Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

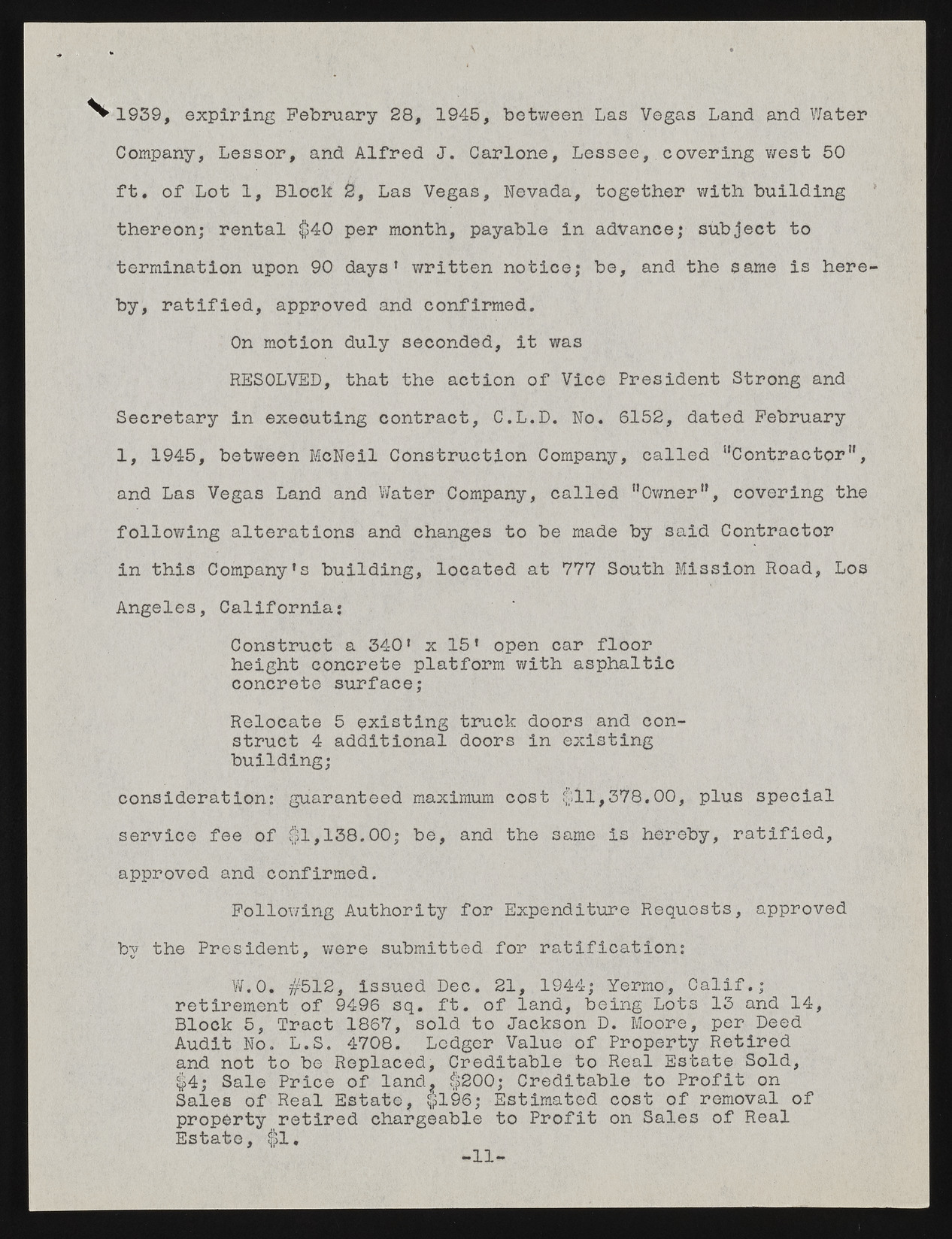

1939, expiring February 28, 1945, between Las Vegas Land and Water Company, Lessor, and Alfred J. Carlone, Lessee, covering west 50 ft. of Lot 1, Block 2, Las Vegas, Nevada, together with building thereon; rental $40 per month, payable in advance; subject to termination upon 90 days’ written notice; be, and the same is here by, ratified, approved and confirmed. On motion duly seconded, it was RESOLVED, that the action of Vice President Strong and Secretary in executing contract, C.L.D. No. 6152, dated February 1, 1945, between McNeil Construction Company, called “Contractor", and Las Vegas Land and Water Company, called "Owner", covering the following alterations and changes to be made by said Contractor in this Company’s building, located at 77V South Mission Road, Los Angeles, California; Construct a 340’ x 15’ open car floor height concrete platform with asphaltic concrete surface; Relocate 5 existing truck doors and construct 4 additional doors in existing building; consideration; guaranteed maximum cost $11,378.00, plus special service fee of $1,138.00; be, and the same is hereby, ratified, approved and confirmed. Following Authority for Expenditure Requests, approved bv the President, were submitted for ratification; W.O. #512, issued Dec. 21, 1944; Yermo, Calif.; retirement of 9496 sq. ft. of land, being Lots 13 and 14, Block 5, Tract 1867, sold to Jackson D. Moore, per Deed Audit No. L.S. 4708. Ledger Value of Property Retired and not to be Replaced, Creditable to Real Estate Sold, $4; Sale Price of land, $200; Creditable to Profit on Sales of Real Estate, $196; Estimated cost of removal of property retired chargeable to Profit on Sales of Real Estate, $1. -11-