Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

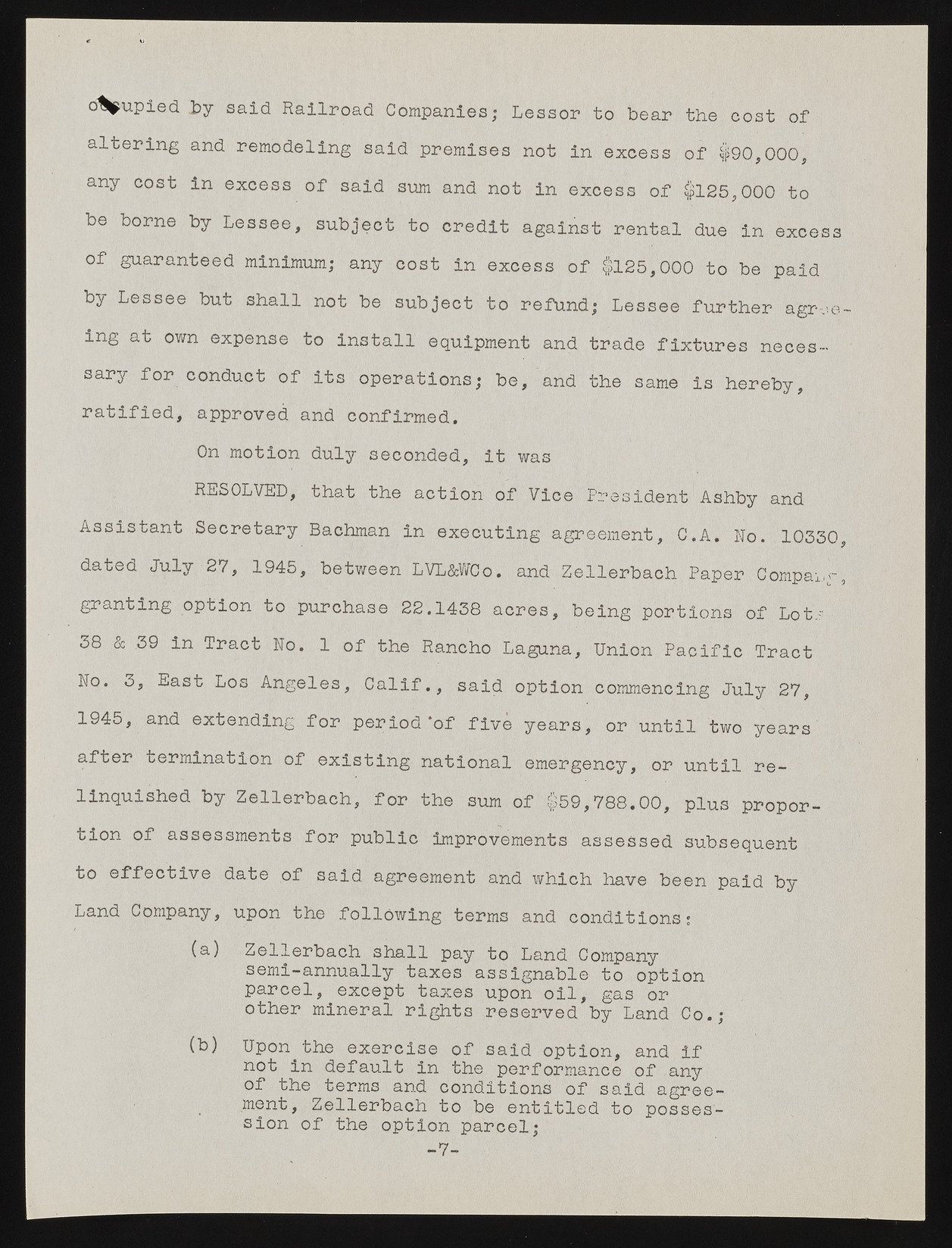

coupled by said Railroad Companies; Lessor to bear the cost of altering and remodeling said premises not in excess of $90,000, any cost in excess of said sum and not in excess of $125,000 to be borne by Lessee, subject to credit against rental due in excess of guaranteed minimum; any cost in excess of $125,000 to be paid by Lessee but shall not be subject to refund; Lessee further agr-je ing at own expense to install equipment and trade fixtures necessary for conduct of its operations; be, and the same is hereby, ratified, approved and confirmed. On motion duly seconded, it was RESOLVED, that the action of Vice President Ashby and Assistant Secretary Bachman in executing agreement, C.A. No. 10330 dated July 27, 1945, between LVL&WCo. and Zellerbach Paper Company granting option to purchase 22.1438 acres, being portions of Lot." 38 & 39 in Tract No. 1 of the Rancho Laguna, Union Pacific Tract No. 3, East Los Angeles, Calif., said option commencing July 27, 1945, and extending for period‘of five years, or until two years after termination of existing national emergency, or until relinquished by Zellerbach, for the sum of $59,788.00, plus proportion of assessments for public improvements assessed subsequent to effective date of said agreement and which have been paid by Land Company, upon the following terms and conditions; (a) Zellerbach shall pay to Land Company semi-annually taxes assignable to option parcel, except taxes upon oil, gas or other mineral rights reserved by Land Co.; (b) Upon^the exercise of said option, and if not in default in the performance of any of the terms and conditions of said agreement, Zellerbach to be entitled to possession of the option parcel; -7-