Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

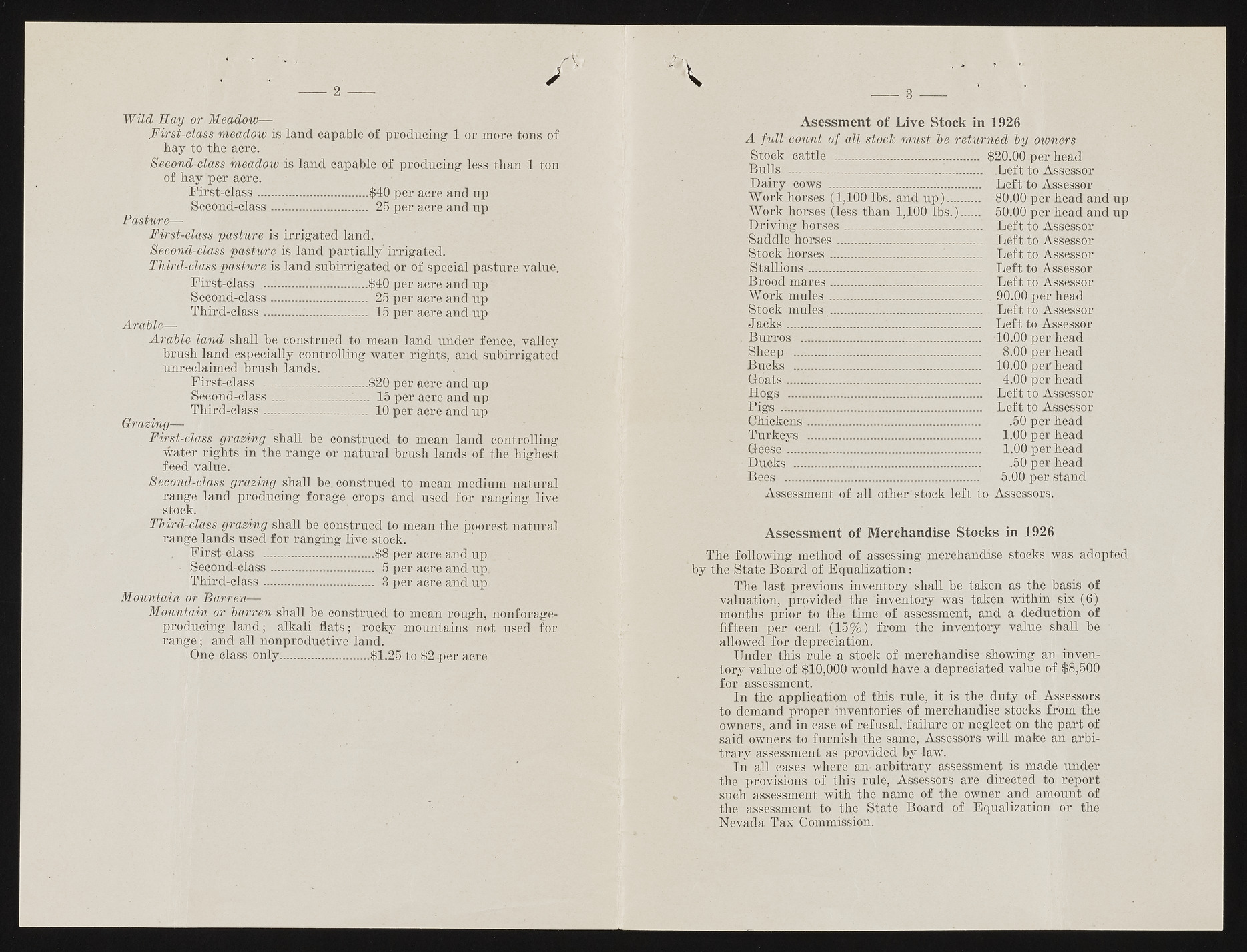

2 Wild Hay or Meadow—- .First-class meadow is land capable of producing 1 or more tons of bay to the acre; Second-class meadow is land capable of producing less than 1 ton of hay per acre. First-class.............................. $40 per acre and up •Second-class .......... 25 per acre and up Pasture— First-class pasture is irrigated land. Second-class pasture is land partially irrigated. Third-class pasture is land subirrigated or of special pasture value. First-class .............-............ $40 per acre and up Second-class.............. ........... 25 per acre and up Third-class....................... . 15 per acre and up A ruble-— Arable land shall be construed to mean land under fence, valley brush land especially controlling water rights, and subirrigated unreclaimed brush lands. First-class ...I,— .,— ,.;...;...._-..$20 per acre and up Second-class...... ......... 15 per acre and up Third-class —- .............. 10 per acre and up Grazing— First-class grazing shall be construed to mean land controlling water rights in the range or natural brush lands of the highest feed value. Second-class grazing shall be. construed to mean medium natural range land producing forage crops and. used for ranging live stock. Third-class grazing shall be construed to mean the poorest natural range lands used for ranging live stock. , First-class „............... ..———..$8 per acre and up ? iSecond-class 5 per acre and up Third-class ....:......................... 3 per acre and up Mountain or Barren ? Mountain or barren shall be construed to mean rough, nonforage-producing land; alkali flats; rocky mountains not used for range; and all nonproductive land. One class only........................ $1.25 to $2 per acre 3 Asessment of Live Stock in 1926 A full count of all stock must be returned by owners Stock cattle ...................... .......... ...... $20.00 per head Bulls .......................... ......................... . Left to Assessor Dairy cows ......................................... Left to Assessor Work horses (1,100 lbs. and up)....... 80.00 per head and up Work horses (less than 1,100 lbs.) ...... 50.00 per head and up Driving horses............... .....................i Left to Assessor Saddle horses ........ ....... ........................ Left to Assessor Stock horses................... .......... Left to Assessor Stallions........... ................................... Left to Assessor Brood mares .,....................................... Left to Assessor Work mules ......I............. .............__..... . 90.00 per head Stock mules .......... ..:......................... . . Left to Assessor Jack s................—.................................. Left to Assessor . Burros .......... ............ .... ............ ......... 10.00 per head Sheep ......... ........................ ........... . 8.0b per head Bucks .............. ........ .... ....................... 10.00 pephead Gnats...................... - ____ ___ ______ 4.00 pe® head Hogs ................................. .................... L ef|;9 Assessor Pigs —............... ...l ,................. ........ Left to Assessor Chickens ................. ............................. .50 per head Turkeys . ........ ........... 1.00 per head Geese.......... ............. ....... .... ... ............ 1.00 per head Ducks ......... ..... ;............ i...................... :.50 pep head Bees ................ .......... ............ -• 5.00 per stand Assessment of all other stock left to Assessors, Assessment of Merchandise Stocks in 1926 The following method of assessing merchandise stocks was adopted by the State Board of Equalization: The last previous inventory shall he taken as the basis of valuation, provided the inventory was taken within six (6) months prior to the time of assessment, and a deduction of fifteen per cent (15%) from the inventory value shall be allowed for depreciation. Under this rule a stock of merchandise showing an inventory value' of $10,000 would have a depreciated value of $8,500 .for assessment. In the application of this rule, it is the duty of.Assessors to demand proper inventories of merchandise stocks from the owners; and in ease of refusal, failure or neglect on the part of - said owners to furnish the same, Assessors will make an arbitrary assessment as provided by law. In all cases where am arbitrary assessment is made under the provisions of this rule, Assessors are directed to report ' such assessment with the name of the owner and amount of the: assessment to the State Board of Equalization or the; Nevada Tax Commission.