Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

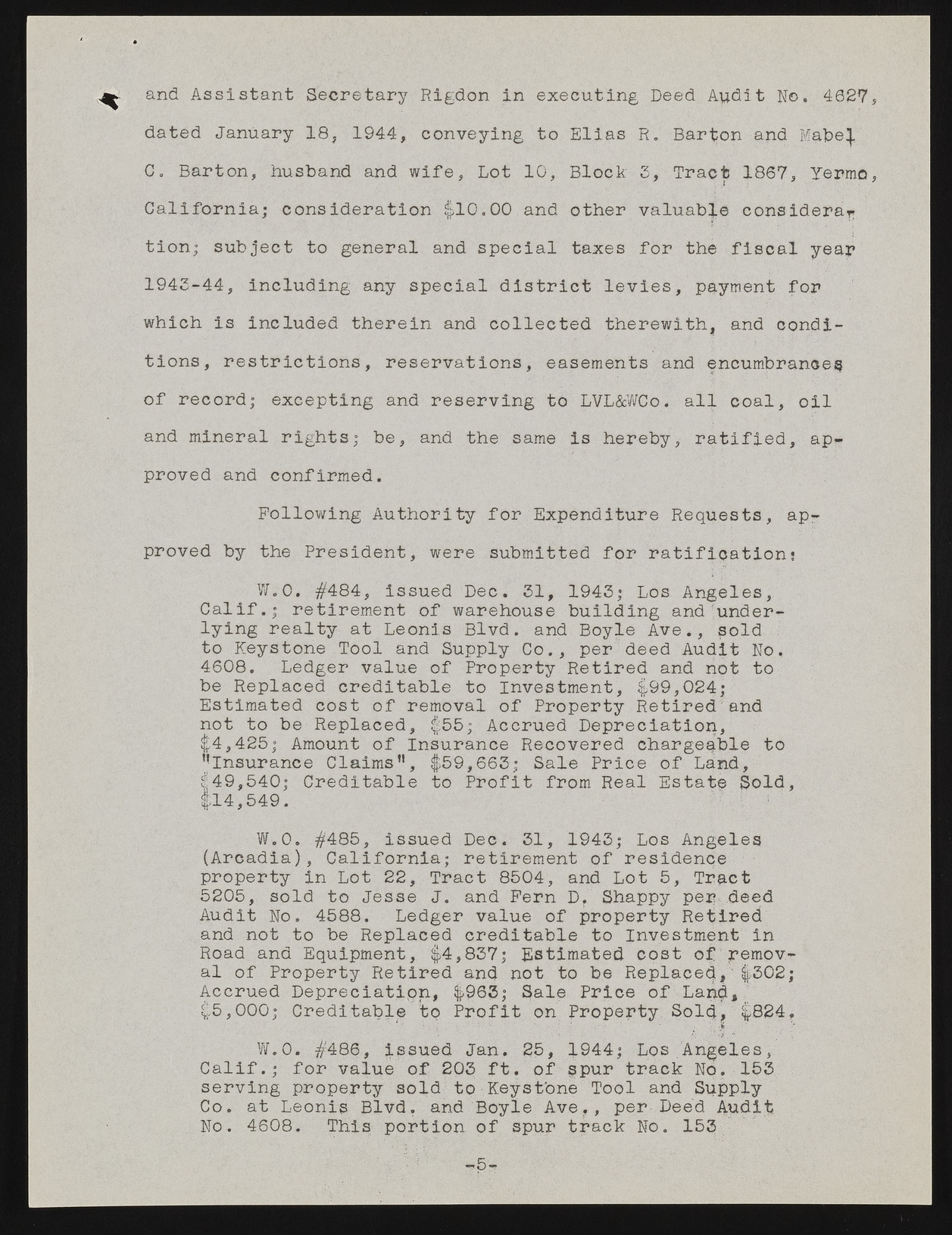

^ and Assistant Secretary Rigdon in executing Deed Audit No. 4027, dated January 18, 1944, conveying to Elias R. Barton and Make}, C. Barton, husband and wife, Lot 10, Block 3, Tract 1867, Yermo, California; consideration $10.00 and other valuable considers,; tion; subject to general and special taxes for the fiscal year 1943-44, including any special district levies, payment for which is included therein and collected therewith* and conditions, restrictions, reservations, easements and encumbrances of record; excepting and reserving to LVL&WCo. all coal, oil and mineral rights; be, and the same is hereby, ratified, ap*» proved and confirmed. Following Authority for Expenditure Requests, approved by the President, were submitted for ratification; W.O. #484, issued Dec. 31, 1943; Los Angeles, Calif.; retirement of warehouse building and'underlying realty at Leonis Blvd. and Boyle Ave., sold to Keystone Tool and Supply Co., per deed Audit No, 4608. Ledger value of Property Retired and not to be Replaced creditable to Investment, 499*024; Estimated cost of removal of Property Retired and not to be Replaced, $55; Accrued Depreciation, 44,425; Amount of Insurance Recovered chargeable to ’’Insurance Claims”, $59,663; Sale Price of Land, $49,540; Creditable to Profit from Real Estate Sold, $14,549. ; W.O. #485, issued Dec. 31, 1943; Los Angeles (Arcadia), California; retirement of residence property in Lot 22, Tract 8504, and Lot 5, Tract 5205, sold to Jesse J. and Fern D, Shappy pep .deed Audit No. 4588. Ledger value of property Retired and not to be Replaced creditable to Investment in Road and Equipment, $4,837; Estimated cost of removal of Property Retired and not to be Replaced, $302; Accrued Depreciation, $963; Sale Price of Land, $5,000; Creditable to Profit on •. ?••••• j •P rop• e’ rty* So.l d•', rj* $* 824.> W.O. #486, issued Jan. 25, 3.944; Los Angeles, Calif.; for value of 203 ft. of spur track No. 153 serving property sold to Keysfone Tool and Supply Co. at Leonis Blvd. and Boyle Ave,, per Deed Audit No. 4608. This portion of spur track No. 153 -5-