, to cover depreciation, on the sum of $>295,253.00, representing the proportion of the purchase price paid by the Lessor applicable to said building; - 3-