Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

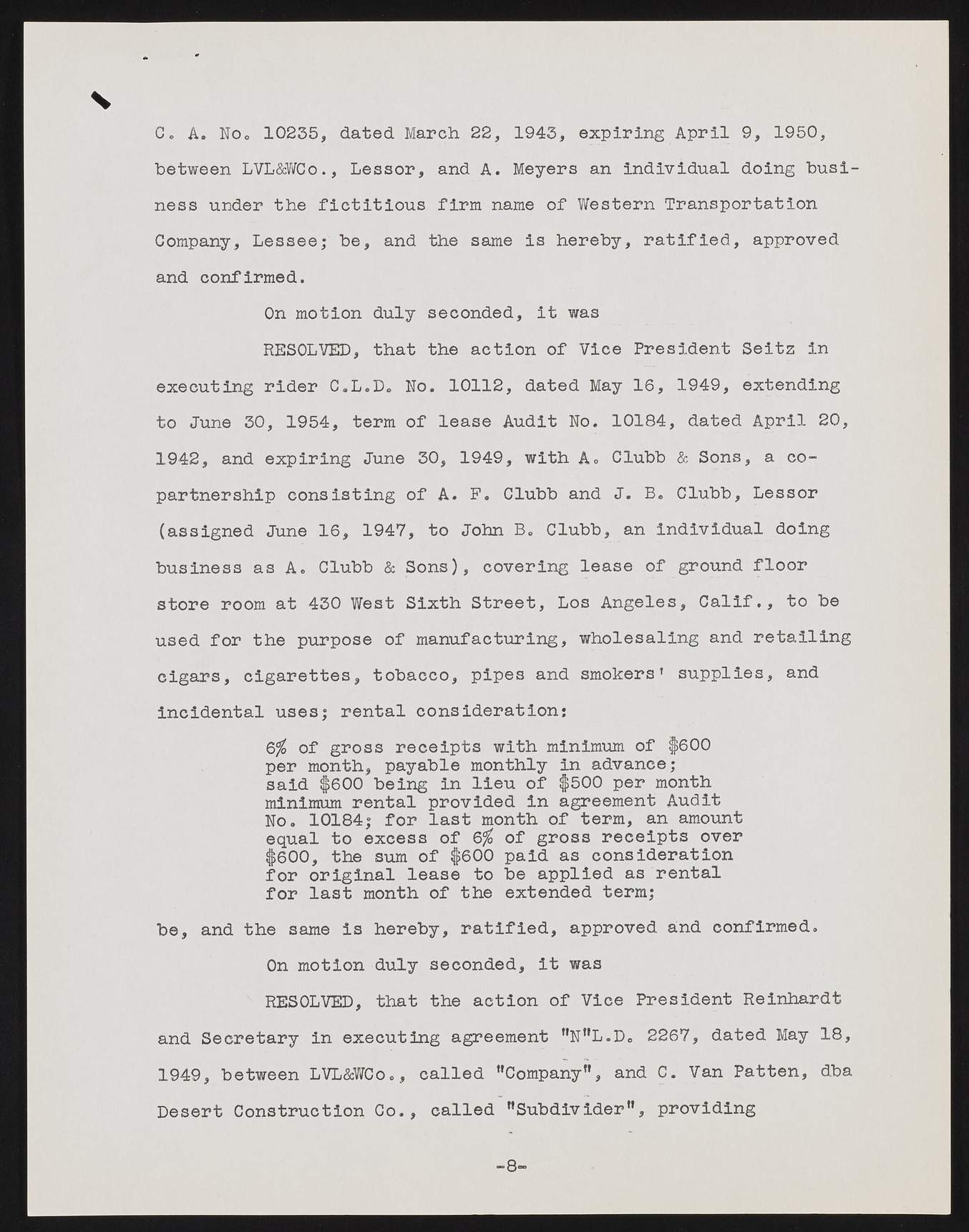

C. A. No. 10235, dated March 22, 1943, expiring April 9, 1950, between LVL&WCo., Lessor, and A. Meyers an individual doing business under the fictitious firm name of Western Transportation Company, Lessee; be, and the same is hereby, ratified, approved and confirmed. On motion duly seconded, it was RESOLVED, that the action of Vice President Seitz in executing rider C.L.D. No. 10112, dated May 16, 1949, extending to June 30, 1954, term of lease Audit No. 10184, dated April 20, 1942, and expiring June 30, 1949, with Ao Clubb & Sons, a copartnership consisting of A. F. Clubb and J. B. Clubb, Lessor (assigned June 16, 1947, to John B. Clubb, an individual doing business as A. Clubb & Sons), covering lease of ground floor store room at 430 West Sixth Street, Los Angeles, Calif., to be used for the purpose of manufacturing, wholesaling and retailing cigars, cigarettes, tobacco, pipes and smokers’ supplies, and incidental uses; rental consideration; Q% of gross receipts with minimum of $600 per month, payable monthly in advance; said $600 being in lieu of $500 per month minimum rental provided in agreement Audit No. 10184; for last month of term, an amount equal to excess of 6% of gross receipts over $600, the sum of $600 paid as consideration for original lease to be applied as rental for last month of the extended term; be, and the same is hereby, ratified, approved and confirmed. On motion duly seconded, it was RESOLVED, that the action of Vice President Reinhardt and Secretary in executing agreement "N"L.D0 2267, dated May 18, 1949, between LVL&WCo., called “Company", and C. Van Patten, dba Desert Construction Co., called "Subdivider", providing -8-