Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

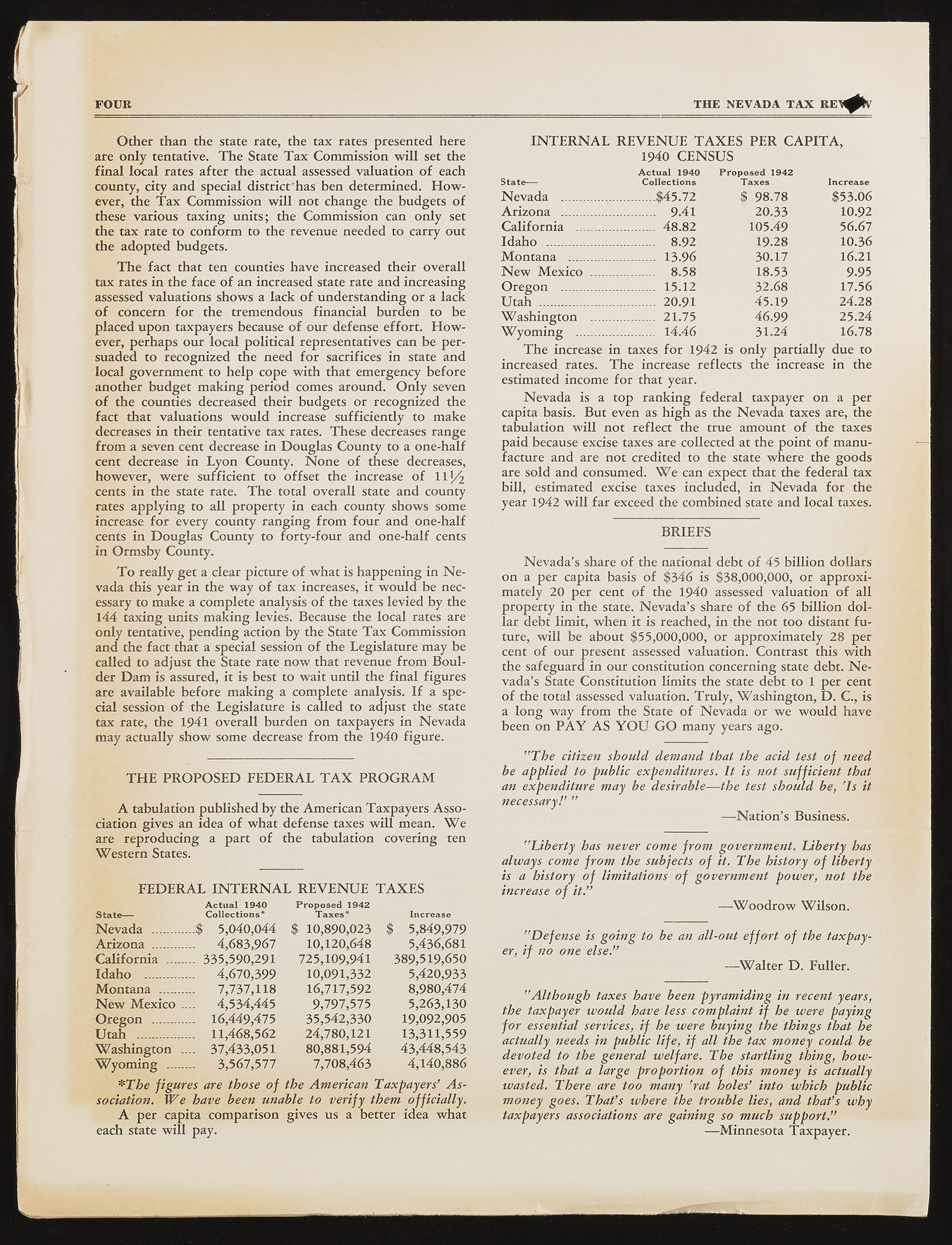

FOUR THE NEVADA TAX RE O th er than the state rate, the tax rates presented here are only tentative. T h e State T a x Com m ission w ill set the fin a l local rates after the actual assessed valuation o f each county, city and special districfh as ben determined. H o w ever, the T a x Com m ission w ill not change the budgets o f these various taxing units; the Com m ission can only set the tax rate to conform to the revenue needed to carry out the adopted budgets. T h e fact that ten counties have increased their overall tax rates in the face o f an increased state rate and increasing assessed valuations shows a lack o f understanding o r a lack o f concern fo r the tremendous financial burden to be placed u pon taxpayers because o f our defense effort. H o w ever, perhaps ou r local political representatives can be persuaded to recognized the need fo r sacrifices in state and local governm ent to help cope w ith that emergency before another budget m akin g period comes around. O n ly seven o f the counties decreased their budgets o r recognized the fact that valuations w o u ld increase sufficiently to make decreases in their tentative tax rates. These decreases range from a seven cent decrease in D o u g la s County to a on e-h alf cent decrease in Lyon County. N o n e o f these decreases, how ever, w ere sufficient to offset the increase o f llJ /2 cents in the state rate. T h e total overall state and county rates app lyin g to all property in each county shows some increase fo r every county ra n gin g from fo u r and on e-h alf cents in D o u g la s County to forty-fou r and one-half cents in O rm sby County. T o really get a clear picture o f w hat is happening in N e vada this year in the w ay o f tax increases, it w o u ld be necessary to m ake a complete analysis o f the taxes levied by the 144 taxin g units m akin g levies. Because the local rates are only tentative, pen din g action by the State T a x Com m ission and the fact that a special session o f the Legislature may be called to adjust the State rate n o w that revenue fro m B o u lder D a m is assured, it is best to w ait until the fin a l figures are available before m akin g a complete analysis. I f a special session o f the Legislature is called to adjust the state tax rate, the 1941 overall burden on taxpayers in N e v a d a may actually show some decrease from the 1940 figure. T H E P R O P O S E D F E D E R A L T A X P R O G R A M A tabulation published by the Am erican T axpayers A sso ciation gives an idea o f w h at defense taxes w ill mean. W e are reproducin g a part o f the tabulation covering ten W e ste rn States. F E D E R A L I N T E R N A L R E V E N U E T A X E S Actual 1940 Proppsed 1942 State— Collections* Taxes* Increase N e v a d a ............$ 5,040,044 $ 10,890,023 $ 5,849,979 A riz o n a .........- 4,683,967 10,120,648 5,436,681 C alifo rn ia ........ 335,590,291 725,109,941 389,519,650 Id ah o .............. 4,670,399 10,091,332 5,420,933 M on tan a .......... 7,737,118 16,717,592 8,980,474 N e w M e x i c o .... 4,534,445 9,797,575 5,263,130 O re g o n ........ 16,449,475 35,542,330 19,092,905 U ta h ................ 11,468,562 24,780,121 13,311,559 W a s h in g to n .... 37,433,051 80,881,594 43,448,543 W y o m in g ........ 3,567,577 7,708,463 4,140,886 *T h e figures are those o f the American Taxpayers’ A ssociation. W e have been unable to verify them officially. A p er capita com parison gives us a better idea w hat each state w ill pay. I N T E R N A L R E V E N U E T A X E S P E R C A P I T A , 1940 C E N S U S State— Actual 1940 Collections Proposed 1942 Taxes Increase N e v a d a .............. _____ ___ $45.72 $ 98.78 $53.06 A r iz o n a ............................ 9.41 20.33 10.92 C a lifo r n ia _______......... . 48.82 105.49 56.67 Id a h o ................... ............. 8.92 19.28 10.36 M o n t a n a ......................U 13.96 30.17 16.21 N e w M e x ic o ____............. 8.58 18.53 9.95 O r e g o n ........................ 15.12 32.68 17.56 U t a h ................ . ............. 20.91 45.19 24.28 W a s h in g t o n ................. ? 21.75 46.99 25.24 W y o m i n g .......... ............. 14.46 31.24 16.78 T h e increase in taxes fo r 1942 is only partially due to increased rates. T h e increase reflects the increase in the estimated income fo r that year. N e v a d a is a top ranking federal taxpayer on a per capita basis. But even as h igh as the N e v a d a taxes are, the tabulation w ill not reflect the true amount o f the taxes paid because excise taxes are collected at the point o f m anufacture and are not credited to the state w here the goods are sold and consumed. W e can expect that the federal tax bill, estimated excise taxes included, in N e v a d a fo r the year 1942 w ill fa r exceed the com bined state and local taxes. B R IE F S N e v a d a ’s share o f the national debt o f 45 billion dollars on a per capita basis o f $346 is $38,000,000, or ap p ro ximately 20 per cent o f the 1940 assessed valuation o f all property in the state. N e v a d a ’s share o f the 65 billio n d o llar debt limit, w h en it is reached, in the not too distant fu ture, w ill be about $55,000,000, o r approxim ately 28 per cent o f our present assessed valuation. Contrast this w ith the safeguard in our constitution concerning state debt. N e vada’s State Constitution limits the state debt to 1 per cent o f the total assessed valuation. T ru ly , W ash in gto n , D . C., is a lo n g w ay from the State o f N e v a d a or w e w o u ld have been on P A Y A S Y O U G O m any years ago. "T h e citizen should demand that the acid test o f need be applied to public expenditures. It is not sufficient that an expenditure may be desirable— the test should be, 'Is it necessary!’ ” — N a tio n ’s Business. "Liberty has never come from government. Liberty has always come from the subjects o f it. The history o f liberty is a history o f limitations o f governm ent power, not the increase o f it.” ^ H - W o o d r o w W ilso n . "Defense is goin g to be an all-out effort o f the taxpayer, i f no one else.” — W a lt e r D . Fuller. "A lth ou gh taxes have been pyramiding in recent years, the taxpayer would have less complaint if he were paying fo r essential services, if he were buying the things that he actually needs in public life, if all the tax money could be devoted to the general welfare. The startling thing, however, is that a large proportion o f this money is actually wasted. There are too many 'rat holes’ into which public money goes. That’s where the trouble lies, and that’s why taxpayers associations are gaining so much support.” — M innesota Taxpayer.