Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

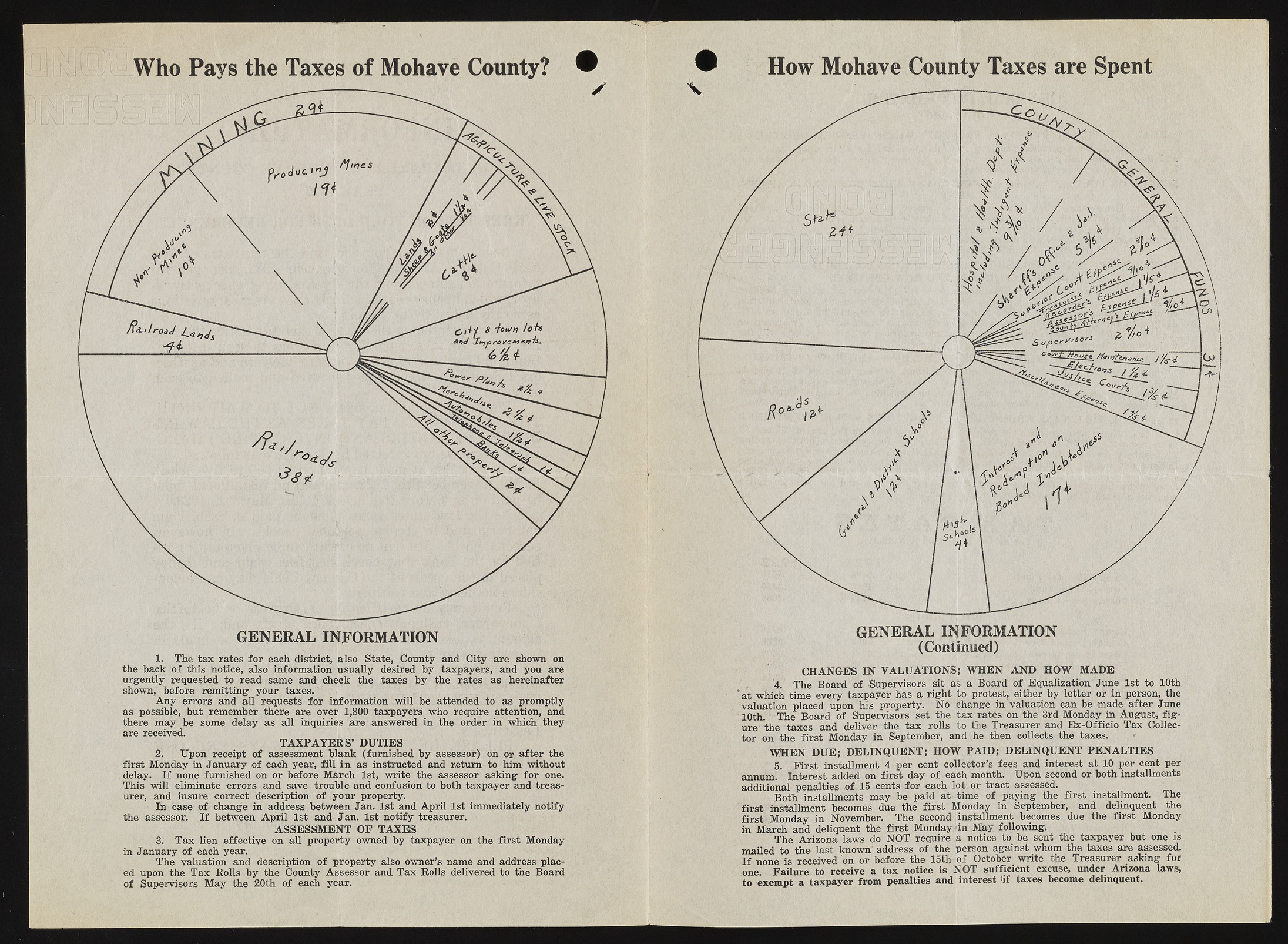

W ho Pays the Taxes of Mohave County? 1. The tax rates fo r each district, also State, County and City are shown on the hack of this notice, also information usually desired by taxpayers, and you are urgently requested to read same and check the taxes by the rates as hereinafter shown, before remitting your taxes. Any errors and all requests fo r information will be attended to as promptly as possible, but remember there are over 1,800 taxpayers who require attention, and there may be some delay as all inquiries are answered in the order in which they are received. T A X P A Y E R S ’ DUTIES 2. Upon receipt of assessment blank (furnished by assessor) on or after the first Monday in January o f each year, fill in as instructed and return to him without delay. I f none furnished on or before March 1st, write the assessor asking fo r one. This will eliminate errors and save trouble and confusion to both taxpayer and treasurer, and insure correct description of your property. In case of change in address between Jan. 1st and April 1st immediately notify the assessor. I f between A pril 1st and Jan. 1st notify treasurer. ASSESSMENT OF TAX E S 3. Tax lien effective on all property owned by taxpayer on the first Monday in January of each year. The valuation and description of property also owner’s name and address placed upon the Tax Rolls by the County Assessor and Tax Rolls delivered to the Board of Supervisors May the 20th of each year. How Mohave County Taxes are Spent GENERA(LCo nItNinFuOeRd)MATION CHANGES IN V A LU AT IO N S ; W H EN A N D HOW MADE 4. The Board of Supervisors sit as a Board of Equalization June 1st to 10th ' at which time every taxpayer has a right to protest; either by letter or in person, the valuation placed upon his property. No change in'valuation can be made after June 10th. The Board of Supervisors set the tax rates on the 3rd Monday in August, fig ure the taxes and deliver the tax rolls to the Treasurer and Ex-Officio Tax Collector on the first Monday in September, and he then collects the taxes. W H E N DUE; D ELINQ U ENT; HOW P A ID ; D ELINQ U ENT P E N A LTIE S 5. First installment 4 per cent collector’s fees and interest at 10 per cent per annum. Interest added on first day of each month. Upon second or both installments additional penalties o f 15 cents for each lot or tract assessed. Both installments may be paid at time of paying the first installment. The first installment becomes due the first Monday in September, and delinquent the first Monday in November. The second installment becomes due the first Monday in March and deliquent the first Monday in May following. The Arizona laws do NO T require a notice to be sent the taxpayer but one is mailed to the last known' address of the person against whom the taxes are assessed. I f none is received on or before the 15th o f October write the Treasurer asking for one. Failure to receive a tax notice is NO T sufficient excuse, under Arizona laws, to exempt a taxpayer from penalties and interest i f taxes become delinquent.