Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

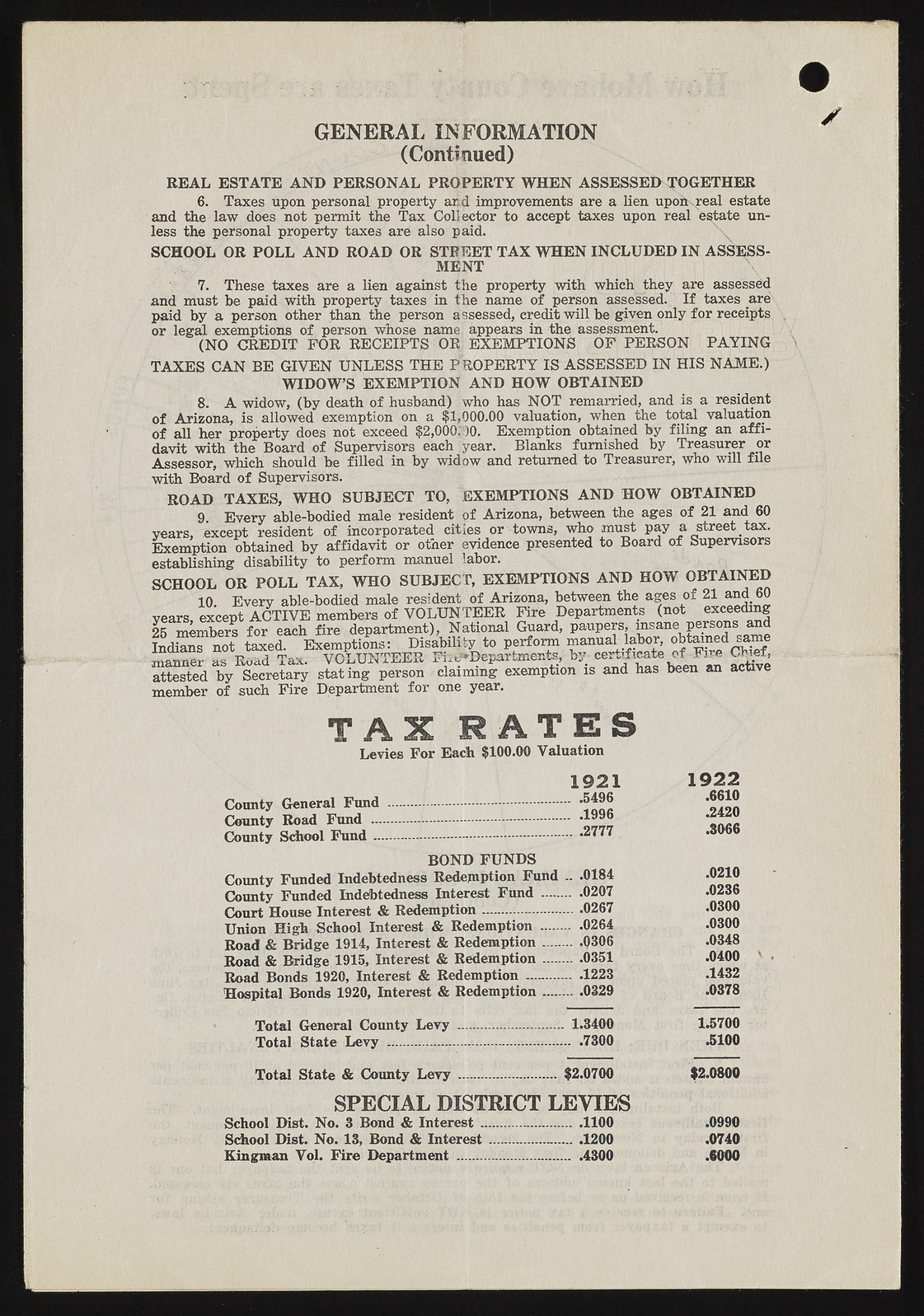

GENERA(LCo nItNinFuOedR)MATION R E A L ESTATE A N D PER SO N AL PR O PE R TY W H E N ASSESSED TOGETHER 6. Taxes upon personal property and improvements are a lien upoii .real estate and the law does not permit the Tax Collector to accept taxes upon real estate unless the personal property taxes are also paid. SCHOOL OR PO LL A N D ROAD OR STREET T A X W H E N INCLUDED IN ASSESSM E N T 7. These taxes are a lien against the property with which they are assessed and must be paid with property taxes in the name of person assessed. I f taxes are paid by a person other than the person assessed, credit will be given only for receipts or legal exemptions of person whose name appears in the assessment. (N O CREDIT FOR RECEIPTS OR EXEM PTIONS OF PERSON P A Y IN G TAX E S CAN BE G IVEN UNLESS TH E P R O P E R TY IS ASSESSED IN HIS N AM E .) W IDOW ’S EXEM PTIO N A N D HOW OBTAINED 8. A widow, (by death of husband) who has N O T remarried, and is a resident of Arizona, is allowed exemption on a $1,000.00 valuation, when the total valuation o f all her property does not exceed $2,000:')0. Exemption obtained by filing an a ffidavit with the Board of Supervisors each year. Blanks furnished by Treasurer or Assessor, which should be filled in by widow and returned to Treasurer, who will file with Board of Supervisors. ROAD TAXES, WHO SUBJECT TO, EXEM PTIONS A N D HOW O BTAINED 9. Every able-bodied male resident of Arizona, between the ages of 21 and 60 years, except resident of incorporated cities or towns, who must pay a street tax. Exemption obtained by affidavit or other evidence presented to Board of Supervisors establishing disability to perform manuel labor. SCHOOL OR PO LL TAX , WHO SUBJECT, EXEM PTIONS A N D HOW OBTAINED 10. Every able-bodied male resident of Arizona, between the ages of 21 and 60 vears except A C TIV E members of V O LU N TE E R Fire Departments (not exceeding 25 members for each fire department), National Guard, paupers, insane persons and t U™ : to e d . Exemptions: Disability to perform manual lator obtained same ?manner as Road Tax. VO LU N TE ER Fm?*Departments, by certificate of Fire Chief, attested by Secretary stating person claiming exemption is and has been an active member of such Fire Department for one year.A T E S Levies For Each $100.00 Valuation 1921 1922 County General Fund ...... M M .1... B i l l |fi County Road Fund SS]BM.........lilt Ufa BOND FUNDS County Funded Indebtedness Redemption Fund .. .0184 .0210 County Funded Indebtedness Interest Fund ......... 0207 .0236 Court House Interest & Redemption........................0267 .0300 Union High School Interest & Redemption ...... .0264 .0300 Road & Bridge 1914, Interest & Redemption...... .0306 .0348 Road & Bridge 1915, Interest & Redemption..........0351 .0400 ' . Road Bonds 1920, Interest & Redemption .......... .1223 .1432 Hospital Bonds 1920, Interest & Redemption .0329 .0378 Total General County Levy ........................ 1.3400 1.5700 Total State Levy ............................................ 7300 .5100 Total State & County L e v y .... ........ $2.0700 $2.0800 SPECIAL DISTRICT LEVIES School Dist. No. 3 Bond & In terest.......................1100 .0990 School Dist. No. 13, Bond & In terest.................... .1200 .0740 Kingman Vol. Fire Department ............. ........Ik. .4300 .6000