Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

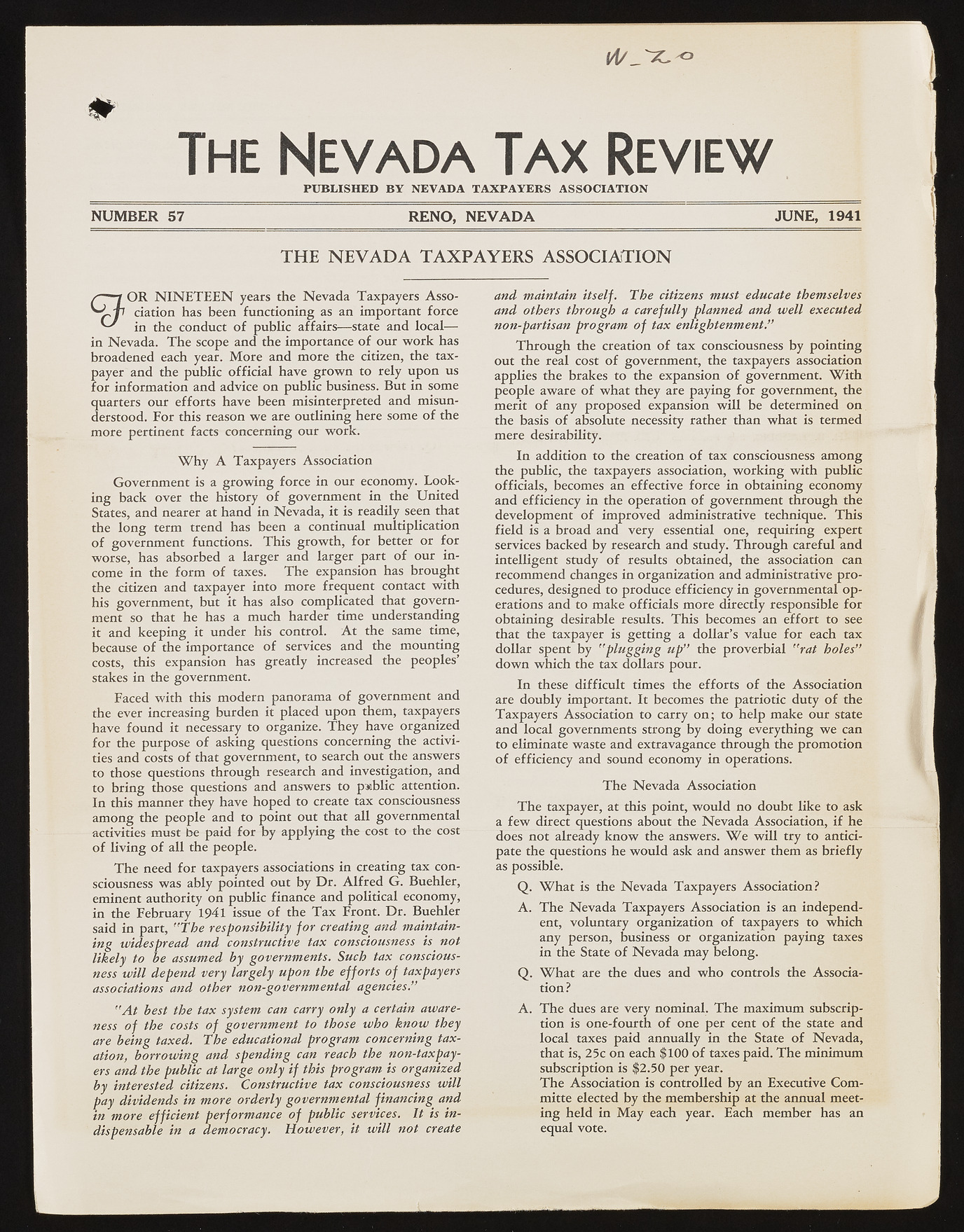

\A/ The Nevada Tax Review PUBLISHED BY NEVADA TAXPAYERS ASSOCIATION NUMBER 57 RENO, NEVADA JUNE, 1941 THE NEVADA TAXPAYERS ASSOCIATION O R N I N E T E E N years the N e v a d a Taxpayers A sso ciation has been functioning as an im portant force in the conduct o f public affairs— state and lo c a l- 9 in N e v a d a . T h e scope and the importance o f ou r w o rk has broadened each year. M o re and m ore the citizen, the taxpayer and the public o fficial have g ro w n to rely u pon us fo r inform ation and advice on public business. B ut in some quarters ou r efforts have been m isinterpreted and m isunderstood. F or this reason w e are outlining here some o f the m ore pertinent facts concerning ou r w ork. W h y A Taxpayers Association G overnm ent is a g ro w in g force in our economy. L o o k in g back over the history o f governm ent in the U n ited States, and nearer at hand in N e v a d a , it is readily seen that the lo n g term trend has been a continual multiplication o f governm ent functions. T h is grow th , fo r better o r fo r worse, has absorbed a larger and larger part o f ou r in come in the fo rm o f taxes. T h e expansion has brou gh t the citizen and taxpayer into m ore frequent contact w ith his governm ent, but it has also complicated that govern ment so that he has a much harder time understanding it and keeping it under his control. A t the same time, because o f the importance o f services and the m ounting costs, this expansion has greatly increased the peoples’ stakes in the governm ent. Faced w ith this m odern panoram a o f governm ent and the ever increasing burden it placed u pon them, taxpayers have fo u n d it necessary to organize. T h ey have organized fo r the purpose o f asking questions concerning the activities and costs o f that governm ent, to search out the answers to those questions through research and investigation, and to b rin g those questions and answers to public attention. In this m anner they have hoped to create tax consciousness am ong the people and to point out that a ll governm ental activities must be paid fo r by applyin g the cost to the cost o f livin g o f all the people. T h e need fo r taxpayers associations in creating tax consciousness w as ably pointed out by D r . A lfr e d G . Buehler, eminent authority on pu blic finance and political economy, in the February 1941 issue o f the T a x Front. D r . Buehler said in part, "T h e responsibility fo r creating and maintaining widespread and constructive tax consciousness is not likely to be assumed by governments. Such tax consciousness w ill depend very largely upon the efforts o f taxpayers associations and other non-governmental agencies.” " A t best the tax system can carry only a certain awareness o f the costs o f governm ent to those who know they are being taxed. The educational program concerning taxation, borrow ing and spending can reach the non-taxpayers and the public at large only if this program is organized by interested citizens. Constructive tax consciousness w ill pay dividends in m ore orderly governmental financing and in m ore efficient performance o f public services. I t is indispensable in a democracy. However, it w ill not create and maintain itself. The citizens must educate themselves and others through a carefully planned and w ell executed non-partisan program o f tax enlightenment.” T h ro u g h the creation o f tax consciousness by pointing out the real cost o f governm ent, the taxpayers association applies the brakes to the expansion o f governm ent. W it h people aw are o f w hat they are paying fo r governm ent, the merit o f any proposed expansion w ill be determined on the basis o f absolute necessity rather than w hat is termed mere desirability. In addition to the creation o f tax consciousness am ong the public, the taxpayers association, w o rk in g w ith public officials, becomes an effective force in obtaining economy and efficiency in the operation o f governm ent through the developm ent o f im proved administrative technique. T h is field is a broad and very essential one, requ irin g expert services backed by research and study. T h ro u g h careful and intelligent study o f results obtained, the association can recom m end changes in organization and administrative p ro cedures, designed to produce efficiency in governm ental o p erations and to make officials m ore directly responsible fo r obtaining desirable results. T h is becomes an effort to see that the taxpayer is getting a d o lla r’s value fo r each tax d ollar spent by "p lu gg in g up” the proverbial "ra t holes” d o w n w hich the tax dollars pour. In these difficu lt times the efforts o f the Association are doubly important. It becomes the patriotic duty o f the Taxpayers Association to carry o n ; to help make ou r state and local governm ents strong by d oin g everything w e can to eliminate waste and extravagance through the prom otion o f efficiency and sound economy in operations. T h e N e v a d a Association T h e taxpayer, at this point, w o u ld no doubt like to ask a fe w direct questions about the N e v a d a Association, if he does not already k n o w the answers. W e w ill try to anticipate the questions he w o u ld ask and answer them as briefly as possible. Q . W h a t is the N e v a d a Taxpayers Association? A . T h e N e v a d a Taxpayers Association is an independent, voluntary organization o f taxpayers to which any person, business o r organization paying taxes in the State o f N e v a d a m ay belong. Q . W h a t are the dues and w h o controls the Association? A . T h e dues are very nom inal. T h e m axim um subscription is one-fourth o f one per cent o f the state and local taxes p aid annually in the State o f N e v a d a , that is, 25c on each $100 o f taxes paid. T h e m inim um subscription is $2.50 per year. T h e Association is controlled by an Executive Com - mitte elected by the m em bership at the annual meetin g held in M a y each year. Each m em ber has an equal vote.