Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

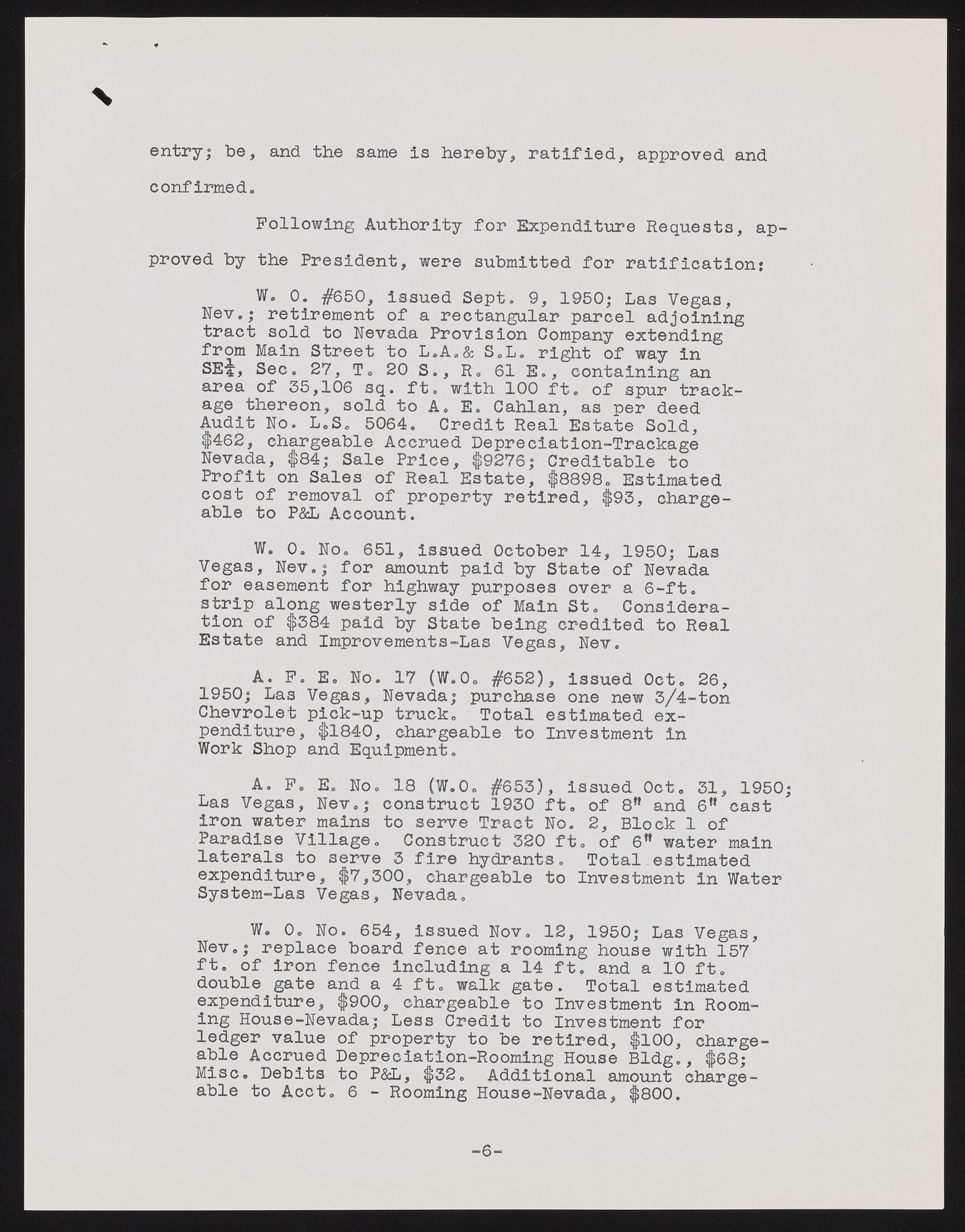

% entry; be, and the same is hereby, ratified, approved and confirmed. Following Authority for Expenditure Requests, approved by the President, were submitted for ratification: W. 0. #650, issued Sept. 9, 1950; Las Vegas, Nev.; retirement of a rectangular parcel adjoining tract sold to Nevada Provision Company extending from Main Street to L.A.& S.L. right of way in SE'ii, Sec. 27, T. 20 S., R. 61 E., containing an area of 55,106 sq. ft. with 100 ft. of spur trackage thereon, sold to A. E. Cahlan, as per deed Audit No. L.S. 5064. Credit Real Estate Sold, $462, chargeable Accrued Depreciation-Trackage Nevada, $84; Sale Price, $9276; Creditable to Profit on Sales of Real Estate, $8898. Estimated cost of removal of property retired, $93, chargeable to P&L Account. W. 0. No. 651, issued October 14, 1950; Las Vegas, Nev.; for amount paid by State of Nevada for easement for highway purposes over a 6-ft. strip along westerly side of Main St. Consideration of $384 paid by State being credited to Real Estate and Improvements-Las Vegas, Nev. A. F. E. No. 17 (W.O. #652), issued Oct. 26, 1950; Las Vegas, Nevada; purchase one new 3/4-ton Chevrolet pick-up truck. Total estimated expenditure, $1840, chargeable to Investment in Work Shop and Equipment. A. F. E. No. 18 (W.O. #655), issued Oct. 51, 1950; Las Vegas, Nev.; construct 1950 ft. of 8” and 6" cast iron water mains to serve Tract No. 2, Block 1 of Paradise Village. Construct 320 ft. of 6W water main laterals to serve 5 fire hydrants. Total estimated expenditure, $7,500, chargeable to Investment in Water System-Las Vegas, Nevada. W. 0. No. 654, issued Nov. 12, 1950; Las Vegas, Nev.; replace board fence at rooming house with 157 ft. of iron fence including a 14 ft. and a 10 ft. double gate and a 4 ft. walk gate. Total estimated expenditure, $900, chargeable to Investment in Rooming House-Nevada; Less Credit to Investment for ledger value of property to be retired, $100, chargeable Accrued Depreciation-Rooming House Bldg., $68; Misc. Debits to P&L, $32. Additional amount chargeable to Acct. 6 - Rooming House-Nevada, $800. -6-